As an alternative approach to originating and developing PPP project ideas, some governments accept unsolicited or privately-initiated PPP projects. By welcoming “privately-initiated” projects, governments can harness information and ideas that private firms have about how to provide services people need. At the same time, allowing firms to promote their own project ideas is tricky. If the idea is then put out to competitive tender, firms may feel there is no point in volunteering good ideas since they cannot benefit from doing so. On the other hand, not putting the idea out to competitive tender could allow a firm to charge more than the cost for a service, leading to allegations of favouritism. The challenge for a PPP framework is to steer a middle course so that private firms are encouraged to offer good ideas and still retain their intellectual property, while also including some competitive element to keep costs down and ensure a sense of fair play.

The PPP framework needs to strike the right balance between several factors: providing incentives to private proponents to submit high-quality project ideas, deterring poor quality proposals, ensuring competitive tension, and demonstrating transparency.

Benefits and Pitfalls of Privately-Initiated projects

Accepting privately-initiated projects allows governments to benefit from the knowledge and ideas of the private sector. This can be a significant advantage where limited government capacity means the private sector is better able to identify infrastructure bottlenecks and innovative solutions. It also provides the government with information about where commercial opportunities and market interest lie. Box 2.11 provides an example of a PPP project originated by a private company that provided an innovative solution to a transport infrastructure problem that the public sector had been struggling to solve.

|

BOX 2.11: Benefits of innovation – High Occupancy Toll Lanes in Virginia A portion of the I-495 highway (the “beltway” around the Washington, DC metro area) and the major I-95 North-South corridor needed repair and expansion to alleviate congestion since the early 1990s. The state of Virginia Department of Transportation (VDOT) had developed a plan to rehabilitate and expand the highway at a cost of $3 billion. However, lack of funding and public opposition over the proposed displacement of over 300 businesses and homes had stalled the project. In 2002, Fluor, an engineering and construction company, submitted an unsolicited proposal to develop High Occupancy Toll (HOT) lanes on Interstate 495 as an alternative way to accommodate traffic volume. HOT lanes are an innovative technology that allows drivers to pay to avoid traffic. The tolled lanes run alongside freeway lanes, and are designed to be free of congestion. To regulate demand for the lanes, tolls for the HOT lanes change depending on traffic conditions; when traffic increases, tolls go up. Cars with more than 3 passengers, and buses, are allowed to use the HOT lanes free of charge. The Fluor proposal reduced the number of businesses and homes displaced from 300 to 6, a major factor in garnering public support for the project. The proposal also minimized project costs by reducing lane widths. In 2005, VDOT awarded the PPP agreement to construct the HOT lanes. The total cost of the project was around $2 billion, compared to the estimated $3 billion under initial plans developed by the government. The state of Virginia contributed $400 million of this cost. The HOT lanes project reached financial close in 2007, and new lanes opened for business in 2012. Source: Virginia HOT Lanes website (http://www.virginiahotlanes.com); Gary Groat (2004) Loosening the Belt Roads and Bridges Vol. 42 No. 4 April 2004; Virginia Department of Transportation (2008) Virginia HOT Lanes Fact Sheet Commonwealth of Virginia; The Public Private Partnerships Reference Guide V 2.0 (World Bank 2014). |

At the same time, the government has to devote administrative resources to assessing and procuring unsolicited proposals. There is always a question of whether government resources would have been better allocated to projects that are known to be in line with government plans and priorities.

In addition, negotiating with a project proponent on the basis of an unsolicited proposal – in the absence of a transparent or competitive procurement process – can create problems. It could result in poor Value for Money from the PPP project, given a lack of competitive tension. It could also provide opportunities for corruption and give rise to complaints about the fairness of the process, especially if a company is seen to benefit from a PPP without opening the opportunity to competitors. For these reasons, some countries prohibit the use of unsolicited proposals for PPPs.

Box 2.12 provides an example of a power project in Tanzania that was directly negotiated following an unsolicited approach by the private investor. Subsequent disputes led to an arbitration in which the contractor was found to have charged more than was reasonable.

|

BOX 2.12: Costs of Direct Negotiation – Independent Power Tanzania The government of Tanzania and the Tanzania Electricity Supply Company entered into contractual agreements with Independent Power Tanzania Limited (IPTL) of Malaysia for the supply of 100 megawatts of power over a 20 year period. This transaction was directly negotiated following an approach by the private investors during a power crisis. After the contract was signed, objections were raised that the project was not least cost and that it was not procured on a transparent and competitive basis. Before the plant started operations, the government submitted the project to international arbitration. The arbitrators found that the private company had inflated the costs of the project, and they ordered the amount that could be recovered to be reduced by about 18 percent. In the arbitration hearings the government alleged that the contract award had been corrupt, but failed to produce evidence to satisfy the Tribunal. The government has not subsequently pursued the corruption investigation. However, legal disputes between the IPTL and the government continued to the date of writing (2015). Source: World Bank/Energy, Transport and Water Department, and Finance, Economics and Urban Department (2009) Deterring Corruption and Improving Governance in the Electricity Sector World Bank; Eberhard and Gratwick IPPs in Sub-Saharan Africa: Determinants of Success World Bank. |

Creating competitive tension

Although some jurisdictions simply discourage privately initiated projects, many have developed mechanisms to take advantage of market initiatives, while also introducing competitive tension. There is no international consensus on the best way to subject unsolicited proposals to competition, but the following approaches can be applied.[67]

- Swiss challenge – following an unsolicited approach, an open bidding process is conducted. If the proponent does not win, it has the option to match the winning bid and win the contract. This approach is used in the Philippines and several states in India;[68]

- Inclusion in best and final offer round – a two-stage bid process in which the highest ranked bidders from the first stage (such as an expression of interest) are invited to submit final proposals in a second stage. The proponent of the market-initiated project is automatically included in the second stage. This approach (as well as the developer’s fee approach, below) is used in the South Africa roads sector;[69]

- Developer’s fee – the firm that made the original offer is paid a fee by the government or the winning bidder. The fee can simply reimburse some project development costs, or be set to provide a return on developing the project concept and proposal. This is one option for dealing with unsolicited proposals permitted in Indonesia under the presidential regulations governing PPPs; and[70]

- Bid bonus – the proponent receives a scoring advantage typically defined as an additional percentage added to its evaluation score in an open bidding process. This approach is used in Chile where the bid bonus can be between 3 and 9 percent of the financial evaluation score (in addition, the proponent is reimbursed for the cost of detailed studies).[71]

Table 2.6 provides further examples and references. These alternatives have not all proved equally effective at enabling competition.[72] In Chile, for example, of 12 concessions awarded from unsolicited proposals as of March 2006, 10 attracted competing bids and only 5 were awarded to the original proponent. On the other hand, in the Philippines under the Swiss Challenge approach, all 11 PPP contracts awarded from unsolicited proposals by 2006 went to the original proponent.

|

TABLE 2.6: Examples of Procurement Strategies for Unsolicited Proposals |

|

|

Jurisdiction |

Key Features |

|

Chile |

· Two-stage process for accepting unsolicited proposals initial proposals are screened; if accepted, the private party must conduct detailed studies and prepare a detailed proposal. The government then prepares bidding documents based on the detailed proposal and puts the project out for competitive tender. · Costs of carrying out studies are reimbursed (paid by the winning bidder or the government if project never proceeds to the bid stage). Costs agreed at the initial project approval stage. · The proponent receives a bid bonus of a pre-defined percentage (between 3 and 8 percent depending on the project) added to a financial evaluation score.[73] |

|

Indonesia |

· Unsolicited proposals welcomed for projects not already on the priority list. · Accepted proposals are put through a normal competitive process. Proponents may either be awarded a bid bonus, of up to 10 percent, or paid a developer’s fee for the proposal. The approach is set by the procuring authority, based on an independent appraisal.[74] |

|

Italy |

· Contracting authorities publish three year plans on an annual basis; private companies are invited to make proposals for infrastructure listed in these plans (following clear content requirements including detailed studies and timeline). Proposals are evaluated by the procuring authority. · A type of Swiss Challenge process is used to procure the project. A first stage is used to identify two competing bidders who, together with the proponent, enter into a negotiated procurement procedure. If a competing proposal is preferred, the proponent is given the right to match that proposal, in which case the proponent is awarded the concession.[75] |

|

Republic of Korea |

· Unsolicited proposals must be evaluated by the procuring authority and the PPP unit (the Private Infrastructure Investment Management Centre, PIMAC). · The opportunity is published and alternate proposals are requested, due within a 90 day time limit. · The proponent receives a bid bonus of up to 10 percent, added to the overall bid evaluation scores. The proponent may modify its original proposal at the bidding stage, but its bonus is reduced to a maximum of 5 percent. Bonuses are disclosed in the request for alternate proposals. · Losing bidders are compensated in part for proposal costs to encourage competition.[76] |

|

Philippines |

· Unsolicited proposals are welcomed for projects not already on the priority list. · The procuring authority must advertise the opportunity for at least three weeks and invite competing proposals within a 60 day time limit. · If competing proposals are received, a Swiss Challenge process is followed if the proponent is not the winning bidder, it is given the opportunity to match the winning bid and win the contract. · If no competing proposal is received, the authority may negotiate with the proponent.[77] |

|

South Africa (roads sector) |

· Unsolicited proposals must comply with clear content requirements, and they are evaluated by the agency. · If the proposal is accepted, the agency and the developer enter into a “scheme development agreement”, under which the private party is responsible for detailed development of the PPP, including developing tender documentation. The agreement includes a developer’s fee payable by the winning bidder to the proponent. · The project is put out to competitive tender in a two-stage best and final offer process. The top two bidders from the first round are invited to resubmit best and final offers; the proponent is also invited, if not already in the top two contenders.[78] |

|

State of Virginia, United States (highways sector) |

· Proposals are welcome that comply with the detailed requirements set out and are evaluated in the same way as government-originated projects. · Proposals for PPPs requiring no government oversight or support are advertised for 90 days (or 120 days for PPPs requiring government support). If no competing proposal is received, the government may negotiate directly with the proponent.[79] |

Dealing with intellectual property

To encourage market-initiated proposals, the government needs to commit to protecting intellectual property. Without such protection, there is little incentive for the private party to invest in any new or innovative ideas. There are various approaches to dealing with intellectual property in an unsolicited proposal.[80]

- Where possible, the government can competitively tender the project by specifying required outputs, and not the required technology to deliver those outputs. This approach is consistent with good practice in defining output-based performance requirements for PPPs; and

- In cases where the intellectual property is crucial to the project, such that it could not be implemented otherwise, direct negotiation may be warranted, along with procedures to benchmark project costs.

The government of New South Wales in Australia provides guidance for practitioners on handling intellectual property,[81] and it allows direct negotiation of the PPP in certain circumstances. Proponents agree that they must identify any intellectual property they wish to protect (subject to agreement with the government). The project is then tendered based on output specifications without revealing technology information if possible. If the intellectual property is “crucial to the existence of the service need”, the government negotiates with the proponent to obtain the rights to the necessary intellectual property before procuring the project competitively. In contrast, in some civil law countries the approach to intellectual property is codified in law, and so not subject to negotiation.

Defining Clear Processes

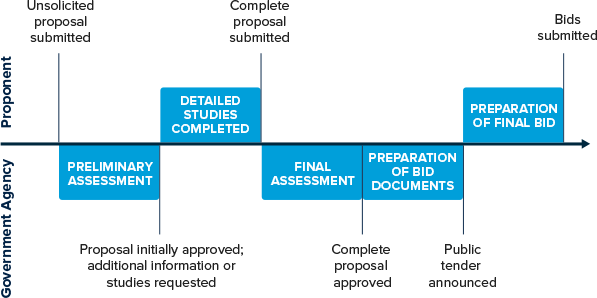

Clear processes for handling unsolicited proposals are important for transparency and achieving Value for Money. Clear processes not only assist the government in managing such a proposal, but they can also help incentivize private developers to invest resources in developing good quality project proposals, and encourage potential competitors to engage in the bidding process. A well-defined process to assess, approve, and bid on a project originating in an unsolicited proposal is illustrated in figure 2.1.[82] First, a private company submits an unsolicited proposal, following clear content and presentation requirements. This proposal is screened, often following a similar approach to that described in section 4.5.1. If the proposal passes the initial screening, the proponent is invited to complete any necessary studies before the proposal is assessed against the standard PPP criteria. If approved, any developer’s fee or bonus that will apply is often agreed at this stage.

The responsible government agency then prepares the bid documents, based on the final proposal, and conducts a tender process. Proponents may or may not have an opportunity to respond to the bid documents and submit a final bid. For example, in Korea the proponent may modify its original proposal and bid, but in doing so forfeits some of its bid bonus.[83]

FIGURE 2.1: Process for Assessing, Approving and Bidding an Unsolicited Proposal

Source: Based on Hodges and Dellacha (2007) Unsolicited Infrastructure Proposals: How Some Countries Introduce Competition and Transparency.

It is worth considering specifying time periods within which each of these steps will be taken.[84] On the one hand, specific deadlines within which the government will deal with proposals can be helpful to provide assurance to the private sector that their proposal will not languish in the process. On the other hand, some countries introduce tight limits on the time allowed for competing proposals, which can deter competition. For example, in the Philippines, the BOT Law of 1993 requires authorities to advertise an opportunity for three weeks and allow 60 days for competitors to respond. This is unlikely to allow competitors enough time to carry out the due diligence necessary to prepare a high-quality strong proposal.[85]

[67] As set out in Hodges and Dellacha (2007) Unsolicited Infrastructure Proposals: How Some Countries Introduce Competition and Transparency.

[68] As described further in Reddy & Kalyanapu (undated) Unsolicited Proposal-New Path to Public-Private Partnership: Indian Perspective.

[69] South Africa National Roads Authority (1999) Policy of the South African National Roads Agency in Respect of Unsolicited Proposals.

[70] Government of Indonesia (2005) Presidential Regulation No. 67 concerning Government Cooperation with Business Entities in the Supply of Infrastructure, as amended by Government of Indonesia (2011) Presidential Regulation No. 56.

[71] Government of Chile (2010) Regulation No. 956 of Public Works Concessions (Reglamento de Concesiones de Obras Publicas).

[72] Hodges & Dellacha (2007) reviewed several countries’ experience with unsolicited proposals in Appendix B of Unsolicited Infrastructure Proposals: How Some Countries Introduce Competition and Transparency.

[73] Government of Chile (2010) Regulation No. 956 of Public Works Concessions (Reglamento de Concesiones de Obras Publicas), Title II: Bids Submitted by Private Parties.

[74] Government of Indonesia (2005) Presidential Regulation No. 67 concerning Government Cooperation with Business Entities in the Supply of Infrastructure, as amended by Government of Indonesia (2011) Presidential Regulation No. 56, Chapter IV.

[75] President of the Republic of Italy (2006) Legislative Decree 163: Code for Public Contracts for Works, Services and Supplies in the Implementation of Directives 2004/17/CE e 2004/18/CE, Articles 156-155.

[76] Kim, Kim, Shin and Lee (2011) Public-Private Partnership Infrastructure Projects: Case Studies from the Republic of Korea, Volume 1: Institutional Arrangements and Performance, pp. 67-69.

[77] Philippines BOT Center (1993) The Philippine BOT Law (Republic Act No. 7718) and its Implementing Rules & Regulations, Rule 10.

[78] South Africa National Roads Authority (1999) Policy of the South African National Roads Agency in Respect of Unsolicited Proposals.

[79] The Commonwealth of Virginia (2005) Public-Private Transportation Act of 1995 (as Amended) Implementation Guidelines.

[80] As described in UNCITRAL (2001) Legislative Guide for Privately-Financed Infrastructure Projects section on unsolicited proposals pp. 91-97.

[81] New South Wales Treasury (undated) Intellectual Property Guidelines for Unsolicited Private Sector Proposals Submitted Under Working with Government.

[82] Hodges and Dellacha (2007) Unsolicited Infrastructure Proposals: How Some Countries Introduce Competition and Transparency.

[83] As described in Kim, Kim, Shin and Lee (2011) Public-Private Partnership Infrastructure Projects: Case Studies from the Republic of Korea, Volume 1: Institutional Arrangements and Performance.

[84] Hodges and Dellacha (2007) describe the benefits and risks of doing so in Unsolicited Infrastructure Proposals: How Some Countries Introduce Competition and Transparency.

[85] Philippines BOT Center (1993) The Philippine BOT Law (Republic Act No. 7718) and its Implementing Rules & Regulations.

Add a comment