|

BOX 1.22: An Initial Clarification: Funding versus Financing Financing is defined in this PPP Certification Guide as the source of money required up-front to meet the costs of constructing infrastructure. Financing is typically sourced by the government through surpluses or government borrowing (for traditional infrastructure procurement) or by the private sector raising debt and equity finance (for PPPs). Funding generally refers to the source of money required to meet payment obligations. In a PPP context, it refers to the source of money over the long-term to pay the PPP private partner for the investments, operating costs, and maintenance costs of the project. Funding is typically sourced from taxes (in government-pays PPPs) or from user charges (in user-pays PPPs). Governments may also utilize more specific sources of funds, one of the most relevant being “land value capture[72]”.

|

The private partner is responsible for raising and providing the funds to develop the asset (that is, for design and construction through to completion of the asset), except to the extent that the government provides part of the finance if the PPP is a co-financed scheme. As a private finance procurement method, all (or a significant portion) of the resources for financing the capital investment comes from the private sector. See box 1.22.

As explained, PPPs commonly involve the creation by the successful bidder of a specific company (SPV) to deliver the project (that is, constructing, financing, and O&M the asset). The SPV signs the contract, so all rights and obligations are assumed by the SPV. Consequently, all cash flows inherent to the project are channeled through the SPV, and assets and liabilities related to the project are recorded in its balance sheet. This is commonly referred to as “ring-fencing” the cash flows.

As for any private company, the funds to be applied to develop the investment (that is, to finance the project) will usually be a mix of debt and equity, which provide tax efficiency (by the creation of the “tax shield”) and overall efficiency as it diminishes the overall cost of all the financial resources (the weighted average cost of capital, WACC).

The most frequent and efficient method of financing is to use the “project finance technique”. Project finance provides a number of advantages, notably higher control of the project governance and performance by the lenders, and the ability of sponsors to raise third party funds without being directly liable vis-a-vis the lenders. But a project needs to meet some conditions to access this type of finance (these include specific lender requests that relate to bankability — see below — and reasonable size so as to offset the higher transaction costs of the mechanism).

Therefore, some projects are financed through “corporate loans” or “corporate finance”; this means that the financing raised in the form of debt by the SPV is fully guaranteed by the sponsor (the equity investor), or funds are raised at the corporate level and passed through to the project entirely as equity (combining equity shares and subordinated sponsor loans – see section 7.2).

This section will explain the following:

- How gearing is paramount for the cost-efficiency of the project, and the most frequent financing structure in PPP projects is based on the project finance technique (section 7.1). This heading will also introduce how the procuring authority has to care about “commercial feasibility”, including the ease of access that the private sponsor has to debt (that is, bankability) when assessing and preparing the project;

- The different categories of funds (debt and equity) and the subcategories or instruments that are typically seen in a PPP project. The potential fund providers for each category, and the role of MDBs and ECAs in financing projects (section 7.2);

- How governments are concerned about the private finance structure in addition to caring about bankability (section 7.3);

- How and why governments may provide part of the financing, alongside private sector debt and equity investment, in the form of grants (that is, co-financing in strict terms) (section 7.4); and

- How a procuring authority can influence the project finance structure (in addition to participating through capital grants), and why it should do so in order to protect or further increase the “commercial feasibility” of the project by means of explicit measures (or to increase affordability) (section 7.5).

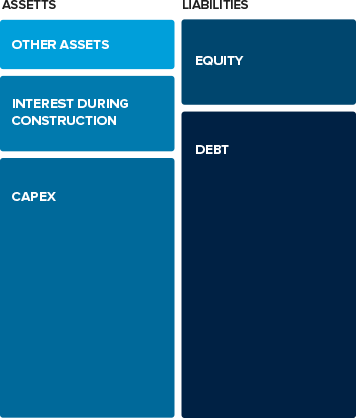

Figure 1.11 illustrates the basic composition of a PPP project company balance sheet at the completion of construction and commencement of operations.

FIGURE 1.11: Simplified Balance Sheet — Assets and Liabilities in a PPP Project Company

Note: CAPEX= capital expenditures.

[72] Land value capture responds to the fact that in many infrastructure projects (notably transportation), the value of the private real estate properties surrounding the infrastructure is increased by the improvement of the connectivity or directly for the urban regeneration in some projects. This approach is implicit in Transit Oriented Development Projects (TOD), such as the Hyderabad Metro Rail project procured by the government of Andhra Pradesh, India. Land value capture mechanisms intend to retain or capture part of the increased value to offset part of the costs of the infrastructure development; this is achieved by different means such as taxes on land value, “betterment taxes”, or “development impact fees”. In some projects, the authority and/or other governments in JV (for example, municipal governments in a heavy rail development connection with a city) may themselves undertake real estate developments on public land (for example, ADIF, the High-Speed Rail public operator in Spain). These and other concepts about land value capture are explained in Accelerating Infrastructure Delivery (WEF, 2014) in section 3.

Add a comment