This section describes the overview of the PPP project process which is then developed in detail — phase by phase — in chapters 3 to 8 of this PPP Guide.

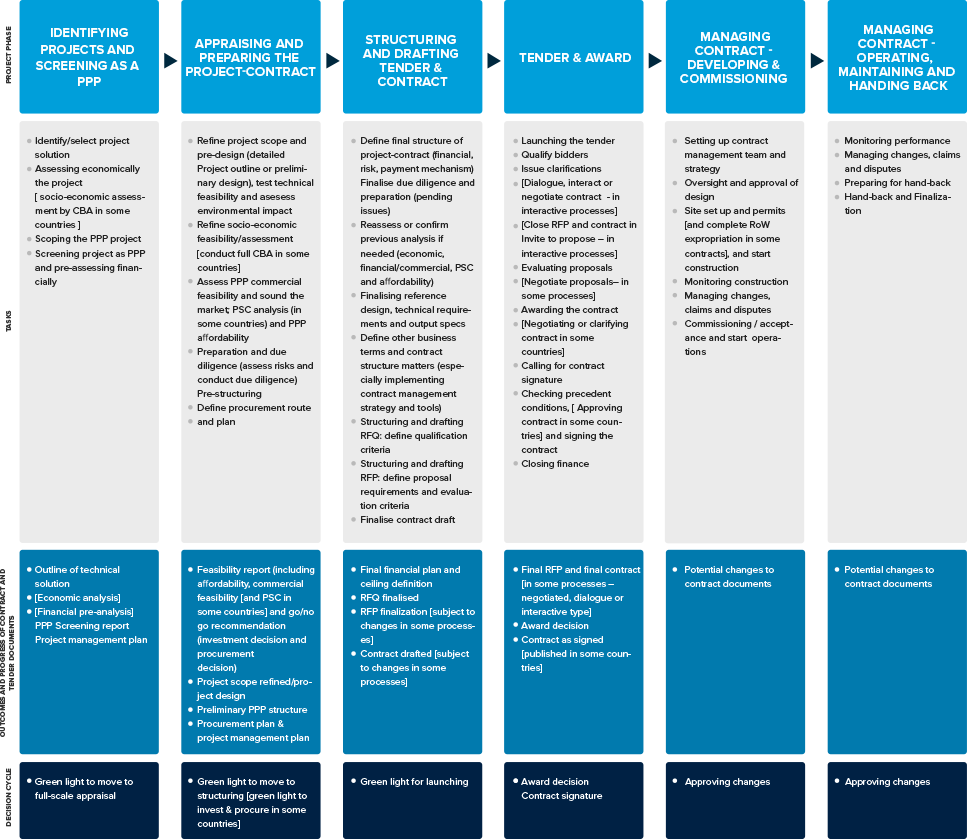

The intention of this description is to give the reader a general view of the whole process, providing a preliminary description of its main phases. It also illustrates how the process may differ in some countries, depending on the tender route or modality selected (when there is more than one available in a country). See figure 1.13.

The process as described in this section and developed through the PPP Guide relates to the cycle of a PPP project. Normally this process starts with project identification and selection, and the PPP Guide assumes that this occurs on a project by project basis[120]. However, when the government assumes a program approach, project identification and selection, as well as the screening of projects as PPP candidates, will typically occur as part of the development of a program.

The definition of each phase, including the name and the scope of each of them, is somewhat arbitrary. There is no universal consensus on what should be included in each phase or where each should start or end. Thus, there are differing views, for example, about how to define contract “structuring” and what exactly should be considered “structuring” or even “feasibility” of a project contract. Additionally, there are different views and approaches about what should be the final outcome of the appraisal activity; whether the appraisal of the project should be regarded as phase in itself and the investment decision taken before confirming the suitability and feasibility of the project as a PPP, or whether both activities and decisions can be better handled in the same phase (which is the approach assumed by this PPP Guide for convenience, as fitting with the context of EMDE countries). See box below.

BOX 26: Considerations regarding appraisal and decisions assumed by this PPP Guide

The standard PPP process cycle described in this PPP Guide involves initial analysis of the project economics and PPP screening in the Identification and PPP Screening Phase, followed by detailed appraisal of the project both as a technical solution and as a PPP during the Appraisal and Preparation Phase. This sequence is well suited to PPP programs motivated by a desire to use PPPs as an alternative to public finance, thus allowing for the acceleration of infrastructure development (see section 5.1). In these circumstances, the investment decision (whether or not the project should proceed) is inter-related with the procurement decision (whether or not the project should be a PPP). If a project is not suitable to be a PPP, it may not be possible (due to fiscal constraints) to deliver it as a traditionally procured project. By screening the project for PPP potential at an early stage, the government can avoid wasting money on appraisal if the project is not suitable to be a PPP.

Thus, since it is necessary to define a common ground in order to provide a proper explanation of the PPP process (as well as the different tasks to be undertaken and decisions made); this PPP Guide is necessarily adopting a flexible approach. The described process presented in figure 1.14 incorporates significant flexibility to reflect the main potential variations in the tasks, decisions and authorizations to be taken within each “phase”.

As a practical matter, the analysis and tasks to be carried out in many phases will actually extend beyond the arbitrary limit of the respective phase. For instance, some of the analysis to be carried out as part of the appraisal may not be finished until subsequent phases, or it may be necessary to revisit this analysis at a later phase.

The work to be carried out in each phase is also influenced by the applicable policy and legal framework.

What is clear though is what has to be done to successfully develop a project as a PPP. Regardless of the order or timing of each of the tasks or the different names and concepts used in different regions and jurisdictions, a PPP procurement will necessary imply significant work under a phased approach. As described in section 5.3, a PPP project must:

- Be based on an appropriate or optimum technical solution or “project”: this is usually referred to as identification;

- Be duly appraised to assess if it is feasible (both the technical solution and the delivery of the project as a PPP), that the PPP is the best procurement solution, and that it be duly prepared before tendering: this relates to appraisal and preparation;

- Have an appropriately structured PPP contract and a well-designed tender process: this will be referred in this PPP Guide as contract and tender structuring and drafting;

- Be effectively procured or tendered in accordance with the applicable legal and regulatory requirements: this may be referred to as the tender process itself (sometimes referred as “managing the transaction”); and

- Be managed during its contract life: this is called contract management.

FIGURE 1.13: General or Main Stages in the PPP Process

FIGURE 1.14: The PPP Process Cycle as Considered in This PPP Guide

Figure 1.14 describes in further detail the process and main tasks commonly developed in each of the phases (as defined in the PPP Guide) noting the most common variations. Many of the tasks and sub-processes are progressive and iterative in nature: examples include appraisal and preparation, and contract and process design. The figure includes a description of how the process moves through to a final contract, and how decisions are also taken under a phased approach.

In addition to differences in the process flow, the terminology used to describe the phases and tasks differs from one jurisdiction to another. Box 1.33 illustrates the key names and concepts used in the PPP Guide, and common variations or alternative names.

|

BOX 1.33: Terminology Issues related to the PPP Process and its Related Tasks. (Preferred terms in this PPP Guide compared with other terms) |

|

|

Preferred terms |

Other terms |

|

Indentification of the project |

Selection of the project.

|

|

Cost benefit analysis (CBA) |

Economic feasibility, economic appraisal. |

|

Screening of the project as a PPP |

Pre-assessing the project as a PPP. Pre-feasibility is also used in some countries. |

|

Appraising |

Feasibility analyses of a project, assessment of a project, due dilligence (limited to some feasibility or assessment processes), assessing the project as a PPP (for the assessment of the PPP option as a procurement alternative for the project, rather than assessing the project itself as a technical solution), project preparation, business case development (in some countries the business case is progressively developed throughout the PPP cycle — appraising activities primarily occurs at the Outline Business Case stage). |

|

Feasibility |

Also named viability in any of its areas. |

|

VfM analysis (of the PPP as a procurement option) |

VfM under the Public Sector Comparator (PSC) method (used in some countries). |

|

Structuring tender (RFQ and RFP) |

Outlining or designing the procurement route or tender process. |

|

Structuring the contract |

Designing the contract. |

|

Drafting (RFQ, RFP and contract) |

Finalizing those documents. In some countries and guides, structuring plus drafting together may be referred to as implementing. |

|

Tender process |

Procurement process or procurement procedure. |

|

Shortlisting |

Select or pre-select bidders. |

|

PPP contract |

PPP project, project agreement (more frequent in private investor context). |

Each of the main phases of such process are analyzed in detail in the respective chapters of this PPP Guide (from chapter 3 to Chapter 8), following chapter 2.

Phase 1 (chapter 3) – Project Identification and PPP Screening

Objectives: To select the right project option (the best technical solution for the need), and to pre-assess the suitability of the project as a potential PPP so as to avoid sinking resources unnecessarily into the full assessment and preparation of unworthy projects.

Tasks: Usual tasks included in this phase are as follows:

- Identify/select project solution out of a number of options;

- Scoping the project;

- Assessing the project economics (including a socio-economic assessment by CBA in some countries) and prioritizing the most worthwhile projects, if needed;

- Screening the project as a potential PPP; and

- Prepare the project governance for the preparation process through tender launch, including developing a project management plan and defining the project team.

The infrastructure identification task is inherent to the process cycle of any infrastructure decision regardless of how it will be procured. It does not form part of the PPP cycle in strict terms, as in many cases and many countries projects will be already identified under a planning exercise, or they may be proposed by an agency or procurement authority during the government term legislature (and will be regarded as such as long as they fit the strategic objectives of the government).

For convenience, this PPP Guide includes this task in the same phase as PPP screening, to reinforce the importance of proper project selection (PPPs cannot perform miracles and a PPP will only succeed if it is an economically sound and sensible project). However, in some cases, especially in EMDEs and when the PPP route is mostly motivated by government financial needs (including the fact that sometimes if it is not procured as a PPP, it will not be procured), identification and appraisal come together with screening and testing of PPP suitability and feasibility

Before considering how a project can be procured, it is necessary to have a clear notion of what is the best solution to the relevant public need from the technical and strategy standpoint. For example, to solve a problem of congestion in a particular city, the possible solutions might be a light rail transit (LRT) investment, an upgrade of the road network, or a metro system. This assessment of possible solutions should be undertaken for any public project decision (in infrastructure, for a service, a policy, a law, or in any other government activity). This is the basis of good practice in project identification.

A number of options should be considered and compared (including a “do nothing” option as a baseline), and the most suitable will be selected according to a selection method. CBA and other simpler methods may be used for this purpose (for example, multi-criteria analysis, cost-effectiveness analysis).This process will identify a technical solution in general terms. At this phase, the project scope may be in the form of an outline including rough cost estimates. The scope and costings will be further developed through a final assessment in the Appraisal Phase.

In addition to using CBA for selection purposes, CBA may also be conducted in the project Identification Phase to pre-assess whether the project makes economic sense. In some countries, other appraisal tasks may also commence in the project Identification Phase. These analyses are generally referred to as pre-feasibility exercises, as they will be adjusted, evolved or further developed in subsequent phases before the project is tendered.

Once the project has been properly identified (including economic pre-assesment), this PPP Certification Guide assumes that the project will be screened as a PPP. This requires defining the contract scope in general terms and conducting a preliminary test of whether the PPP method of procurement is appropriate for the project.

At the end of this phase, a decision is made whether to proceed with a full appraisal analysis both of the project and the project contract as a PPP on the basis of a “PPP screening report”. The report should also include a description of how the project process will be managed under a project plan and related schedule.

Phase 2 (chapter 4) – Appraisal and Preparation Phase

Objectives: To assess whether the project and PPP project contract is feasible in order to mitigate the risk of project failure during tender or during the contract life of the project, and to further advance its preparation as a PPP.

The usual set of tasks to be carried during this phase are as follows.

- Refine project scope and pre-design, test technical feasibility and assess environmental impact;

- Refine socio-economic feasibility/assessment (CBA) or conduct it in full from the outset;

- Assess PPP commercial feasibility (which includes bankability) and test the market;

- Develop other financial assessments: VfM under the Public Sector Comparator method (PSC analysis) in some countries, PPP affordability, and national accounting impact analysis (in some countries);

- Preparation and due diligence: assess risks and conduct due diligence tasks;

- Pre-structuring the PPP; and

- Define procurement strategy/route and design the procurement plan.

Box 1.34 provides information on alternative processes for identifying and appraising PPP projects.

BOX 1.34: Alternative Processes for Identifying and Appraising PPP Projects

|

The standard PPP process cycle described in this PPP Guide involves initial analysis of the project economics and PPP screening in the Identification and Screening Phase, followed by a detailed appraisal of the project both as a technical solution and as a PPP during the Appraisal Phase. The standard PPP process cycle described in this PPP Guide is therefore well suited to EMDE countries with PPP programs motivated by a desire to use PPPs as an alternative to public finance. However, for some governments (particularly in developed countries with strong fiscal positions), the key motivation for using PPPs is efficiency and effectiveness (see section 5.2). These governments are able to separate the investment decision from the procurement decision, making the investment decision first. Thus, the government first decides whether the project should proceed (based on socio-economic analysis) irrespective of how it is procured, and then decides whether PPP procurement will offer better Value for Money than traditional delivery. This decision-making process is only possible when the government is in a fiscal position to undertake the project as either a PPP or as a traditional project, and it enables a different decision-making process from the standard process described in this PPP Guide. The State of Victoria, Australia, is an example of a jurisdiction that is in a fiscal position to undertake projects as either PPPs or traditional projects. It focuses on efficiency and effectiveness as a motivation for using PPPs. The initial stages in the project cycle in the State of Victoria are as follows: · For a large and complex project that might become a PPP, the first phase is the development of a strategic business case. The strategic business case analyzes the problem or business need to be addressed, the benefits that the government expects in successfully responding to the problem, and the identification of a strategic response (which may include an infrastructure project) that will best address the identified problem or business need. To identify the preferred strategic response, options are analyzed using a form of multi-criteria analysis. True cost-benefit analysis is not required. The options examined at this stage typically represent different strategic responses, for example, the options considered for a public transit need might include a bus way and light rail; · The strategic business case may identify the expected procurement route if this is known, but detailed evidence for this is not required as no decision on procurement is made at this stage; · Following consideration of the strategic business case, the government makes a decision as to whether a full business case should be developed. The full business case contains what the PPP Certification Process describes as appraisal, including full cost-benefit analysis — usually for more than one project option. Options compared at this stage typically represent different scope options for the preferred strategic response identified at the previous stage. For example, if the strategic business case identified light rail as the preferred strategic response to a public transit need, the full business case might look at two different alignments and two different technologies (overhead power supply versus wireless) for the light rail project; · In addition, the full business case includes the procurement strategy, which is a qualitative comparative analysis of different procurement methods. Usually, the procurement strategy is one of the last elements of the business case developed, and it focuses only on the preferred project scope option. As the cost-benefit analysis and other elements of the appraisal are largely complete at this stage, the analysis of possible procurement methods benefits from a strong understanding of the project; and · The government then decides (as part of its budget process) whether the project should proceed (this is the investment decision). If approval is given for the project to proceed, the government then decides how it should be delivered, including whether it should be a PPP or traditionally procured (this is the procurement decision). |

A project should be appraised regardless of the procurement method that may be finally selected to develop and manage it. Therefore, much of the work done in this phase is common for any type of procurement and not exclusive to a PPP process. In fact, PPP is just a “branch” of the broader public investment management process (World Bank 2014). However, in addition to the appraisal tasks and preparatory activities that would be conducted for any other project, there are also specific tasks and activities to assess and prepare the project as a PPP.

In countries or contexts with a strong public works tradition (practically all), there is a tendency to think that the preparation and bidding processes of PPP projects can be as short as those typically used for public works projects. However, this is far from true; practitioners wishing to design suitable and realistic PPP projects and their tendering processes will have to realize that preparing, appraising and structuring a sound PPP project is much more demanding in terms of time than that a conventional project.

The feasibility analysis is two-fold. Firstly, the feasibility analysis is used to assess whether the project (or the form of procurement) is the optimum solution for the identified project need. This is usually done in the Identification Phase. Secondly, a feasibility analysis is used to assess the feasibility of the solution (can this project be done with no or limited risk of failure?).

Assessment of whether the project is the optimal solution requires a full cost-benefit analysis. The analysis should be done during appraisal unless it was done in the Indentification Phase. If the analysis was done in the Identification Phase, it will sometimes be developed further, or refined, in the Appraisal Phase if a more complete set of data is available for confirmation purposes at that stage.

The central purpose of the appraisal of the project is to confirm that the project is Value for Money (in the broad sense) for society, which is commonly regarded as the “economic” or “socio-economic” feasibility. A number of additional feasibility assesments are conducted to confirm whether the expected net benefit or value for society estimated for the project is achievable.

Analysis is also conducted to determine whether PPP delivery of the project is the best procurement option. In many countries this involves the preparation of a Public Sector Comparator, which is used to compare the PPP option with other methods (usually conventional procurement). This is used to test and confirm that the PPP option, as a procurement method, will likely produce additional net benefits, rather than destroy part of the overal benefit inherent in the project solution.

As appraisal is a progressive and iterative process; some elements of the feasibility analysis continue during the next phase (structuring). This is particularly true of analysis elements that are specific to the PPP route and relate to financial matters, such as commercial and financial feasibility, VfM/PSC, and affordability.

There is a subtle distinction between appraisal and preparation. Preparation refers to the activities handled by the government to mitigate project risks and advance matters that are the responsibility of the government before the contract is tendered, starting with a due dilligence of risks and obstacles that may threaten the success of the project. Examples include conducting geotechnical tests when the geotechnical risk represents a serious uncertainty to the project outcome, securing site availability for a facility, or obtaining preliminary environmental clearances.

Preparation activities may continue during the next phase. They should be finalized within the timeline estimated in the procurement plan and before the tender is launched.

As introduced, feasibility is commonly divided into several types of exercises or analysis. Some of them relate to the project in itself. These include technical, economic or socio-economic, and legal and enviromental feasibility. Most of these elements of feasibility relate to the “doability” of the project, although socio-economic feasibility relates more to the value of the project.

Other elements of feasibility relate to the project as a PPP. These include the PSC or other form of test for the appropriateness of the PPP option, financial and commercial feasibility, and the affordability test (which includes a control on the government’s aggregated exposure to PPPs). It is also customary in some countries to analyze the nature of the transaction in terms of fiscal treatment (that is, whether the infrastructure and related debt should be regarded as public sector assets and liabilities in the national accounting system).

The outcomes of this phase include the foundations of the feasibility assesment (as to whether the project is beneficial and doable) which enables the government to decide whether the project should proceed to the next phase. The outcomes also include an initial outline of a proposed PPP structure for the project, which is further developed in the next phase.

Before moving to the next stage (structuring), the procurement strategy is defined and a procurement plan is shaped during this phase. The basic features of the procurement strategy are as follows.

The approach to qualifications, including:

- the timing of the issue of the request for qualifications, that is, in advance of or at the same time as the RFP;

- whether to pre-select (shortlist) or only apply pass/fail qualification criteria;

- The approach to request for proposals, including;

- the timing of the finalization and issue of the RFP and contract — whether before or after a period of dialogue and interaction, or not allowing for interaction or dialogue but only minor clarifications; and

- The approach to bid submittal and evaluation — whether negotiations and iterative proposals are allowed.

The definition of these features will depend on the legal framework and common practice in the respective country. Box 1.35 introduces the main types of tender process used worldwide.

|

BOX 1.35: Main Types of Tender Processes Open tender or one-stage tender process There is only one single stage, integrating submission of qualifications and proposals. The proposal requirements also include the qualification requirements, structured in one single document or two separate but linked documents (RFP and contract). Open tender is the most common (and in some jurisdictions the only) method for procurement in many Latin American countries. This approach is also used in the Philippines for some projects. This form of open tender is also named the “one-stage tender process” by some practitioners and guides. Open tender with pass/fail pre-qualification (or two-stage open tender) This may be considered a variant of the former type of process, with the only difference being the timing of the issuance of documents, separating the call for qualifications (RFQ) from the call for bids or invitation to propose (RFP issuance). Therefore, there is an initial stage in which potential bidders are invited to pre-qualify before the issuance of the RFP and contract, but there is no shortlisting. Issuance of the RFP implies an invitation to propose. Usually, there is only one bid (that is, only one round of bids) and no negotiations. This is also common in a number of countries in Latin America (for example, México). Restricted procedure (shortlisting with one bid) As with open tender with pre-qualification, there is an initial stage in which potential bidders are invited to submit qualifications. Qualifying bidders (those that meet the pass/fail criteria) are ranked on the strength of their qualification responses, and a limited number of the highest ranking bidders are shortlisted. This shortlist of bidders will be invited to submit their bids, and will be evaluated on them before an awarding decision is made. This is a common method in a number of countries, such as EU member countries and India and Negotiated process (shortlisting with negotiations) Based on a previous shortlisting, companies are invited to submit their bids. Negotiations are then opened with all of the shortlisted bidders or with a limited number of candidates. Bids may be iterative, with more than one bid submitted by each proponent during the bid process before calling for the final offer. Only the final bid may be evaluated, but negotiations may be established with the preferred bidder (which is not desirable). The negotiated process may be considered a variant of the former type, that is, any negotiated process is usually a restricted process. Dialogue or interaction process In some countries, shortlisting is accompanied by a dialogue or interactive structured process. First, the RFQ is issued (customarily including the basic business terms and the project structure) with the intention of pre-selecting a shortlist of qualified bidders. Dialogue or interaction then takes place in conjunction with the RFP process. This modality has significant variations among countries, notably the distinction between Australia, the EU, and New Zealand. |

Phase 3 (chapter 5) – Structuring and Drafting Phase

Objectives: To define and develop a PPP contract solution and tender process that best fits with the specific features of the project contract so as to protect and, if possible, optimize VfM.

Tasks:

- Define the final structure of the project contract (financial stucturing, risk allocation and structuring, payment mechanism definition) and outline the contract;

- Finalize due diligence and preparation (finalizing the preparation tasks started in the Appraisal Phase);

- Re-assess or confirm previous analysis if needed (economic, financial, commercial – potentially including new market testing, and updating the PSC and affordability analysis);

- Finalize the reference design, technical requirements and output specifications;

- Define other business terms and contract structure matters (especially implementing contract management strategy and tools);

- Structure and draft the RFQ: defining the qualification criteria;

- Structure and draft the RFP: defining the proposal requirements and evaluation criteria (and regulations for the dialogue or interactive phase, when the tender process is of this type, or negotiation procedures when negotiations are allowed); and

- Finalize the draft contract for issuing with the RFP.

The main work in this phase corresponds to two main tasks:

1. The structuring and drafting of the project contract; and

2. The structuring and drafting of an enforcable package of procurement documentation, including the RFQ and RFP.

Structuring the contract: The structure that was developed at a preliminary level in the previous phase must now be refined (especially with respect to the financial structure, payment mechanism and risk allocation, as it is usually in this phase that the risk analysis is developed in substantial and greater detail). The rest of the business terms should also be developed before starting to draft the contract.

Structuring the RFQ and RFP: It is not only the contract that has to be designed during this phase. The tender process must also be structured and designed because it should be tailor-made to fit the characteristics of the project. The tender process will have been selected at the end of the Appraisal Phase, but many details will now be defined according to the project specifics. These include the bar for pass/fail qualification criteria and the specific evaluation criteria. They also include some relevant features of the tender process, such as bid bond requirements, time to submit, and detailed regulations for dialogue or interaction in these type of tender processes.

Drafting is the process of effectively developing all the contents and provisions of the tender package, including the RFQ, RFP, and contract. Drafting should occur only after the main characteristics of each document have been outlined, discussed and approved. The timing of the drafting of the documents may vary depending on the tender process selected. In an open tender, the qualification conditions are included in the same document and form part of the RFP. In these processes, the tender is one single package covering qualifications and selection requirements, requirements to submit proposals, evaluation criteria, and contract regulations.

In two-stage processes, it may not be necessary to finalize the RFP at the same time as the RFQ. However, the foundations of the proposal requirements and evaluation criteria, and especially those of the contract, should be defined before the launch of the qualification process. The period between launch of the qualification process and receiving submissions is the time available to refine and finalize the RFP and contract[121].

The structuring and drafting process is a highly iterative task. The contract structure is linked to the resolution of risk matters, financial and commercial feasibility, and therefore affordability. These will all still be assessed during this phase, and they depend on the final definition of the technical requirements and output specifications.

Once all assessments are finalized in parallel and iteratively with contract structure refinements, the drafts are closed and submitted for internal approvals, so as to obtain the green light for launching the tender process.

Phase 4 (chapter 6) – Tender Phase (to award and sign contract)

Objectives: To smoothly but rigourously manage the process to select the best value proposal in a competitive and regulated environment, and execute the contract with the most suitable and reliable bidder.

Tasks:

- Launching the tender;

- Qualify bidders (and shortlisting them in some processes);

- Issue clarifications;

- Dialogue, interact or negotiate contract — in interaction processes;

- Close RFP and contract in issue the invitation to propose (ITP)— in interaction processes;

- Evaluating proposals;

- Negotiate proposals — in some processes;

- Awarding and calling for contract signature;

- Checking precedent conditions (approving contract in some countries) and signing the contract; and

- Financial close.

The key activity during this phase is the management of the tender process as it has been designed and regulated through the RFQ and RFP. The process should be managed as smoothly as possible to maximize the value inherent in the project.

Many features and characteristics of the tender process will be the same as in any other public procurement process. The same general objectives of procurement (such as transparency and fairness) apply to a PPP procurement as to other procurement processes. However, PPP procurements are more complex than most other procurement processes, and the particularities of the PPP will demand additional attention and resources from the procuring authority.

The Tender Phase can be divided into several stages, which will depend upon the type of procurement process that has been selected.

Generally there are four main stages into which any tender process may be divided.

- Pre-qualification (in open tenders with a pre-qualification stage) or shortlisting (in a process with shortlisting or pre-selection of candidates);

- Bid period from launching through to bid submission or reception (in open tenders without pre-qualification) or from an invitation to offer (or to negotiate) through bid submission in other processes;

- Bid evaluation (including qualifications in one-stage open tenders) and award — the procuring agency receives, analyzes/assesses, evaluates and selects a winner (usually referred to as the preferred bidder); and

- Contract signature or “commercial close” (from decision to award to the effective date of contract) – financial close may occur at the end of this period or at a later time after contract signature.

The actual outline of the process and a more detailed description of the phases will vary depending on the tender process type.

At one extreme of the spectrum of tender process types is the one-stage open tender. The main variation of the open tender process is the two-stage open tender with pre-qualification. At the other extreme of the spectrum of variations, there are various interactions or dialogue processes.

In an open tender with one stage, the steps or sequence of the tender process will be as follows.

1. Bid period (from launching through to bid submission) — bidders prepare and submit their bids, together with their qualifications;

2. Qualification and evaluation — the procuring agency receives, analyzes/assesses, evaluates and selects a winner (the preferred bidder); and

3. Contract execution — from award to contract signature.

From an internal agency standpoint, the qualification and evaluation stage is also divided into 2.1 “Qualification”, 2.2 “Evaluation” (usually starting with technical and other potential valuation drivers subject to qualitative assessment, and later the economic/price offer and potentially other numerical criteria), and 2.3 “Award”. In some jurisdictions there can be negotiation between the procuring agency and the preferred bidder before the contract is awarded.

Even under open tender there may be variations in the award process: in some jurisdictions it is necessary to obtain the authorization of a general attorney or general auditor, or to obtain ratification by the legislature (for example, parliament). The award stage itself has two sub-stages in some jurisdictions, with the award decision being considered provisional for a certain time before it becomes definitive.

Some jurisdictions allow for limited clarifications of the offer after contract award. In addition, the RFP will generally define some precedent conditions to be met (which must be completed within a certain time limit) before contract signature can occur. In particular, the constitution of the SPV that will sign the contract must be provided to the government.

In other types of processes, the timing and therefore the stages varies significantly. For example, under a competitive dialogue method based on two stages, the process will be handled according to the following stages and sequence.

1. RFQ: From invitation to qualify, and then to Submission of Qualifications (SoQ);

2. Evaluation of qualifications and selection of the shortlist: This stage finishes with the publication of the results of selection and appointment of the qualified (or shortlisted) bidders;

3. Dialogue or interactive phase: This stage starts with the issuance of the invitation to negotiate or call for dialogue (during which the contract will be discussed and refined in EU dialogue process);

4. Bid/offer submission: This may be done in a form of consecutive offers and a final bid (sometimes between only two competitors); and

5. Contract execution: From award to contract signature. This may include final negotiations in some processes.

Apart from the dialogue or interactive process itself, the rest of the process and management challenges are the same as in other procurement methods. The authority will have to qualify (in this case usually to shortlist) and evaluate offers so as to select the awardee and subsequently manage the contract execution process.

In addition to signing the contract, the awardee must achieve financial close which is the point at which it has finance available for the project. As mentioned in section 7, in some countries financial close is done soon after signing the contract. In other countries, more time is required for the awardee to reach financial close, but construction does not start until financial close has occurred. These variations are explained further in chapter 6 (additionally, appendix A to chapter 6 offers the perspective of the private partner in managing the process of preparing and submitting the bid, and closing the financing).

With this phase, the procurement process finishes and the Contract Management Phase then starts.

Phase 5 (chapter 7) – Contract Management Phase — Construction

Objectives: To proactively manage the contract so as to avoid or minimize the impact of risks and threats (in this case, during the Construction Phase) associated with changes, claims and disputes. In this phase, it is especially important to monitor compliance with construction requirements.

Tasks:

- Establishing governance and a contract management team;

- Establishing and executing contract administration — including the development of a contract management manual (initially focused on the Construction Phase);

- Oversight and managing site handover, permits and design;

- Monitoring private party’s compliance and performance during construction;

- Managing delays;

- Managing communication and stakeholders;

- Managing changes (due to change orders proposed by government or suggested by the private partner), claims (due to retained or shared risk events), and disputes;

- Administrating payments during construction in co-financed projects; and

- Commissioning/acceptance and start of operations.

The foundations of the contract management strategy include a range of tools that are included in the contract itself. These include:

- The financial model and reporting;

- Mechanisms to remedy faults and missed performance such as penalties, Liquidated Damages (LDs), deductions, or even early termination; and

- The basic procedures to deal with risks, claims, changes and disputes.

However, it is good practice to develop a contract management manual in “common language” as a more friendly management tool. The manual should not be a substitute for the contract as a “reference” document, but should help the contract management team to develop their management task. The manual may serve to clarify ambiguities or further develop management procedures that are outlined in the contract. It may even serve to reach a consensus regarding potential ambiguities.

The very first task within the Contract Management Phase is to develop the manual, establish the contract management team, and establish the management decision governance (decision flows). Preparation for this task should commence before contract signature.

Chapter 7 explains the main elements of the contract management strategy common throughout the contract life, before explaining the specific managerial aspects related to the first part of the contract, development and construction through to commissioning and service commencement.

Contract management includes many different activities, which include:

- Monitoring performance;

- Managing other threats and risks that may affect the project outcome and therefore the VfM;

- Managing changes in the contract, risk allocation, disputes, and many other events including early termination;

- Administering the obligations and responsibilities of the procuring authority;

- Providing authorizations;

- Calculating and liquidating payments;

- Analyzing claims; and

- Managing information and communications.

Some of the tasks listed above are continuing tasks (monitoring, administering payments). Others are discrete and respond to episodes of risks occurring. The episodic processes primarily relate to the following situations or types of events.

- Claims for compensation or financial adjustments (typically referred to as rebalancing in civil law countries), especially those due to project contract risk events that have been retained by the procuring authority or shared;

- Changes in contract service requirements or “change orders”, which may be especially relevant during the Construction Phase; and

- Disputes resulting from the former and other changes.

The Construction Phase is completed with the commissioning of the asset and the authorization and order to commence the service or operations period, which is by itself a relevant milestone to be carefully managed.

Phase 6 (chapter 8) – Contract Management Phase — Operations (to finalization and hand-back)

Objectives: To proactively manage the contract so as to avoid or minimize the impact of risks and threats (in this case, during the Operations Phase) associated with changes, claims and disputes. This is especially true of monitoring the performance, and controlling the hand-back of the asset at the contract expiration date.

Tasks:

- Monitoring performance;

- Managing changes, claims and disputes;

- Preparing for hand-back; and

- Hand-back and finalization.

During this phase of the contract life, the foundations of contract management are naturally the same as during construction. However, some situations and risks are specific to the Operations Phase.

It is good practice for the contract management manual to include specific sections dedicated to each of the phases.

During the Operations Phase, the proper monitoring of contract performance starts (as the essence of PPPs is to pay for the service rendered and only when and to the extent the service is provided), as does the administration of the payment mechanism.

This is the phase in which the procuring authority commonly has to deal with the following.

- Non-compliance and under-performance of the private partner in executing specification outputs under the contract;

- Changes in ownership and/or transfer shares;

- Refinancing (which is a change in the financial plan, usually with impacts in the contract financial architecture, as long as refinancing gains are shared); and

- Oversight of the renewal plan, renewal investments and renewal fund management.

This phase also includes the contract expiration and the handback of the asset to the procuring authority. The contract should include specific provisions for the hand-back, as well as technical specifications for the required condition of the infrastructure at this point in time. To meet this condition, the private party may have to make material investments before turning the asset over to the authority.

These, and other specifics related to contract management during the operations period of the contract are described in chapter 8.

The rest of the PPP Guide provides further knowledge on all the relevant topics regarding the use and management of the PPP option to procure and manage infrastructure.

These documents provide guidance to some external references. A selection of other general guides on PPPs are provided in the first section, then some additional specific references, mentioned in this chapter, are provided as further sources of information on some of the specifics.

|

Name of Document |

Authors/Editors and year |

Description |

htpp link (when available) |

|

|

General PPP Guides on the PPP Concept and the PPP Process Cycle |

||||

|

Infrastructure Australia National PPP Guidelines, Volume 2: Practitioners’ Guide |

Commonwealth of Australia (2011) |

Detailed guidance material for implementing agencies regarding how to implement PPP projects under the national PPP policy, including project identification, appraisal, PPP structuring, the tender process, and contract management. Includes detailed guidance in annexes on technical subjects. |

http://infrastructureaustralia.gov.au/policy-publications/public-private... |

|

|

How to Engage with the Private Sector in Public-Private Partnerships in Emerging Markets |

World Bank - Farquharson, Torres de Mästle, and Yescombe, with Encinas (2011) |

Describes and provides guidance on the whole PPP process, highlighting the experience of developing countries. Briefly covers project selection. The focus is on preparing and bringing the project to market, and engaging with the private sector. |

https://openknowledge.worldbank.org/bitstream/handle/10986/2262/594610PU... |

|

|

Online Toolkit for Public Private Partnerships in Roads and Highways World Bank |

World bank, PPIAF (2009) |

Implementation and monitoring provides guidance and links to further material on project identification, feasibility studies and analysis, procurement, contract award, and contract management. |

http://www.ppiaf.org/sites/ppiaf.org/files/documents/toolkits/highwaysto... |

|

|

World Bank PPP in Infrastructure Resource Centre, online at: http://ppp.worldbank.org/public-private-partnership/ |

World Bank |

Provides links and references for a wide number of PPP-related topics. |

||

|

Public Private Partnerships Reference Guide Version 2.0 |

World Bank(2014) |

This is a comprehensive description of the PPP process and PPP foundations, including a useful and detailed list of external key references for each topic. |

http://ppp.worldbank.org/public-private-partnership/library/public-priva... |

|

|

South Africa National Treasury PPP Manual |

South Africa (2004) |

A comprehensive guide to PPP process management. |

http://www.ppp.gov.za/Legal%20Aspects/PPP%20Manual/Module%2001.pdf |

|

|

The Guide to Guidance - How to Prepare, Procure and Deliver PPP Projects |

EPEC (2012) |

This is a comprehensive description of the PPP process, including numerous references to further guidance on each of the topics and phases described. |

http://www.eib.org/epec/g2g/iii-procurement/31/314/index.htm |

|

|

Attracting Investors to African PPP |

World Bank 2009 |

Includes interesting reflections from the perspective of the African region. |

https://openknowledge.worldbank.org/bitstream/handle/10986/2588/461310re... |

|

|

Public-Private Partnerships: In pursuit of Risk Sharing and Value for Money |

OECD (2008) |

Analyzes PPPs from the perspective of VfM and risk sharing. |

|

|

|

Standardization of PFI Contracts (version 4) |

HM Treasury (2007) |

Detailed guidelines to structure a PFI (user-pays PPP) contract. |

|

|

|

Standardization of PFI2 Contracts |

HM Treasury (2012) |

Develops the former standards so as to adapt them to PF2. |

https://www.gov.uk/government/uploads/system/uploads/attachment_data/fil... |

|

|

Information and Guidance about Institutional Investment in PPPs and Infrastructure Funds |

||||

|

Pension Funds Investment in Infrastructure – A Survey |

OECD, September 2011 |

A survey of the presence of institutional capital in infrastructure assets. |

http://www.oecd.org/futures/infrastructureto2030/48634596.pdf |

|

|

Institutional Investment in Infrastructure in Emerging Markets and Developing Economies |

PPIAF, 2014. |

A general overview of institutional investors. |

http://www.ppiaf.org/sites/ppiaf.org/files/publication/PPIAF-Institution... |

|

|

Where Next on the Road Ahead? Deloitte Infrastructure Investors Survey. |

Deloitte, 2013 |

An interesting paper on the recent evolution and trends among the infrastructure funds, and the institutional investor’s role in infrastructure investment. |

http://www2.deloitte.com/content/dam/Deloitte/global/Documents/Financial... |

|

|

What are Infrastructure Funds? |

Kelly DePonte, Pribitas Partners, 2009 |

Provides a useful introduction to the work of infrastructure funds. |

http://probitaspartners.com/wp-content/uploads/2014/05/What-are-Infrastr... |

|

|

Investment Financing in the Wake of the Crisis: The Role of Multilateral Development Banks |

Chelsky and others, 2013 |

Provides information about the role of Multilateral Investment Banks. |

http://siteresources.worldbank.org/EXTPREMNET/Resources/EP121.pdf |

|

|

Introductory Information on Project Finance |

||||

|

PPP: Principles of Policy and Finance |

E. R. Yescombe (2007) |

Chapters 8–12 provide knowledge about project finance techniques in the PPP context. |

|

|

|

Guide to Guidance: How to Prepare, Procure, and Deliver PPP Projects |

EPEC 2012 |

Annex 1 provides a useful summary on project finance in the context of PPPs. |

http://www.eib.org/epec/g2g/iii-procurement/31/314/index.htm |

|

|

|

|

|

|

|

|

Other References and Readings cited in this Chapter |

||||

|

|

|

|

|

|

|

A New Approach to Public-Private Partnerships: Consultation on the Terms of Public Sector Equity Participation in PF2 Projects |

HM Treasury 2012 |

A consultation paper on the new PPP approach developed in the UK with respect to the public sector participation in equity. |

https://www.gov.uk/government/uploads/system/uploads/attachment_data/fil... |

|

|

Guidance Note: Calculation of the Authority’s Share of a Refinancing Gain |

HM Treasury, 2008 |

A methodology to calculate the share in PPP refinancing. |

https://www.gov.uk/government/uploads/system/uploads/attachment_data/fil... |

|

|

Infra-scope. Evaluating the Environment for PPPs in Latin America and the Caribbean |

Developed by the EIU and commissioned by FOMIN, with the sponsorship of the Government of Spain. 2013 |

Provides a general view of the evolution and degree of development of the countries in the Latin America region. |

http://www.fomin.org/en-us/Home/Knowledge/DevelopmentData/Infrascope.aspx |

|

|

The U.K. Treasury Infrastructure Finance Unit: Supporting PPP Financing During the Global Liquidity Crisis |

Farquharson and Encinas, 2010 |

Describes the intervention and proactive measures to financially support PPPs. |

http://wbi.worldbank.org/wbi/document/uk-treasury-infrastructure-finance... |

|

|

|

HM Treasury, August 2016 |

Describes the process and matters related to debt funding competitions. |

https://www.gov.uk/government/uploads/system/uploads/attachment_data/fil... |

|

|

HM treasury UK, 2004 |

Provides information on risk management of the PPP process. |

https://www.gov.uk/government/uploads/system/uploads/attachment_data/fil... |

||

|

HM Treasury UK 2007 |

Provides information on key issues related to project governance of a public project. |

https://www.gov.uk/government/uploads/system/uploads/attachment_data/fil... |

||

|

Eggers and Start-up, Deloitte, (2006), updated in 2015 |

The PPP maturity concept is proposed and explained by Deloitte, including three stages of development. This study provides a short and easily digestible overview of the advantages and disadvantages of PPPs. |

|||

|

Bent Flyvberg, Transportation Planning and Technology, vol. 30, no. 1, February 2007, pp. 9-30 |

Explains how optimism bias or simply lack of appropriate analysis is one of the most common reasons for project failures. |

|

||

|

Green Book: Appraisal and Evaluation in Central Government |

HM treasury UK, (2003) |

Provides a description of signs of PPP suitability, in box 23, “Considering private provision”. |

https://www.gov.uk/government/uploads/system/uploads/attachment_data/fil... |

|

|

Good Practice Note - Managing Retrenchment

|

IFC (August 2005).- |

Provides guidelines on retrenchment management |

http://www.ifc.org/wps/wcm/connect/8b14b6004885555db65cf66a6515bb18/Retr... |

|

|

Performance Standard 2. Labor and working conditions |

IFC (2012) |

Provides guidelines on retrenchment management |

http://www.ifc.org/wps/wcm/connect/2408320049a78e5db7f4f7a8c6a8312a/PS2_... |

|

|

Experiencia Española en Concesiones y APPs: Rails and Light Rails and other transport infrastructure (

|

A. Rebollo commissioned by IDB (2009). |

Describes the Spanish experience in rail and light rail PPPs and provides case studies and reflections on payment mechanisms |

http://idbdocs.iadb.org/wsdocs/getdocument.aspx?docnum=35822328 |

|

|

Handshake (the International Finance Corporations´s quarterly journal on PPPs) issue #1

|

IFC (May 2012 reprinted) |

Provides for information and discussions about the role of PPPs in the water sector |

http://www.ifc.org/wps/wcm/connect/3bc26a0048fbf6248799ef28c8cbc78b/Hand... |

|

|

Handshake issue #3 |

IFC (October 2011) |

Discusses the role PPPs and other private involvement in the health sector. |

|

|

|

IMF, Finance & Development

|

IMF (2013) |

Provides reflections on shadow banking |

http://www.imf.org/external/pubs/ft/fandd/2013/06/basics.htm). |

|

|

Mejores Prácticas en el financiamiento de Asociaciones Público Privadas en America Latina Best Practices in Public-Private Partnerships Financing in Latin America, Washington, DC: World Bank Institute Conference Report, World Bank

|

World Bank Institute (2011) |

Reproduces the outcome of a Conference held in May 2011 in Washington about best practice in private finance in the Latin America region. |

http://www.ppiaf.org/sites/ppiaf.org/files/publication/ConferencereportS... |

|

|

The Financial Crisis and the PPP Market – Remedial Actions |

(EPEC, 2009), |

An interesting read to learn more about how intervention measures may help PPPs in times of economic or financial crisis. |

http://www.eib.org/epec/resources/epec-credit-crisis-paper-abridged.pdf |

|

|

National PPP Forum – Benchmarking Study, Phase II: Report on the performance of PPP projects in Australia when compared with a representative sample of traditionally procured infrastructure projects |

University of Melbourne 2008 |

Australia’s National PPP Forum (representing Australia’s National, State and Territory governments) commissioned The University of Melbourne in 2008 to compare 25 Australian PPP projects with 42 traditionally procured projects |

|

|

|

Sources for Cases Studies |

||||

|

Prepared by UCSF Global Health Group and PwC, 2013. |

Describes the case of an integrated health PPP in Lesotho. |

http://globalhealthsciences.ucsf.edu/sites/www.ppp-certification.com/fil... |

||

|

European Commission, (2004) |

Includes a number of European case studies, including a number of joint venture examples in the water and transportation sectors. |

http://ec.europa.eu/regional_policy/sources/docgener/guides/pppresourceb... |

||

|

|

Provides further information about PPP application in some of these sectors, including concrete examples and case studies. |

|||

|

Government of India and PPIAF, 2010 |

A paper that describes the main lessons learned (good and bad) for a number of projects. This is very useful to complement the information and explanations provided about “project failures” in this chapter. |

|||

|

World Economic Forum, 2010 |

Includes several case studies on relevant PPP transactions. |

http://www3.weforum.org/docs/WEF_IV_PavingTheWay_Report_2010.pdf |

||

|

Eberhard, and others, The World Bank Institute and the Public Private Infrastructure Advisory Facility (PPIAF), The World Bank, Washington, D.C., May 2014 |

Analyses cases studies, including the energy IPP program in South Africa. |

http://ppp.worldbank.org/public-private-partnership/library/south-africa... |

||

|

Infrastructure Magazine, Deloitte, July 2010 |

Describes the case study of the I-95 in Florida. |

Project websites: http://www.i595express.com/ and http://www.595express.info/ |

||

|

A Preliminary Reflection on the Best Practice in PPP Health Sector: A Review of Different PPP Case Studies and Experiences |

The United Nations Economic Commission for Europe (UNECE), World Health Organization (WHO) and the Asian Development Bank (ADB), in draft version 2012 |

include several case studies on the various scopes and structures in health PPPs. |

http://www.unece.org/fileadmin/DAM/ceci/images/ICoE/PPPHealthcareSector_... |

|

|

Case Studies on the Public Private Partnerships at Humansdorp District Hospital Universitas, Pelonomi Hospitals and Inkosi Albert Luthuli Central Hospital |

PPP Unit of the National Treasury South Africa, 2013. |

Describes several case studies on the various scopes and structures in health PPPs in the country. |

http://www.ppp.gov.za/Legal%20Aspects/Case%20Studies/Humansdorp%20Overal.... |

|

[120] The described PPP process does not include a task that is regarded as part of the project cycle in some guides: project ex-post evaluation is regarded as good management practice for PPP programs or when a country uses the PPP tool as a strategic tool in a programmatic way, and it is explained in Chapter 1 (“Establishing PPP framework”) with other framework related matters.

[121] In two-stage processes that include a dialogue or interactive phase, it is common practice to include a description of the proposed key terms of the project contract together with the RFQ package. This includes the basic structure and fundamental features that are being considered, as well as a brief description of the evaluation procedures.

Add a comment