irina unkovski

The need for resilient, sustainable and new infrastructure is on the rise globally. Executives around the world are concerned about the adequacy and existence of infrastructure. Availability of infrastructure is a critical issue for business as it impacts on operating costs and it becomes a major factor in strategic planning and decision making. The long term outlook for the businesses does not look bright as 77% of the surveyed participants by the Economics Intelligence Unit on behalf of KPMG International[1] are concerned that current plans and investments in infrastructure are not sufficient to support long-term growth of business.

Poor or inadequate transportation facilities, poor energy infrastructure driving the energy costs and delivery of poor social services due to difficulty in operating old and neglected infrastructure places drastic pressure on Public Sector to deliver on all these challenges. In turn, Governments are looking to find new and more effective ways to improve vital infrastructure through private financing and Public Private Partnerships.

Governments’ excitement of providing infrastructure through PPPs is short-lived. During the feasibility study and procurement period of the PPPs the input of effort into the process by Government is admirable, however the same efforts diminish and are not maintained once the ink is dry on the contract.

At the very start of the construction phase the Governments behave as if the entire project has been completed when in fact all that has been set are the rules of the engagement. So what does happen once the contract is signed?

Usually, expensively negotiated contracts are gathering dust at the official’s bottom drawers while the public sector contractual rights are being unused, locking the full value and excellent service due. This phenomenon is greatly supported by the Governments' inability to recognise the contract management importance and associated disciplines that are needed to deliver the successful project during the commissioning and operating phase.

The statistics show that 66% of sampled PFI contract managers devoted half of their time to managing the contract and 42% of the contracts sampled had failed to levy any performance deductions in the past (Ipsos MORI survey, 2008)[2]. There are several possible reasons for such low findings. These can be categorised as contract management being undermined by the owners of the project thereby under-resourcing contract management function, contract managers not having the right skills and therefore often unaware of their rights under the contract, the attitude of “know it all” by contract managers when it comes to service management jeopardises the contract and project by ignoring the valid details of the contract when unlocking the value, and disillusionment of the contract managers that by levying deductions actually serves to worsen performance and trading deductions for other services brings value to the project when in fact it diminishes that very same point.

Therefore, the issue of “excellence in theory” (a great feasibility study) versus “not really project that is delivering” (commissioning and operating phase) can be bridged by simply applying good contract management to PPPs.

APMG International will be launching a PPP certification scheme in partnership with the World Bank Group in early 2016, to improve performance of PPP practitioners across all aspects of PPPs. As one of the major themes emphasised in the scheme, contract management will be one of the topics that will give great insight of how proper implementation of contract management is imperative to the success of the PPPs.

[1] KPMG International (2009), Bridging The Global Infrastructure Gap: Views From The Executive Suite conducted in cooperation with the Economist Intelligence Unit https://www.kpmg.com/dutchcaribbean/en/Documents/Publications/Bridgingth...

[2] Ipsos MORI 2009, Investigations the performance of operational PFI contracts: A research study conducted for Partnerships UK on behalf of HM Treasury

Irina Unkovski

Irina is a qualified Quantity Surveyor and holds a Master’s Degree in Building specializing in various Infrastructure Procurement Methods. She has more than 15 years of experience working with both Public and Private sector on various Infrastructure initiatives. Currently, Irina is with Deloitte South Africa, leading Corporate Finance Infrastructure Capital Project Team.

Irina has completed various consulting assignments mostly at National and Provincial Government levels specifically development of infrastructure on PPPs within transport, healthcare and commercial buildings. As a result she is familiar with various vehicles, which could be used in alternative service delivery, be it by National, Provincial or Local Government.

Currently, Irina is developing a methodology for Project Management of existing and operating PPPs which will assist government officials in successful delivery, as well as provide a tool for managing the PPP inception for both Transaction Advisors and government officials. She has been involved in projects of monitoring nature such as Gautrain, as well as assisting clients in the public sector with monitoring and assurance of the adjudication of tenders over R 30bn in value.

Infrastructure has finally made it to the top of political agenda following many years of neglect and decades of improper planning. Many business leaders are of the opinion that inadequate infrastructure will negatively impact their companies’ long-term growth and the decision of where to do business will be influenced by surrounding and available infrastructure. Government frontrunners are saying that developing countries need new infrastructure, while developed countries need rebuilt infrastructure and almost every country is struggling to finance its infrastructure needs. The common thread of both public and private sector is the need for new infrastructure bridging it with private finance and investment and attracting the same through sensible pricing and better regulatory policies.

The question is how the optimal mix of public and private sector involvement for any given project be determined so that limited public money can create maximum public value. The answer is through Public Private Partnerships.

In order for Public Private Partnerships to prove beneficial to the Government and to the public, they need to answer these following questions:

- Is the project affordable?

- Is the theoretical value for money demonstrated? And;

- Has appropriate transfer of risk between public and private sector achieved?

This can be achieved if the project is executed as it is originally envisaged and if proper contract management and administration is applied throughout lifespan of the project.

The effectiveness of a PPP cannot be guaranteed at financial close. Therefore, contract management is critical to securing value for money by implementing key elements during the construction and operational stage of the PPP in order for the risks to be managed and realised as was envisaged when the project was formulated during the feasibility stage.

APMG International will be launching a PPP certification scheme in partnership with the World Bank Group early 2016, to improve performance of PPP practitioners across all aspects of PPPs. One of the topics that is emphasised in the PPP Certification Guide is contract management. This will give great insight of how proper implementation of contract management is imperative to the success of the PPPs.

Written by PPP Certification Guide author, Irina Unkovski - Infrastructure and Capital Projects Specialist

Irina Unkovski

Irina is a qualified Quantity Surveyor and holds a Master’s Degree in Building specializing in various Infrastructure Procurement Methods. She has more than 15 years of experience working with both Public and Private sector on various Infrastructure initiatives. Currently, Irina is with Deloitte South Africa, leading Corporate Finance Infrastructure Capital Project Team.

Irina has completed various consulting assignments mostly at National and Provincial Government levels specifically development of infrastructure on PPPs within transport, healthcare and commercial buildings. As a result she is familiar with various vehicles, which could be used in alternative service delivery, be it by National, Provincial or Local Government.

Currently, Irina is developing a methodology for Project Management of existing and operating PPPs which will assist government officials in successful delivery, as well as provide a tool for managing the PPP inception for both Transaction Advisors and government officials. She has been involved in projects of monitoring nature such as Gautrain, as well as assisting clients in the public sector with monitoring and assurance of the adjudication of tenders over R 30bn in value.

In a PPP project the public sector invites the private sector, via a bidding process, to design, build, finance and operate an asset in order to provide a service to or on behalf of the public sector. In addition, the project must be affordable, provide value for money, and obtain optimal risk transfer between the public and private sectors.

The payment for this service can either come directly from the public sector (government) or from the end users (general public). Examples of government-pays infrastructure could be schools, hospitals and other accommodation projects. Examples of user-pays infrastructure include toll roads, rails and other transportation systems where the payment mechanism demands the user to pay for the service.

PPPs – key benefits and requirements

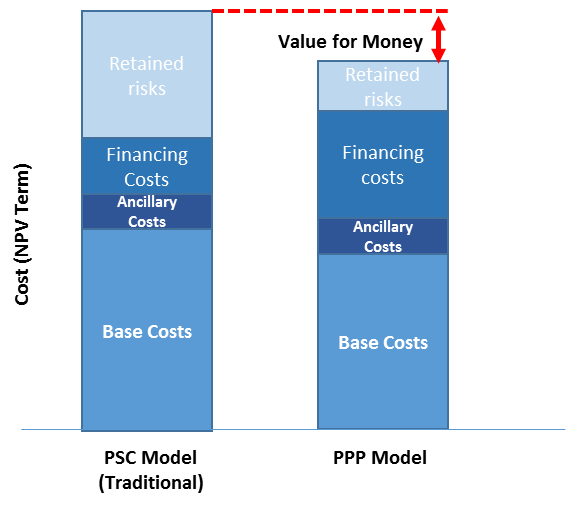

The benefits of PPPs are numerous, the main one being obtaining Value for Money. This means delivering a project with a superior quality for the same amount of money than the public sector would spend on the same service in a given fiscal year. There are several components of the Value for Money factor which include: risk transfer, output based specifications, long term nature of contracts, performance measurements and incentives, private sector management skills and other various money drivers.[1] For a PPP to be successful the majority, if not all of the components, must be satisfactorily delivered and concluded. Sometimes, if not often, they are not.

Value for Money – the 5 main pitfalls

Let’s look at the components of the Value for Money and see where are the major pitfalls that occur and most importantly, why? As per Van Herpen (2002), the key pitfalls are as follows:

Risk will be transferred to the party which is best able to manage this risk and at the lowest cost. The risk allocation is produced during the feasibility study of the process while assessing the value for money. If this section of the risk assessment is not done properly and sufficiently right at the beginning and prior to the contract signature, the risk transfer can be diluted and retained by the public sector. Another issue can actually creep up due to insufficiently (badly) written contracts that can omit significant scenarios that can either revert the risk to or be retained by public sector. Finally, during the life of the project, certain engagements are initiated by either public or private parties that shouldn’t be – often leading to risk reverting by default to the party that originally was not supposed to bear the risk. For example, if the public sector gets involved in the decision-making specifically around the design of the asset the risks around the design aspect will by default revert back to the public sector.

Output based specifications can provide many benefits such as giving the Private sector the freedom to produce innovative ideas and ways of delivering at reduced cost without compromising the final output and quality. However, problems might arise when the public sector is not quite certain what it wants to achieve and what exactly the outputs should be. These decisions can be quite costly for the public sector as delays and variations might occur therefore not achieving the anticipated Value for Money.

The Long term nature of contracts allows the service provider (Private sector) more time to recover the cost of the investment. It also provides a learning curve for the service provider and in turn increases efficiency. It also makes it easier to transfer the technology risk to the service provider as they will have better judgement when renewal of assets and capital expenditure is incurred. However, long term contracts come with their pitfalls as well. The main one is the reduction in competitive pressure on the service provider to reduce costs and increase quality, which creates a state of complacency. Therefore it is extremely important that the service provider delivery is closely monitored and at the same incentivised in order to keep up the standard as originally envisaged by the project.

Performance measurement and incentives are a great way to achieve the goal of the project and what is stipulated by the contract, and can be beneficial to both parties if properly implemented. The benefits and rewards can be shared making the project a success. However, on many occasions, the importance of performance monitoring and management is overlooked by the public sector. This results in the Value for Money being completely diminished as the private sector will not invest much to provide for corrective measures. Therefore it is imperative that performance measurement is monitored and measured on a regular basis by the Public sector for obtaining Value for Money.

Private sector management skills are also key benefits that PPPs can provide to the Public sector. Traditionally, project management is not something that the public sector used to undertake due to the nature of their business however, in order to produce quality delivery to the general public, management skills are imperative to success of any project. The Public Sector can learn a great deal from the Private Sector with respect to proper project and programme management through long term partnership projects and implement on other various occasions. This however can be also a pitfall as public sector sometimes is not open to spending time learning new methods and even ignoring the roles and responsibilities of what should be done on the PPP project itself jeopardising projects success due to the improper management.

These are just few examples of how potentially benefits can quickly turn into pitfalls while executing PPPs. To learn more on these and many others, please refer to the recently released APMG Public-Private Partnerships Certification Program produced by APM Group.

[1] G.E.W.B Van Herpen, 2002, Public Private Partnerships the Advantages and Disadvantages Examined, Dutch Ministry of Transport, Public Works and Water Management, AVV Transport Research Centre

Irina Unkovski

Irina is a qualified Quantity Surveyor and holds a Master’s Degree in Building specializing in various Infrastructure Procurement Methods. She has more than 15 years of experience working with both Public and Private sector on various Infrastructure initiatives. Currently, Irina is with Deloitte South Africa, leading Corporate Finance Infrastructure Capital Project Team.

Irina has completed various consulting assignments mostly at National and Provincial Government levels specifically development of infrastructure on PPPs within transport, healthcare and commercial buildings. As a result she is familiar with various vehicles, which could be used in alternative service delivery, be it by National, Provincial or Local Government.

Currently, Irina is developing a methodology for Project Management of existing and operating PPPs which will assist government officials in successful delivery, as well as provide a tool for managing the PPP inception for both Transaction Advisors and government officials. She has been involved in projects of monitoring nature such as Gautrain, as well as assisting clients in the public sector with monitoring and assurance of the adjudication of tenders over R 30bn in value.

The Foundation level training, aimed at candidates from public sector institutions in Lesotho, was delivered in Maseru by Training Byte Size, an accredited training provider. Candidates from ministries and municipalities with a mixed skill set and experience level in delivering PPPs attended the course. Due to the various levels of understanding of the topic, the course is structured in such way that provided sufficient detail and understanding for the beginner level and also served as a refresher course for the candidates that have been involved in the PPP market for some time.

The training sessions were promoted in an interactive environment which included presentations and references to real PPP projects from across the world as well as exam simulations. The debates and discussions were very engaging as the local market already had an example of the PPP project running in Lesotho. Mixed skill sets allowed for various discussion topics including legal PPP framework in Lesotho, financial instruments used and the role of the public sector pre, during and post signature of the PPP agreement.

Contract management was one of the big topics discussed as many candidates acknowledged that the Value for Money is derived during the service period where monitoring of the delivery of services are closely related to the monetary value of the project.

Serah Njere Njoroge from World Bank Group said, “PPPs and private financing have the potential to increase access to infrastructure in Africa. PPIAF is currently supporting the government of Lesotho in the development of the PPP framework and building much needed capacity for PPP implementation. In June 2017, with support from PPIAF 20 government officials in Maseru, Lesotho were offered the PPP certification training. Participants were drawn from various ministries including Finance, Health, Works, Development Planning and Energy”.

The training has received very positive feedback from the candidates who also concluded that one of the big success factors was preparation before the course by reading through the available material and the guide published on the APMG site. As a stepping stone towards becoming a Certified PPP Professional (CP3P), the candidates successfully undertook Foundation exam at the end of the course.

Credits : Written by Irina Unkovski

Irina is a qualified Quantity Surveyor and holds a Master’s Degree in Building specializing in various Infrastructure Procurement Methods. She has more than 15 years of experience working with both Public and Private sector on various Infrastructure initiatives. Currently, Irina is with Deloitte South Africa, leading Corporate Finance Infrastructure Capital Project Team.

Irina Unkovski

Irina is a qualified Quantity Surveyor and holds a Master’s Degree in Building specializing in various Infrastructure Procurement Methods. She has more than 15 years of experience working with both Public and Private sector on various Infrastructure initiatives. Currently, Irina is with Deloitte South Africa, leading Corporate Finance Infrastructure Capital Project Team.

Irina has completed various consulting assignments mostly at National and Provincial Government levels specifically development of infrastructure on PPPs within transport, healthcare and commercial buildings. As a result she is familiar with various vehicles, which could be used in alternative service delivery, be it by National, Provincial or Local Government.

Currently, Irina is developing a methodology for Project Management of existing and operating PPPs which will assist government officials in successful delivery, as well as provide a tool for managing the PPP inception for both Transaction Advisors and government officials. She has been involved in projects of monitoring nature such as Gautrain, as well as assisting clients in the public sector with monitoring and assurance of the adjudication of tenders over R 30bn in value.