all

This article was first featured on the World Bank Group's Public-Private Partnerships Blog.

“What is different now?” This question echoed through my head during my recent morning runs along the beautiful Ishim River in Astana, Kazakhstan.

I was in Astana on mission to launch the new technical assistance program for Kazakhstan’s PPP policy reform, which addresses bottlenecks that constrain project structuring. This reform is especially important if the country’s Almaty Ring Road PPP is to be effective. Almaty Ring Road has been a thought-provoking transaction because previous attempts to solidify the partnership have not panned out, and grasping the history is important to resolving this successfully. Moazzam Mekam, IFC’s Regional Manager for Central Asia, and I spent many hours brainstorming on scenarios that would allow us to bring all of the stakeholders into agreement. Most of the time, it felt like we were trying to pull a rabbit out of a hat.

The Almaty Ring Road is Kazakhstan’s only PPP in preparation right now, and it’s in the spotlight during its prequalification stage. The advisory services are provided by IFC; three years of project preparation have been devoted to ensuring that this is the right project to take to market as a PPP. As the World Bank Group continues to support Kazakhstan on bringing private sector participation into the delivery of public infrastructure services, the reality is that since the 2006 Concession Law, not one PPP project has transpired. Before the Concession Law, there were three PPP projects, but all of them have had issues.

As I resumed one of my sunrise runs in this very flat, picturesque, futuristic city, I recalled a recent conversation with Moazzam. He made the point that even when there is a high level of political support for PPPs in the country, institutional and regulatory frameworks are sometimes not ready for PPPs. Capacity and willingness to undertake PPPs at the line ministry/agency level is limited. In instances like this, or when conditions exist in a similar context, we must ask ourselves how to respond, and how to move forward.

Of course there is neither a panacea, nor a perfect formula to get it right. Every government, sub-national or national, has its own forces at play. Our job is to understand those forces well enough to evaluate the appropriateness of a PPP, and then, if it’s decided that the environment is right for this sort of partnership, to structure an effective PPP.

I’ve learned over time that each PPP is different, and solutions must be tailored to very specific conditions. The waste sector in Brazil can’t use the same PPP that worked for the waste sector in Colombia; a light rail PPP that transformed one city in India would fall apart in another Indian city.

As a starting point, we believe that it make a difference if all IFIs join hands together on the main actions needed to reform Kazakhstan’s PPP agenda. That’s why I am working with Moazzam’s team to provide technical assistance on screening and preparation of projects.

Our emphasis is on convening all the stakeholders in the PPP space – such as the European Bank for Reconstruction and Development, the Asian Development Bank, and the United Nations Economic Commission for Europe – making it possible to reach a common understanding. Then we will be equipped to work with the government to present a unified voice on what needs to be done. Our plan is to identify two to three key ‘deal breakers’ which absolutely have to be addressed in order to move the projects forward. This will send a strong signal to the market that Kazakhstan is open for business.

In Kazakhstan – and around the globe – our challenge is not to do one PPP transaction every four or five years, but to do a portfolio of properly vetted PPP transactions every year. This requires a greater level of understanding and commitment around PPPs than currently exists in many of the countries we serve. As we join forces internally to reach this goal, we envision a different way of helping governments succeed in delivering infrastructure services in the long term, with more rapid progress between the time that advice is offered and when a project comes to fruition.

How can we better incentivize governments to act upon the advice they seek? This is, of course, a challenge we all share. We’re open to hearing your suggestions on how we can collaborate even more effectively, ultimately helping to shift policies that will affect positive change on the ground.

Special thanks to Moazzam Mekan for his contributions to this piece.

SOURCE:

https://blogs.worldbank.org/ppps/helping-governments-act-upon-advice-they-seek

Jyoti is the Program leader of the PPP Certification Program on behalf of the MDBs (ADB, EBRD, IDB, MIF, IsDB, WBG and PPIAF). She sits in the PPP Unit of the World Bank Group and is based in Washington DC.

Jyoti is currently leading the dialogue on PPPs in Kazakhstan and Tajikistan from the World Bank Group and previously in Brazil, Vietnam, Russia, Uruguay, Mozambique, Madagascar, Kenya and Ethiopia. Her work focusses on infrastructure project financing, financial viability assessments and structuring of PPP options.

Her recent achievements have been defining the private capital mobilization/catalyzation among development community; launching the Global PPP Certification program −‘CP3P’; financial recovery planning for Vietnam Electricity and; structuring PPPs in Irrigation toolkit. Jyoti specializes in Infrastructure Finance with an MBA from George Washington University and Mathematics in undergraduate, she has over 10 years of work experience in project finance transactions and PPPs.

See below for some examples of Jyoti's other work:

- A financial recovery plan for Vietnam electricity: with implications for Vietnam's power sector

- How to develop sustainable irrigation projects with private sector participation

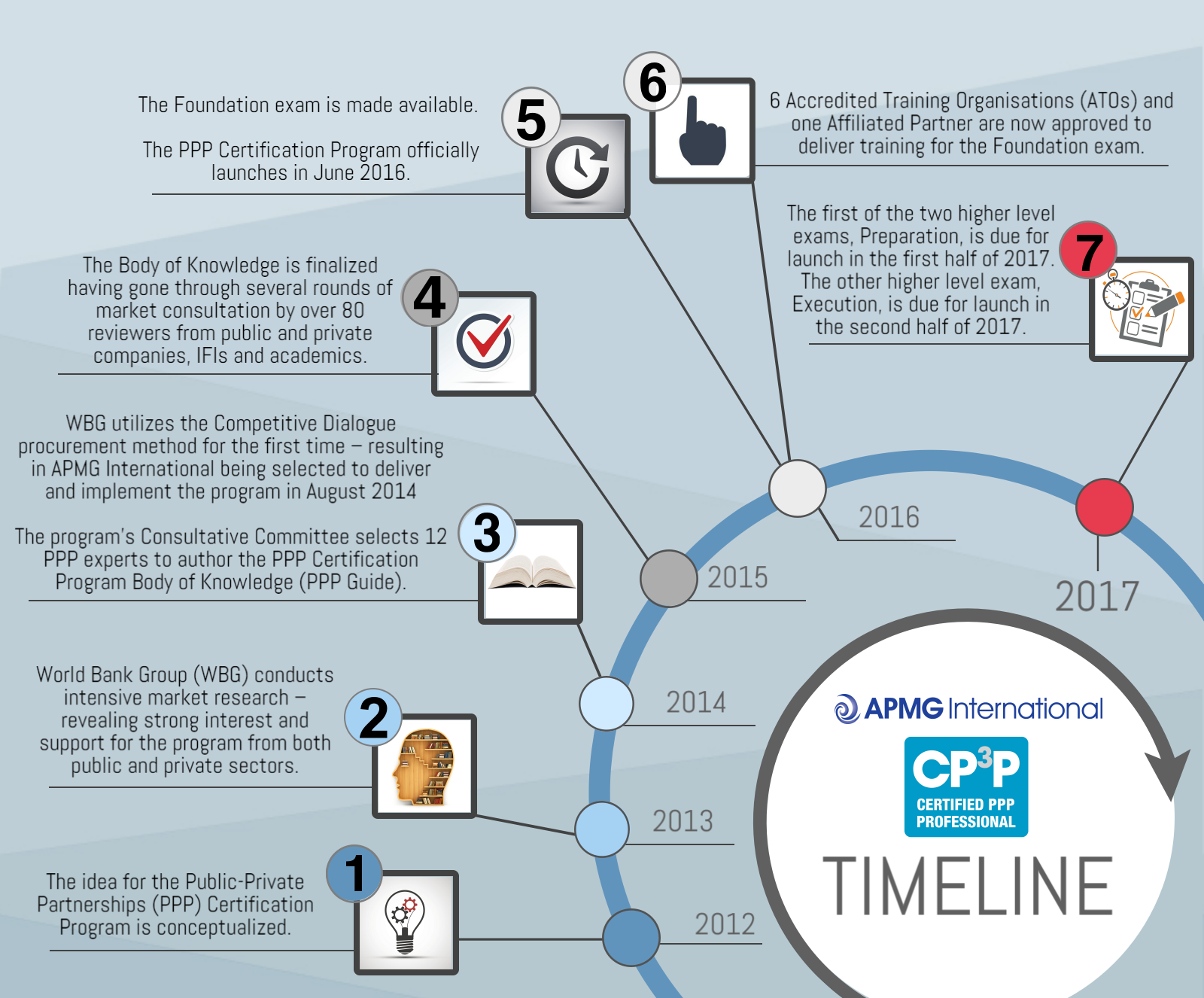

It's a momentous occasion for us at APMG – we've recently established a partnership with the World Bank Group (WBG) to create a new certification program for people working with Public-Private Partnerships (PPPs).

WGB’s the world’s largest development bank. Its objective is to reduce poverty in poorer countries. It has created a multi-module PPP Certification Program to address the pressing need for governments to utilize effective PPPs.

Growing populations and aging infrastructure are straining the capacity of many nations to deliver essential public services and grow their economies. Overcoming this infrastructure deficit will require public and private sectors working together, and well-structured public-private partnerships (PPPs) are one solution for helping governments raise the large sums of capital needed to meet infrastructure demands and spur development.

APMG currently delivers professional certifications in all regions of the globe every day of the year. We believe that qualifications give organizations confidence that people can deliver high standards while they are extremely motivating for staff. We are delighted to work with the World Bank Group and the regional development banks in this important initiative.

Up-skilling those responsible for the management of PPP programs will deliver significant benefits to the communities they are designed to help. We hope they will also be a challenge and stimulation for those who take the training courses and put themselves forward for the examinations, starting in 2015.

Over the next year we will be developing the new Body of Knowledge which will support the certification scheme. We are currently inviting authors and contributors.

For more information email partnerships@apmg-international.com

Matt Brewitt

As the Social Media and Online Content Writer within APMG’s Marketing Team – I help produce written copy for the APMG PPP website and the PPP Certification Program digital newsletter. I'm also responsible for creating social media material supporting the program and to raise awareness around PPP good practice.

The need for resilient, sustainable and new infrastructure is on the rise globally. Executives around the world are concerned about the adequacy and existence of infrastructure. Availability of infrastructure is a critical issue for business as it impacts on operating costs and it becomes a major factor in strategic planning and decision making. The long term outlook for the businesses does not look bright as 77% of the surveyed participants by the Economics Intelligence Unit on behalf of KPMG International[1] are concerned that current plans and investments in infrastructure are not sufficient to support long-term growth of business.

Poor or inadequate transportation facilities, poor energy infrastructure driving the energy costs and delivery of poor social services due to difficulty in operating old and neglected infrastructure places drastic pressure on Public Sector to deliver on all these challenges. In turn, Governments are looking to find new and more effective ways to improve vital infrastructure through private financing and Public Private Partnerships.

Governments’ excitement of providing infrastructure through PPPs is short-lived. During the feasibility study and procurement period of the PPPs the input of effort into the process by Government is admirable, however the same efforts diminish and are not maintained once the ink is dry on the contract.

At the very start of the construction phase the Governments behave as if the entire project has been completed when in fact all that has been set are the rules of the engagement. So what does happen once the contract is signed?

Usually, expensively negotiated contracts are gathering dust at the official’s bottom drawers while the public sector contractual rights are being unused, locking the full value and excellent service due. This phenomenon is greatly supported by the Governments' inability to recognise the contract management importance and associated disciplines that are needed to deliver the successful project during the commissioning and operating phase.

The statistics show that 66% of sampled PFI contract managers devoted half of their time to managing the contract and 42% of the contracts sampled had failed to levy any performance deductions in the past (Ipsos MORI survey, 2008)[2]. There are several possible reasons for such low findings. These can be categorised as contract management being undermined by the owners of the project thereby under-resourcing contract management function, contract managers not having the right skills and therefore often unaware of their rights under the contract, the attitude of “know it all” by contract managers when it comes to service management jeopardises the contract and project by ignoring the valid details of the contract when unlocking the value, and disillusionment of the contract managers that by levying deductions actually serves to worsen performance and trading deductions for other services brings value to the project when in fact it diminishes that very same point.

Therefore, the issue of “excellence in theory” (a great feasibility study) versus “not really project that is delivering” (commissioning and operating phase) can be bridged by simply applying good contract management to PPPs.

APMG International will be launching a PPP certification scheme in partnership with the World Bank Group in early 2016, to improve performance of PPP practitioners across all aspects of PPPs. As one of the major themes emphasised in the scheme, contract management will be one of the topics that will give great insight of how proper implementation of contract management is imperative to the success of the PPPs.

[1] KPMG International (2009), Bridging The Global Infrastructure Gap: Views From The Executive Suite conducted in cooperation with the Economist Intelligence Unit https://www.kpmg.com/dutchcaribbean/en/Documents/Publications/Bridgingth...

[2] Ipsos MORI 2009, Investigations the performance of operational PFI contracts: A research study conducted for Partnerships UK on behalf of HM Treasury

Irina Unkovski

Irina is a qualified Quantity Surveyor and holds a Master’s Degree in Building specializing in various Infrastructure Procurement Methods. She has more than 15 years of experience working with both Public and Private sector on various Infrastructure initiatives. Currently, Irina is with Deloitte South Africa, leading Corporate Finance Infrastructure Capital Project Team.

Irina has completed various consulting assignments mostly at National and Provincial Government levels specifically development of infrastructure on PPPs within transport, healthcare and commercial buildings. As a result she is familiar with various vehicles, which could be used in alternative service delivery, be it by National, Provincial or Local Government.

Currently, Irina is developing a methodology for Project Management of existing and operating PPPs which will assist government officials in successful delivery, as well as provide a tool for managing the PPP inception for both Transaction Advisors and government officials. She has been involved in projects of monitoring nature such as Gautrain, as well as assisting clients in the public sector with monitoring and assurance of the adjudication of tenders over R 30bn in value.

Infrastructure has finally made it to the top of political agenda following many years of neglect and decades of improper planning. Many business leaders are of the opinion that inadequate infrastructure will negatively impact their companies’ long-term growth and the decision of where to do business will be influenced by surrounding and available infrastructure. Government frontrunners are saying that developing countries need new infrastructure, while developed countries need rebuilt infrastructure and almost every country is struggling to finance its infrastructure needs. The common thread of both public and private sector is the need for new infrastructure bridging it with private finance and investment and attracting the same through sensible pricing and better regulatory policies.

The question is how the optimal mix of public and private sector involvement for any given project be determined so that limited public money can create maximum public value. The answer is through Public Private Partnerships.

In order for Public Private Partnerships to prove beneficial to the Government and to the public, they need to answer these following questions:

- Is the project affordable?

- Is the theoretical value for money demonstrated? And;

- Has appropriate transfer of risk between public and private sector achieved?

This can be achieved if the project is executed as it is originally envisaged and if proper contract management and administration is applied throughout lifespan of the project.

The effectiveness of a PPP cannot be guaranteed at financial close. Therefore, contract management is critical to securing value for money by implementing key elements during the construction and operational stage of the PPP in order for the risks to be managed and realised as was envisaged when the project was formulated during the feasibility stage.

APMG International will be launching a PPP certification scheme in partnership with the World Bank Group early 2016, to improve performance of PPP practitioners across all aspects of PPPs. One of the topics that is emphasised in the PPP Certification Guide is contract management. This will give great insight of how proper implementation of contract management is imperative to the success of the PPPs.

Written by PPP Certification Guide author, Irina Unkovski - Infrastructure and Capital Projects Specialist

Irina Unkovski

Irina is a qualified Quantity Surveyor and holds a Master’s Degree in Building specializing in various Infrastructure Procurement Methods. She has more than 15 years of experience working with both Public and Private sector on various Infrastructure initiatives. Currently, Irina is with Deloitte South Africa, leading Corporate Finance Infrastructure Capital Project Team.

Irina has completed various consulting assignments mostly at National and Provincial Government levels specifically development of infrastructure on PPPs within transport, healthcare and commercial buildings. As a result she is familiar with various vehicles, which could be used in alternative service delivery, be it by National, Provincial or Local Government.

Currently, Irina is developing a methodology for Project Management of existing and operating PPPs which will assist government officials in successful delivery, as well as provide a tool for managing the PPP inception for both Transaction Advisors and government officials. She has been involved in projects of monitoring nature such as Gautrain, as well as assisting clients in the public sector with monitoring and assurance of the adjudication of tenders over R 30bn in value.

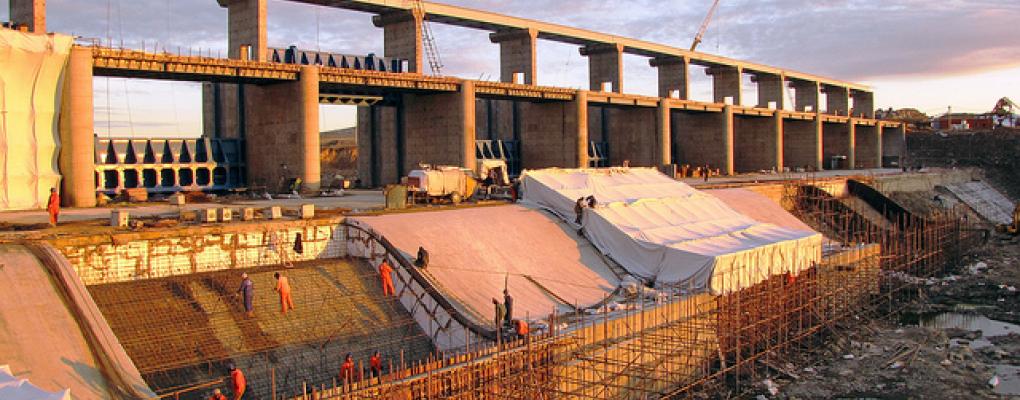

Late last year I was teaching a course on infrastructure finance, in a highly regarded University in Brazil and one of the students asked me, without context: “how to bring losers on board of a Public-Private Partnership project?”

It was a good question, particularly because it shed light on a very relevant aspect of PPP projects, one which the professional community discusses less than it should: There can be losers!

For example, entire communities can lose their houses due to the flooding of large areas needed for a new hydropower generating facility or small vendors that can loose demand due to a new turnpike being built a few miles away. In sum, the total costs of large infrastructure projects can be unevenly borne by some groups.

The choice of the PPP procurement route can also interfere on the distribution of costs of projects. By introducing private finance mechanisms, there can be groups that lose long-standing privileges such as rights of charging specific values of users. Also, the Private finance mechanisms often include contractual incentives to optimize managerial costs, which can increase pressure on the productivity of the labour and other resources.

In fact, good practice recommends that the selection of PPP projects should be preceded by a sound cost and benefit analysis that indicate a positive net benefit for the society. However, having a net positive impact only indicates that a project generates benefits that can address its costs and it does not guarantee that there will be no losers.

To turn a PPP project into a win-win game requires, thus, the careful and deliberate development of contractual mechanisms that distribute the benefits of the project in ways that those that bear its costs also appropriate some of the benefits!

So, back to the question of my dedicated student: How do we bring the losers on board? A direct answer is: We can turn them into winners. The rules that allocate the benefits can range from direct payment of compensations to more sophisticated incentives to the private operator such as specific output specifications (that meet some group’s requirements).

The greatest challenge, in my opinion, is not so much to design a compensation but to map the affected groups and to identify correctly their requirements, so the majority of legitimate interests can be accommodated into the PPP deal. This is why community consultation and other participatory techniques are so important! The preparation of PPP projects has to dedicate a serious amount of resources, including a professional and qualified team, to understand the needs of the people affected by the initiative, as a part of the general project appraisal and this assessment should be as central as the financial and legal due diligence[1].

So, in my opinion, the establishment of a sincere dialogue with the broader community is a necessary step to design PPP contracts that can decisively bring would-be losers on board, allocate the project’s benefits fairly, create a win-win situation and attract effective public support for PPP initiatives!

Written by PPP Certification Guide author, Marcos Siqueira Moraes

[1] The PPP Guide, which will be published as a part of the PPIAF sponsored PPP Certification Program (https://ppp.apmg-international.com//home.aspx) has a specific section on Social Impact Assessment and recommends a test of Social Feasibility as a criteria for the approval of PPP initiatives!

Marcos Moraes

Marcos Siqueira is a recognized expert in PPPs in Brazil, with a multidisciplinary background and over ten years of hands-on experience preparing and managing PPP contracts.

Marcos began his career as financial advisor for governments and was later hired by the government of Minas Gerais, in Brazil, to promote a program to attract private investment in infrastructure. This turned out to become the first PPP Unit in the country, responsible for the delivery of one of the most diverse PPP programs in Brazil. While Marcos was its CEO, the PPP program of Minas Gerais and its projects received several national and international awards for their technical excellence.

As an infrastructure professional, Marcos personally managed over US$ 3 billion worth of transactions in sectors such as transport, social infrastructure, energy and environmental assets. Marcos has had a diverse international experience, being involved in capacity building initiatives in Africa, Latin America and Asia. He has been an associate professor of public policy in Fundação João Pinheiro and Fundação Dom Cabral.

Since December 2014, Marcos is a consultant of the Inter-American Development Bank in a large-scale initiative aimed to compare institutional environments for PPP in several countries.

Marcos holds a bachelor degree in law and public administration. He also received a Masters degree in Public Policy from the University of Sheffield, in the UK.

On behalf of APM Group I’d like to share my excitement for the upcoming PPP Certification Program which is scheduled to be available early next year. The certification results from the hard work of several Multilateral Development Banks (MDBs) across the globe - the World Bank Group (WBG), the Asian Development Bank (ADB), European Bank for Reconstruction and Development (EBRD), Inter-American Development (IAD), the Islamic Development Bank (IsDB) and is part funded by the Public Private Infrastructure Advisory Facility (PPIAF).

This certification program will enable people to prove their competency working within a PPP team and help plan their career progression. This collaborative effort is driven by APMG’s and WBG’s shared desire to strengthen PPP best practice worldwide. The creation of the upcoming certification and its accompanying APMG PPP Certification Program Guide is a response to several issues many nations are facing today.

Growing populations and aging infrastructures are inhibiting the ability of many nations to provide essential public services needed to develop their economies - tackling this infrastructure deficit will require the public and private sectors to work together. Sound structured public private partnerships provide an effective solution to this issue – helping governments raise the funds necessary to meet infrastructure demands and stimulate economic development.

Both public and private sectors in emerging markets and developing economies (EMDEs) often lack the ability to formulate, implement and maintain PPPs – causing many projects to fail. Through this certification program and its supporting guide we hope to help develop capability and make the role of PPPs more prominent in enabling delivery of essential services that are key to the UN’s vision of ending extreme poverty.

The certification program will play in important role in capacity building by creating a global standard of knowledge. We aim to craft a common language on PPPs and unify the understanding and expectations between practitioners working on different stages and sides of the PPP process.

APMG has over twenty years’ experience in Programme and Project Management certification programs such as PRINCE2, Agile Project Management and PMDPro - the certification for project managers working in humanitarian and disaster zones.

APMG delivers professional certifications across the globe each day of the year. Our belief is that certifications provide organizations with the confidence that people can deliver high standards while being highly motivating for staff. We’re proud to be working with WBG and the regional development banks in such an important endeavour.

Up-skilling the people responsible for the management of PPP programs will bring considerable benefits to the communities they are designed to assist. We also hope the certification program will be challenging and stimulating for the candidates who take the training courses and progress to taking the exams.

How to be a CP3P APMG Professional?

The APMG PPP Certification Program Guide is scheduled to be published online and free of charge in Q1 2016. This will inform the syllabus for the APMG PPP Certification Program which can be studied remotely at your own leisure or via an APMG Accredited Training Organization. To obtain the CP3P credentials you will need to pass an exam. The Foundation exams are also currently scheduled to be delivered Q1 2016.

PPIAF (The Public-Private Infrastructure Advisory Facility (PPIAF) is a multi-donor technical assistance facility managed, staffed and housed by the World Bank Group in the Public-Private Partnership Cross Cutting Solution Area (PPP CCSA). Established in 1999, PPIAF provides technical assistance grants to developing countries’ governments to create enabling environments for private investment in infrastructure. PPIAF has 15 contributing donors.

Fiscal Year 2015 (July 2014 – June 2015) brought significant changes to PPIAF. A new strategy focused on programmatic support to client countries anchored by strategic knowledge initiatives was approved by donors. As per this strategy PPIAF’s core interventions focus on building institutions’ capacity and increasing national governments’ and sub-national authorities’ creditworthiness, political buy-in and ownership by strengthening the institutional, legal, and regulatory frameworks, managing associated risks, and enhancing transparency and accountability.

In July 2014 PPIAF provided funding to support the PPP Certification Program, which is strongly aligned with PPIAF’s strategy. PPIAF’s clients in developing countries, partners, and donors will benefit from the PPP Certification Program as it would help them to acquire the skills required in implementing PPP programs.

In the past two years PPIAF launched a number of large programmatic initiatives, building on partnerships with other development financing institutions, in the technical assistance field. In West Africa, PPIAF is supporting the West African Economic and Monetary Union (UEMOA), under which umbrella member countries create an institutional architecture to facilitate regional and national PPP projects.

In the Caribbean, we are supporting the creation of a regional PPP framework. In South Asia, PPIAF is helping Bangladesh scale up the national PPP program. The City Creditworthiness Academy created with PPIAF support in 2013 continues to provide training academies to municipalities to invest in green and resilient infrastructure.

Since 1999 PPIAF has provided funding of over $260 million spanning over 135 developing countries across the world, in the energy, water and sanitation, transport, ICT sectors and various knowledge products, toolkits, and publications.

PPIAF Useful Resources

PPP Knowledge Lab

PPIAF Annual Report 2015

PPIAF Strategy fiscal years 2015-2017

Impact Stories

Toolkits

PPP Resources/Library

Follow PPIAF at http://ppiaf.org and via Twitter: @PPIAF_PPP

Amsale Bumbaugh

When it was set up in 1991, the European Bank for Reconstruction and Development (EBRD) was mandated to help former Soviet and former socialist countries open up to market-based economies. The goal is also reflected in our name — reconstruction and development after the damage inflicted by decades of rigid central planning.

Infrastructure is key to that reconstruction and development as well as to a transition towards a better economic future.

At the same time the widening infrastructure gap across the countries where we invest – now 36 including Cyprus, Greece, Turkey and countries of the southern and eastern Mediterranean region – highlights the need for improved project preparation, capacity-building expertise at the local level, and more private sector capital. Public-private partnerships (PPPs) provide opportunities for the private sector to play a constructive and expanded role.

Following the recent call from the G20 to support greater levels of infrastructure investment, the EBRD created an infrastructure project preparation facility (IPPF). The Bank mobilised €40 million, part of this amount in grant financing and part of it from private investors, to increase support for project preparation and delivery of improved infrastructure by both the public and private sectors.

With this newly created instrument, the EBRD plans to reach diverse sectors and countries across our region, with approximately 10 PPPs and some 20 'commercialised' public sector projects to be prepared over the next three years.

At the EBRD we believe that sharing knowledge of how to develop workable project structures is crucial for accelerating PPPs. We welcome the new PPP certification programme initiated by the World Bank Group and supported jointly by a number of MDBs during its implementation. The programme can strengthen the capacities of governments and markets to build credible and financially viable PPPs across emerging market countries.

Written by Thomas Maier, EBRD Managing Director for Infrastructure

Thomas Maier

IsDB is one of the Multi-National Development Banks (MDB) supporting the APMG Public-Private Partnerships Certification Program, as well as a major contributor to the PPP Certification Program Guide. We speak with IsDB's Fida Rana, from its Public Private Partnership Division to discuss its involvement in the APMG PPP Certification Program.

What is IsDB’s history with PPPs?

IsDB has supported PPP projects in its 56 member countries across various sectors such as transport (sea port, toll roads, airports etc), energy (both conventional and renewable), social infrastructure (hospital). Through Islamic modes of financing, the bank has provided funding to many PPP projects along with other conventional commercial banks and MDBs. IsDB has also been active in upstream PPP space, such as assisting governments in the MENA region in PPP project preparation. Recently the bank has started offering PPP capacity development support by organising case based PPP workshops for its member country institutions and governments, in order to enhance their understanding of PPP projects and to disseminate the knowledge of PPP deals.

What excited IsDB to support the APMG PPP Certification Program?

The APMG PPP Certification Program is an excellent initiative by the MDBs to create standard body of knowledge that can become a global reference when it comes to PPP practice. We are glad to see that the body of knowledge includes Islamic finance and its application in PPP. Islamic finance is growing rapidly, experts estimate that it has crossed USD 2 trillion marks in 2014. That’s roughly equal to the size of Canada’s economy. For more than a decade, the Islamic finance industry has been experiencing a double digit growth, starting from a mere USD 200 billion in 2003. As the certification will feature Islamic finance module, the participants will be able to have a grasp on this topic.

How will the PPP Certification benefit PPPs worldwide?

The major beneficiary group of the certification would be those who are involved in PPP project preparation, mainly government officials of line ministries and PPP units. By understanding the PPP project cycle, risk and mitigation features better, the certification will help them to prepare bankable PPP projects.

Fida Rana

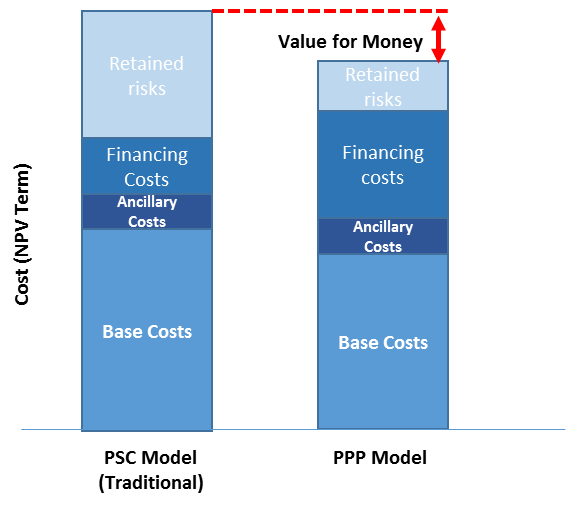

In a PPP project the public sector invites the private sector, via a bidding process, to design, build, finance and operate an asset in order to provide a service to or on behalf of the public sector. In addition, the project must be affordable, provide value for money, and obtain optimal risk transfer between the public and private sectors.

The payment for this service can either come directly from the public sector (government) or from the end users (general public). Examples of government-pays infrastructure could be schools, hospitals and other accommodation projects. Examples of user-pays infrastructure include toll roads, rails and other transportation systems where the payment mechanism demands the user to pay for the service.

PPPs – key benefits and requirements

The benefits of PPPs are numerous, the main one being obtaining Value for Money. This means delivering a project with a superior quality for the same amount of money than the public sector would spend on the same service in a given fiscal year. There are several components of the Value for Money factor which include: risk transfer, output based specifications, long term nature of contracts, performance measurements and incentives, private sector management skills and other various money drivers.[1] For a PPP to be successful the majority, if not all of the components, must be satisfactorily delivered and concluded. Sometimes, if not often, they are not.

Value for Money – the 5 main pitfalls

Let’s look at the components of the Value for Money and see where are the major pitfalls that occur and most importantly, why? As per Van Herpen (2002), the key pitfalls are as follows:

Risk will be transferred to the party which is best able to manage this risk and at the lowest cost. The risk allocation is produced during the feasibility study of the process while assessing the value for money. If this section of the risk assessment is not done properly and sufficiently right at the beginning and prior to the contract signature, the risk transfer can be diluted and retained by the public sector. Another issue can actually creep up due to insufficiently (badly) written contracts that can omit significant scenarios that can either revert the risk to or be retained by public sector. Finally, during the life of the project, certain engagements are initiated by either public or private parties that shouldn’t be – often leading to risk reverting by default to the party that originally was not supposed to bear the risk. For example, if the public sector gets involved in the decision-making specifically around the design of the asset the risks around the design aspect will by default revert back to the public sector.

Output based specifications can provide many benefits such as giving the Private sector the freedom to produce innovative ideas and ways of delivering at reduced cost without compromising the final output and quality. However, problems might arise when the public sector is not quite certain what it wants to achieve and what exactly the outputs should be. These decisions can be quite costly for the public sector as delays and variations might occur therefore not achieving the anticipated Value for Money.

The Long term nature of contracts allows the service provider (Private sector) more time to recover the cost of the investment. It also provides a learning curve for the service provider and in turn increases efficiency. It also makes it easier to transfer the technology risk to the service provider as they will have better judgement when renewal of assets and capital expenditure is incurred. However, long term contracts come with their pitfalls as well. The main one is the reduction in competitive pressure on the service provider to reduce costs and increase quality, which creates a state of complacency. Therefore it is extremely important that the service provider delivery is closely monitored and at the same incentivised in order to keep up the standard as originally envisaged by the project.

Performance measurement and incentives are a great way to achieve the goal of the project and what is stipulated by the contract, and can be beneficial to both parties if properly implemented. The benefits and rewards can be shared making the project a success. However, on many occasions, the importance of performance monitoring and management is overlooked by the public sector. This results in the Value for Money being completely diminished as the private sector will not invest much to provide for corrective measures. Therefore it is imperative that performance measurement is monitored and measured on a regular basis by the Public sector for obtaining Value for Money.

Private sector management skills are also key benefits that PPPs can provide to the Public sector. Traditionally, project management is not something that the public sector used to undertake due to the nature of their business however, in order to produce quality delivery to the general public, management skills are imperative to success of any project. The Public Sector can learn a great deal from the Private Sector with respect to proper project and programme management through long term partnership projects and implement on other various occasions. This however can be also a pitfall as public sector sometimes is not open to spending time learning new methods and even ignoring the roles and responsibilities of what should be done on the PPP project itself jeopardising projects success due to the improper management.

These are just few examples of how potentially benefits can quickly turn into pitfalls while executing PPPs. To learn more on these and many others, please refer to the recently released APMG Public-Private Partnerships Certification Program produced by APM Group.

[1] G.E.W.B Van Herpen, 2002, Public Private Partnerships the Advantages and Disadvantages Examined, Dutch Ministry of Transport, Public Works and Water Management, AVV Transport Research Centre

Irina Unkovski

Irina is a qualified Quantity Surveyor and holds a Master’s Degree in Building specializing in various Infrastructure Procurement Methods. She has more than 15 years of experience working with both Public and Private sector on various Infrastructure initiatives. Currently, Irina is with Deloitte South Africa, leading Corporate Finance Infrastructure Capital Project Team.

Irina has completed various consulting assignments mostly at National and Provincial Government levels specifically development of infrastructure on PPPs within transport, healthcare and commercial buildings. As a result she is familiar with various vehicles, which could be used in alternative service delivery, be it by National, Provincial or Local Government.

Currently, Irina is developing a methodology for Project Management of existing and operating PPPs which will assist government officials in successful delivery, as well as provide a tool for managing the PPP inception for both Transaction Advisors and government officials. She has been involved in projects of monitoring nature such as Gautrain, as well as assisting clients in the public sector with monitoring and assurance of the adjudication of tenders over R 30bn in value.

At conferences, in meetings, and even during casual work conversations, I am asked the same two questions: “Which countries are ideal for investments in infrastructure? Where should the investors invest and what new opportunities should they look toward?”

While sitting in the World Bank gives us a bird’s-eye view of emerging markets and developing economies (EMDEs), it doesn’t offer the up-close-and-personal perspective that investors demand in order to answer these questions in a succinct way. Not that there’s any shortage of synoptic responses. Any number of “market gurus” can assess projects in a second, gathering all the low hanging fruits which are out there in EMDEs. If there is a private deal to be made, then the deal is already done.

Assessing investment possibilities becomes complicated where there is a third party involved. I live and breathe this challenge because I work in the world of public-private partnerships (PPPs) – developing infrastructure finance – where the deal is tough to come by. In the PPP universe, the government is not only the grantor but also the procurer of goods and services, policy maker, regulator, supplier, and buyer or off -taker of the outputs. And this is a universe where the 10,000-foot view of infrastructure in emerging markets is a useful perspective from which to examine the global infrastructure investment landscape.

Getting the lay of the land

Before looking at the global infrastructure investment landscape, it is important to know which regions have the greatest needs. A recent World Bank study[1] shows South Asia ranking at the top (see the graph below) in terms of both annual infrastructure investment requirement as percentage of GDP (15%) and absolute terms of investment amount ($300 billion). What does this number mean? In order to keep up with the regional predicted GDP growth rate of 6%, the South Asia region countries need to invest nearly 15% of their GDP in new infrastructure and to maintain existing infrastructure.

Getting the lay of the land

Before looking at the global infrastructure investment landscape, it is important to know which regions have the greatest needs. A recent World Bank study[1] shows South Asia ranking at the top (see the graph below) in terms of both annual infrastructure investment requirement as percentage of GDP (15%) and absolute terms of investment amount ($300 billion). What does this number mean? In order to keep up with the regional predicted GDP growth rate of 6%, the South Asia region countries need to invest nearly 15% of their GDP in new infrastructure and to maintain existing infrastructure.

Notwithstanding these findings, an examination of the Private Participation in Infrastructure (PPI) database shows that the top destinations for private sector investment continue to be Brazil, China, India, Mexico, and Turkey. These five countries accounted for 73% of investments and 63% of all projects in 2014.

So what happens to the rest of EMDEs? These overlooked countries, working toward PPI maturity, truly fit the definition of “emerging economies.” I’ve broken down this concept so we can quantify these nations’ potential for private investment in infrastructure, and the graph below depicts how a country can be considered an investment destination.

I define PPI maturity to be a function of understanding, willingness, and commitment toward PPI under the current circumstances. Maturity could range from high to low (Y axis). PPI maturity looks specifically at private sector participation in public infrastructure and will require different levels of government support depending on country’s capacity (Z axis). PPI maturity could be different at a given time and for a given country.

There are further considerations. On the graph, the X axis shows areas or phases which, in my experience, weigh heavily on a project’s chances of success. These include:

- Whether the project will even have access to long term financing from either domestic or foreign source?

- If there is availability of this long term financing to public infrastructure?

- Have any of the high priority projects closed, and at the same time, are state-owned enterprises beginning to see the value of PPI? and

- Are sub-nationals entering the PPI market? (For those that experienced the first generation of PPPs, are they bearing lessons and putting more emphasis on contract management?)

Government support as shown in the Z axis will range from full support (direct financial, indirect guarantee, and regulatory) to minimal (regulatory) as country matures in PPI. Throughout the phases, the country maturity levels can go up and down depending on whether it continues to learn and improve.

Charting a course

This last point – whether a country continues to learn and improve – is key. There are many countries that are making the effort to be PPI mature and market ready. Some are clarifying their PPP legal framework, some are professionalizing their financial and local capital markets, and some are already launching pilot projects. Several countries have progressed to a second generation of PPPs, building on the lessons from the first wave or going back to the drawing board.

There’s no right answer to the two questions that keep coming my way, and which are certainly directed at countless other infrastructure finance professionals around the world. Not only is there no right way, but if there’s an approach that works one day, the next day will be different. Successful PPP deal-making will keep changing according to the circumstance, government support, and level of PPI maturity. Charting these elements, as in the graph above, is the first step toward mapping out a future for infrastructure finance possibilities in EMDEs.

First featured on the World Bank Group's Public-Private Partnerships Blog. Research contributions from Zichao Wei.

Jyoti is the Program leader of the PPP Certification Program on behalf of the MDBs (ADB, EBRD, IDB, MIF, IsDB, WBG and PPIAF). She sits in the PPP Unit of the World Bank Group and is based in Washington DC.

Jyoti is currently leading the dialogue on PPPs in Kazakhstan and Tajikistan from the World Bank Group and previously in Brazil, Vietnam, Russia, Uruguay, Mozambique, Madagascar, Kenya and Ethiopia. Her work focusses on infrastructure project financing, financial viability assessments and structuring of PPP options.

Her recent achievements have been defining the private capital mobilization/catalyzation among development community; launching the Global PPP Certification program −‘CP3P’; financial recovery planning for Vietnam Electricity and; structuring PPPs in Irrigation toolkit. Jyoti specializes in Infrastructure Finance with an MBA from George Washington University and Mathematics in undergraduate, she has over 10 years of work experience in project finance transactions and PPPs.

See below for some examples of Jyoti's other work:

- A financial recovery plan for Vietnam electricity: with implications for Vietnam's power sector

- How to develop sustainable irrigation projects with private sector participation

10 years ago, I saw these thought-provoking figures, “1.2 billion people live without electricity. 2.4 billion people don’t have improved sanitation. At least 663 million people lack access to safe drinking water.”

That was a milestone in my life when I decided to invest the rest of my life on bridging the infrastructure gap globally and particularly, in my region (Middle East) and my beloved country (Iran), through doing research and professional practices.

After four years of repeatedly outperforming in civil engineering industry, I pursued a PhD in Civil Engineering (Drexel University, Philadelphia, PA, 2010 to 2014) to enhance my technical and analytical skills about critical infrastructures.

Meanwhile, I completed my professional certifications (CCM, PMP, PMI-RMP, MCP, and ENV SP) and participated in industry chapters and focus groups, such as the PMI Delaware Valley Chapter and the ASCE Philadelphia Chapter. This challenging journey allowed me the opportunity to familiarize myself with many of the ongoing leadership and technical issues that face industry as a whole.

On 2015, as the next phase of my personal mission toward bridging the infrastructure gap, I joined the University of Tehran as an Assistant Professor of Construction Project Management, focusing on infrastructure development. At the same time, I started to cooperate with a few companies on some major infrastructure projects in Iran; the opportunity that helped me deeply understand the challenging gaps toward infrastructure development.

During these years, I have continued to follow global movements related to achieving the Sustainable Development Goals and ending poverty. Believing that this major mission requires an integrated-global movement, I was excited when I realized that this important task has come true under establishing the Global Infrastructure Forum.

I am very pleased to see, as stated in the Chairman’s Statement of the Global Infrastructure Forum (April 16, 2016), that such a movement will encourage a greater range of voices to be heard, particularly from developing countries. Voices of people like me! This is a great opportunity for which I am waiting for more than 10 years.

Bridging the infrastructure gap requires proactive actions from both the Forum and people from developing countries. The Forum has initiated their essential movement. Highlighted in the Chairman’s Statement, they plan to support country-led approaches to planning, executing, supervising, and evaluating sustainable, resilient, inclusive, and well-prioritized infrastructure programs and robust infrastructure frameworks.

Now, it’s our turn from developing countries. To move on this direction, I formed a research group, including my grad students and me. We defined “Infrastructure Development” as our main focus. We plan to (i) perform multiple research studies to improve information on infrastructure; (ii) translate the related body of knowledge (the PPP Certification Program Guide) to be used by Persian-language practitioners (i.e., people of countries like Iran, Afghanistan and Tajikistan); and (iii) collaborate with national and international organizations to promote compatible, efficient approaches.

Also, the Forum has initiated another great movement, the Public-Private Partnerships Certification Program (CP3P), which is the most necessary ring on the infrastructure development chain.

To promote this program in our region and to ensure that I know the common, global knowledge of the field, I started self-studying the PPP Guide. I passed the CP3P Foundation exam on Thursday 4/14/2016 and now, I am planning to organize PPP training courses in the region under APMG surveillance in the near future.

Backed by global prestigious institutions like the World Bank Group and several Multilateral Development Banks, the CP3P program has several invaluable advantages for the entire world:

· It will act as a common language among professionals in the PPP field.

· It will provide a basis to share the related knowledge world-wide.

· It will enhance the positive culture of tackling infrastructure challenges.

· It will help to integrate global experiences related to Public-Private Partnerships.

· It will perfect the comprehensive plan of actions toward ending poverty.

From the viewpoint of an individual, I have benefited from the CP3P program in different ways:

· Studying the Body of Knowledge (the PPP Guide) has familiarized me with the common language and good practices of the field.

· Knowing the PPP basics has built a good confidence for me to communicate with other professionals in the field.

· Being among those who are certified by a prestigious joint program will demonstrate to all national and international institutions that my abilities are aligned with international PPP good practice.

Hossein Nourzad is an Assistant Professor of Construction Project Management at University of Tehran, an Accredited CP3P Trainer at K-Infrastructure (based in Spain), and a PPP consultant. Prior to working at UT, he was a PhD Student at Department of Civil, Architectural, and Environmental Engineering at Drexel University. Hossein Nourzad also has an MBA (focusing on economical risks of infrastructure projects), a Master of Science as well as a Bachelor of Science in Civil Engineering. During the last 13 years of his mixed academic and professional experience, his main focus has always been related to “bridging the infrastructure gaps globally”. He loves networking with other professionals in the field (both in academia and industry) to share the state-of-the-art knowledge and experience. Hossein completed his professional certifications (CP3P, PMP, PMI-RMP, MCP, ENV SP, and CCM) while participating in industry chapters and focus groups. His current focus is on Infrastructure development through “Public-Private Partnership” and “Sustainability”.

Visit Hossein's website here.

LONDON, June 20, 2016—APMG International just launched the new APMG Public-Private Partnerships (PPPs) Certification Program. The Certification Program has been developed to establish good practices across the globe for professionals working on PPPs.

Responding to the need to enhance knowledge around PPPs and in the absence of a global certification program on PPPs - the APMG PPP Certification Program is an innovation and a collaboration between the Asian Development Bank (ADB), the European Bank for Reconstruction and Development (EBRD), the Inter-American Development Bank (IDB), the Islamic Development Bank (IsDB), the Multilateral Investment Fund (MIF) and the World Bank Group (WBG). The program is part funded by the Public-Private Infrastructure Advisory Facility (PPIAF).

Authored by many of the world’s top PPP experts with contributions from the multilateral development banks (MDBs), the PPP Certification Program Guide is at the core of the APMG PPP Certification Program. The PPP Guide is the definitive body of knowledge on PPPs, compiling a range of quality materials on PPP good practices – it can be used to support study for the APMG PPP Certification Program or as a stand-alone downloadable publication on PPPs.

“This is the first time the multilateral development banks have joined forces to promote a global program for building capacities for PPPs. We are delighted to partner with APMG to share with the world this unprecedented certification program on PPPs. This new curriculum aims to build capacity through foundation exams and a thorough PPP Guide. We hope this will serve as a comprehensive resource for PPP professionals and enable better understanding of how to deliver PPPs globally.” Laurence Carter, Senior Director, Public-Private Partnerships, World Bank Group, on behalf of the MDBs involved in this initiative.

The Foundation level exams are now available for self-study and work is underway to develop the Preparation and Execution level exams. The Foundation exam is aimed to test that candidates have sufficient understanding of the first chapter of the PPP Guide – ensuring they will be able to act as an informed member of a PPP finance project.

Once all three of the APMG PPP Certification Program levels are available – candidates will have the opportunity to gain the Certified Public-Private Partnerships Professional (CP3P) credential – providing them with global recognition of PPP proficiency.

The APMG PPP Certification Program and the PPP Guide will benefit PPP practitioners and can improve the quality of PPPs worldwide, while PPP professionals around the world can benefit from this opportunity to access this specialized knowledge and achieve a certification from a globally recognized program.

By helping to build a sounder knowledge around the management of PPPs as an option for governments to deliver basic infrastructure needs, the program intends to build capacity and knowledge access of professionals that are or will be working in their countries respective PPP programs, from government officials or their advisors.

About APMG International

APMG International is a global accreditation and certification body. APMG administers a range of professional assessment, development and certification schemes in key management disciplines including Business Relationship Management, PMD Pro – Project Management for NGOs and IACCM Contract and Commercial Management.

APMG works with strategic partners to provide access to best practice guidance, training and certification to help individuals and their organizations deliver positive results and change through improved efficiency and performance www.apmg-international.com

Matt Brewitt

As the Social Media and Online Content Writer within APMG’s Marketing Team – I help produce written copy for the APMG PPP website and the PPP Certification Program digital newsletter. I'm also responsible for creating social media material supporting the program and to raise awareness around PPP good practice.

I’ve been immersed in the world of public-private partnerships (PPPs) for over a decade, and during that time I have seen first-hand how these partnerships can help large-scale infrastructure projects overcome serious challenges. The new APMG PPP Certification Program, a global certification program on PPPs, offers access to knowledge at a scale that has never before existed, and it has the potential to improve the effectiveness of infrastructure PPPs around the world.

Filling a gap

The APMG PPP Certification Program is a significant step forward in the long-term goal of introducing PPPs as an effective option for meeting countries’ basic service and infrastructure needs, while helping to reduce poverty. But until now, people involved in PPP projects have lacked a common professional language, set of terms, and understanding of best practices based on experience. In some cases, this has resulted in PPPs that did not achieve their potential or benefit those in need as originally intended.

The APMG PPP Certification Program offers a path to higher quality PPPs because it fills these gaps, strengthening the professionalism of those who are actually creating, staffing, and managing those partnerships. On an even more fundamental level, the program will help countries decide which projects are best suited to the PPP approach so that time and resources are used most effectively.

First of its kind

The APMG PPP Certification Program and CP3P, the new professional credential for those who complete the program, are products of a ground-breaking collaboration among multilateral development banks (MDBs) and institutions that share the belief that more effective PPPs offer possibilities that have not yet been realized. The program is an innovation of the Asian Development Bank (ADB), the European Bank for Reconstruction and Development (EBRD), the Inter-American Development Bank (IDB), the Islamic Development Bank (IsDB), the Multilateral Investment Fund (MIF), and the World Bank Group (WBG), and is partly funded by the Public-Private Infrastructure Advisory Facility (PPIAF).

One element of the APMG PPP Certification Program that distinguishes it is the PPP Certification Program Guide, a free, downloadable, and comprehensive body of knowledge on all aspects of PPPs. This PPP Certification Program Guide is a stand-alone resource on PPPs as well as a tool to support candidates’ work toward the CP3P credential; as such, it is a monumental contribution to scholarship on infrastructure and PPPs. The team that created and reviewed it includes several of the world’s leading PPP experts, hand-picked by the founding MDBs. Together, the APMG PPP Certification Program, the PPP Certification Program Guide, and the CP3P credential build a foundation upon which PPPs, used in the right circumstances, can achieve their full potential.

The World Bank Group and PPPs

On our end, the World Bank Group is committed to helping governments make informed decisions about improving access and quality of infrastructure services, including the PPP delivery option when the circumstances are right. This approach is further strengthened when governments can assemble robust data, build capacity, develop and test tools, promote disclosure, and encourage engagement with all relevant stakeholders. Information and guidance on each of these can be found at the PPP Knowledge Lab, an online platform developed in collaboration with the MDBs: https://pppknowledgelab.org/.

PPPs can address the World Bank Group’s twin goals by enhancing the reach and quality of the delivery of basic services. When designed well and implemented in a balanced regulatory environment, PPPs can bring greater efficiency and sustainability to the provision of such public services as water, sanitation, energy, transport, telecommunications, healthcare, and education. PPPs can allow for better allocation of risk between public and private entities. PPPs are one tool among others for infrastructure delivery; every country has its own unique opportunities and challenges, and as an institution we recognize that solutions need to be tailored to the context.

My sincere thanks go to everyone who has made the program and body of knowledge possible. This includes the forward-thinking MDBs and institutions that committed early on to this project, as well as the steering consultative committee, the World Bank Group and APMG project teams, the PPP Certification Program Guide’s authors, and the external review panel members. I’d also like to thank the candidates who will be pursuing the CP3P credential, because their work will help strengthen infrastructure around the world.

I invite you to read my recent blog post, which discusses this in greater depth, at:

http://blogs.worldbank.org/ppps/worldwide-effort-improve-ppp-practice

Jyoti is the Program leader of the PPP Certification Program on behalf of the MDBs (ADB, EBRD, IDB, MIF, IsDB, WBG and PPIAF). She sits in the PPP Unit of the World Bank Group and is based in Washington DC.

Jyoti is currently leading the dialogue on PPPs in Kazakhstan and Tajikistan from the World Bank Group and previously in Brazil, Vietnam, Russia, Uruguay, Mozambique, Madagascar, Kenya and Ethiopia. Her work focusses on infrastructure project financing, financial viability assessments and structuring of PPP options.

Her recent achievements have been defining the private capital mobilization/catalyzation among development community; launching the Global PPP Certification program −‘CP3P’; financial recovery planning for Vietnam Electricity and; structuring PPPs in Irrigation toolkit. Jyoti specializes in Infrastructure Finance with an MBA from George Washington University and Mathematics in undergraduate, she has over 10 years of work experience in project finance transactions and PPPs.

See below for some examples of Jyoti's other work:

- A financial recovery plan for Vietnam electricity: with implications for Vietnam's power sector

- How to develop sustainable irrigation projects with private sector participation

A question I often receive at meetings is how to calculate value for money in PPPs. Many governments hire consultancy services that produce impressive spreadsheets on VfM. Very good, but for those governments who do not have the capacity to afford these services or do not understand the spreadsheet, here are some basics:

What is Value for Money?

The first thing the spreadsheets do is calculate how much ‘cheaper’ a project would be compared with traditional procurement. If that was the case, we would have to name it ‘Cheaper through PPPs’; value is more than money alone. But let’s answer the question just form the financial respective. There are three main components that will give you value for money;

- A well-structured financial deal with good risk allocation;

- Life cycle approach in the project; and

- Management of the operational phase of the contract, the tail

What are the numbers?

A well-structured financial deal with good risk allocation will save you about 10% with a traditional procurement. Over 80% (UK National Audit Office) have budget overruns, sometimes up to 100%. Good PPPs prevent these overruns at the expenses of a government.

Life cycle approach will result in a significant reduction of costs over the 20-30 years of the project, an average of 15-20% can be saved, depending on the type of infrastructure. Good management during the operational life of the contract will save the government an average of 5-10%.

The value for money of a well organised PPP can add up to around 30-40% compared with traditional procurement. A road with an estimated cost of $1000 Million will be reduced to $600-700 Million.

Where do governments lose their value for money?

The eagerness of many politicians and governments to get a project done, especially when election time is in sight, will increase the subsidies and guarantees towards the private sector. The 10% VfM will vaporise and in some cases become negative.

Life cycle is hardly seen in VfM. If governments do not know what a project costs (not how much the budget is but real cost), you never know what you have saved. As most governments do not allocate funding/budget for maintenance this VfM is hardly seen in hard numbers.

Sadly, management of the contract is hardly discussed and receives little attention. Here governments again lose money, in combination with the guarantees and subsidies. In the end, the life cycle will still save money and will reduce costs toward 10%, and our imaginary road will cost $900 Million, if you’re lucky.

How can we get the most out of our VfM?

The real VfM is investing in understanding PPPs at government level and hire good consultancy services (but be in charge). Capacity building is not just a phrase; it is in the end providing you VfM. The Netherlands PPP Unit (20 full time staff, managing 20 projects) had an annual budget of $200.000 for training and capacity building. The average value for money in the PPP projects was and still is between 15-25%, projects ranging between $500 million – $4000 million. The Netherlands audit office calculated that PPPs saved about 400 million Euro in 5 years of PPP; the capacity building budget for the ministry, including the PPP unit, special training for maintenance of the PPP contract and a ‘project academy’ for the project manager within the government was around 5 Million Euro’s over the same period. A net result of 395 million Euro. Still interested in a spreadsheet on VfM?

Jan van Schoonhoven

Senior Advisor on PPP and Innovative Financing for the Netherlands Government

Currently, Jan van Schoonhoven is Senior Advisor on PPP and Innovative Financing for the Netherlands Government. His main role is to develop investment ready projects supported by the Netherlands government in economies in transition. He works for the Intergovernmental Water Centre in The Hague, a center supported by the Ministries of Infrastructure, Foreign and Economic affairs.

From 2012-2015 he was seconded to the United Nations in Genève as Executive Director of the International PPP Centre of Excellence of the United Nations. This center was established by the 56 member countries of UNECE to assist governments in developing a successful PPP pipeline by using best practices and implementing PPP standards. The center closely works with the Multilateral Banks (World Bank en ADB).

Based as a diplomat in Geneva, Jan van Schoonhoven also supported the discussions on the Sustainable Development Goals and the partnership with the private sector with a number of UN organization, like the UNCTAD, and WHO and furthermore at the WTO.

Before the UN, Jan van Schoonhoven was director of the Netherlands PPP Unit and transformed the PPP environment of the Netherlands form 2 projects (2006) to 20 projects and almost 20 Billion Euro’s in 2012. High-speed Rail, the second largest Locks in the World and the second Port of Rotterdam are international know projects.

Jan works for the World Bank on Procurement and PPP and supports the development on PPP of Ghana. He is independent director at the PPP Centre in Kazakhstan and member of the Infrastructure Think Tank of the G20. He also established a PPP center on Aruba, with already two projects with financial close.

Jan van Schoonhoven was born in 1963 and started his career as Officer in the Royal Netherlands Navy in 1982. He did a large number of tours around the world, including UN missions. In 1999 he joined the Ministry of Infrastructure and started as Director of the Coastal Defense and Anti Flooding organization. He lives in The Hague, is married and has three daughters.

Contact details

Jan.van.schoonhoven@rws.nl

+31 6 52596136

https://www.government.nl/topics/public-private-partnership-ppp-in-centralgovernment/

This is an unprecedented time of change for the healthcare sector globally. Demand is rising exponentially as life expectancy increases, and patients are better informed and have higher expectations. The information revolution has also given clinicians better access to evidence-based practice, and scientific and technological innovation that will transform the way health services are delivered.

The United Nations' Sustainable Development Goals (SDGs) set some challenging targets in relation to healthcare. As well as SDG3 – the aim of ensuring healthy lives and the promotion of wellbeing for all at all ages – they also include targets for reducing inequality, improving the resilience and sustainability of services and infrastructure, and economic development. Many of the other SDGs – improving water and sanitation, ending poverty and hunger, and the promotion of inclusive, safe, resilient and sustainable cities will directly enable societies to improve health outcomes and provide healthcare more efficiently to their people.

Unfortunately, many health systems are subject to tough financial constraints and realising the SDGs will call for significant investment. One way of overcoming this challenge could be the use of Public-Private Partnerships (PPPs), but they must be used very carefully. If managed well, PPPs can play an important role in attracting private sector expertise and investment that will help achieve the SDGs.

At their best they can enable change, give patients the best care in an appropriate setting, and make healthcare staff feel valued and fulfilled. But it is crucial that the suitability of PPP for any given programme is carefully assessed; at their worst they can represent poor value for money and lack transparency which could result in worsening inequality.

SDG3 comprises three subgroups: three targets similar to the Millennium Development Goals (ending certain epidemic and communicable diseases, and reducing maternal deaths and infant mortality); three focussed on non-communicable diseases (addressing road traffic accidents, substance abuse and mental illness); and three cross-cutting targets aiming to improve health systems, including universal health coverage.

The first of these categories can have the most easily defined investment needs and measures of success. A reduction in maternal mortality ratio (MMR) to 70 per 100,000 live births (SDG3.1) will require each country to reduce its MMR by two thirds, and no country should have an MMR greater than 140. Some of the world’s lowest income countries have a baseline MMR greater than 420 with the highest levels seen amongst poorer rural communities which have limited access to healthcare services. To address this there is a need for significant investment in infrastructure, technology and staff.

The Saving Mothers Giving Life partnership is one example – a PPP between the governments of Uganda, Zambia, the USA and Norway, clinical institutions and the commercial firm Merck delivered over $10m of capital investment in facilities such as operating theatres to perform safe caesarean sections; and recurring costs associated with staffing and improvements in maternal health networks, leading to reductions in maternal mortality by 53% in target facilities in Zambia, and 45% in target facilities in Uganda.

The key to addressing non-communicable diseases is the introduction of sustainable public health strategies and effective local networks. Low levels of investment and high cultural barriers can therefore make it a difficult match for PPP. In 2003, a PPP between Pakistan’s Ministry of Health and Non-Governmental Organisation Heartfile developed a plan for better integrating efforts to tackle non-communicable diseases and invested in development and communication of the plan and its delivery through local networks. But they found that changes in national governance, health system constraints such as poor regulation of private providers, and incoherent clinical workforce planning impeded its implementation.

Changing health systems is the most difficult task to assess. There is a need for investment in strong health information systems and the generation of robust, relevant measures in the first instance. But improving equality of access calls for a clearly defined set of healthcare policies and strategies for delivering them, so that investment is prioritised in the areas where it will make the most difference.

Where this has been tackled successfully, the programmes are characterised by strong and objective political focus on areas where PPPs will really add value, and a robust partnership between the government and private sector which provides demonstrable value for money. It is crucial that these partnerships are systematically assessed because there is no single “private sector” and the quality of outcomes will depend on many factors, including the simplicity of the project, its suitability for PPP arrangements and the culture and approach of each specific private sector partner.

There are good examples of success: In Ghana, the establishment of a National Health Insurance Scheme which features private as well as public investment resulted in a five-fold increase in access to primary healthcare services between 2003 and 2011. The governments of Mexico and Singapore have taken the same approach and seen similar results.

The need for clarity and evidence-based guidance on implementation has led the United Nations Economic Commission for Europe to sponsor the development of UN Standards on best practice in the implementation of PPP programmes. Starting at a very high level, the Standards will provide governments with recommendations on implementation developed by PPP specialists from government and the private sector. UNECE will also commission “Centres of Excellence” in several sectors which will provide ongoing advice and support to governments considering PPP programmes.

The Sustainable Development Goals represent a shared vision for the world’s population in 2030. PPPs can play a significant role in delivering them, but it is critical that governments ensure that any PPP programme fits within an appropriate policy framework and investment strategy, so that it delivers the best possible value for money. One important feature of successful PPP programmes is the development of strong public sector management skills and governance, and the recent development of PPP management certification programmes will help achieve this end.

Director of Healthcare Projects

Peter is responsible for business development in the healthcare sector for John Laing, a leading international investor in economic and social infrastructure which has delivered more than 20 major healthcare PPP projects and over 40 clinics and primary care facilities.

He has worked on the development of public infrastructure since 1989 and has substantial experience in the successful structuring and delivery of a diverse range of Public-Private Partnerships in the healthcare, water and transportation sectors in the UK, Africa, the Middle East, South East Asia and the Caribbean. Since 2001 he has focussed specifically on healthcare projects, managing the development and delivery of major acute and mental health schemes with a capital value exceeding £2bn.

Peter is a Chartered Civil Engineer and a Fellow of the Institution of Civil Engineers. He is also a Non-Executive Director of the Oxford University Hospitals NHS Trust which operates one of the UK’s leading teaching hospitals, and is leading a project to develop a standard for the implementation of Healthcare PPP projects globally for the United Nations.

Over 110 delegates attended our event in Seoul, one of three events held last week showcasing the APMG PPP Certification Program.

The event opened with a congratulatory speech from Mr. Seong-hoo Kang, Director General, Regional Economic Cooperation, Ministry of Strategy and Finance. Welcoming the launch of the PPP Certification Program in Korea, Mr. Seong-hoo Kang expressed his pride in Korea being chosen as the first country in Asia to launch the certification.

The Korean government has given its commitment to support organizations and individuals involved in Public-Private Partnerships (PPPs) which will help Korean and other EMDB governments to raise the funds necessary to meet infrastructure demands and stimulate economic development.

“ADB is delighted to partner with APMG to launch this unprecedented certification program on PPPs in Korea,” said Mr. Trevor W. Lewis, Principal of PPP Specialist Office, Asia Development Bank, who joined the event via video-conference.

Mr. Nick Houlton, Chief Operating Officer, APMG International, shared his excitement about the Certification Program’s launch, “the PPP Certification Program Guide has been developed by some of the world’s leading experts in PPPs across the globe and was driven by a mutual desire to see PPP good practices become commonplace worldwide. Creating the certification program was a closely collaborative effort and is the first of its kind. It is a response to the difficult challenges many nations are currently facing and is hoped to bring transformational change to PPPs.”

Ms. Helen Yu, General Manager at APMG-International, China and R.O.Korea, who also supported the conference, was delighted to report that over 20 delegates are already planning to study the guide and intend to take the exams in the near future.

Expressing interest in the program, one delegate said during the Q&A session, “This is just the right time for the launch of the PPP program. It’s time for me to start to study PPP guide, pass the exam and obtain the certification. The certification will (help me to) distinguish myself and approve my expertise in PPP.”

The APMG PPP Certification Program is an innovation and a collaboration between the Asian Development Bank (ADB), the European Bank for Reconstruction and Development (EBRD), the Inter-American Development Bank (IDB), the Islamic Development Bank (IsDB), the Multilateral Investment Fund (MIF) and the World Bank Group (WBG). The program is part funded by the Public-Private Infrastructure Advisory Facility (PPIAF).

Matt Brewitt