IPSAS 32 deals specifically with service concession agreements, focusing on their governmental accounting consequences. The guideline presents a very comprehensive approach that includes most of the contracts defined as PPPs for the purpose of the PPP Guide. In fact, IPSAS 32 describes service concession agreements as long-term contracts between a government and a private party whereby:

- The operator uses a public asset (such as a prison, airport, or water pipe) to provide a public service for a specified period of time on behalf of the government; and

- The operator is compensated for its services over the period of the service concession arrangement.

Both government-pays and user-pays PPP contracts are covered by IPSAS 32. Furthermore, IPSAS 32 states that all contracts with the following characteristics should have consequences for the governmental balance sheet in terms of gross debt.

- The government controls or regulates what services the operator must provide with the asset, to whom it must provide them, and at what price; and

- The government also controls any significant residual interest in the asset at the end of the arrangement term.

Most PPPs meet these criteria, which is why, under IPSAS 32, most PPPs are expected to have an impact on the aggregate public debt.

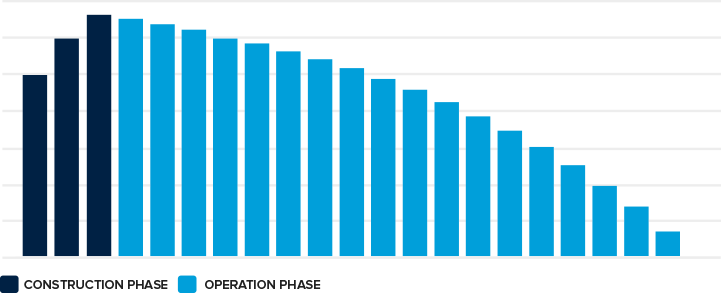

Independently of the approach taken to decide about debt impact, the effect of contracts on aggregate fiscal indicators, such as debt, will vary during different stages of project implementation.

Accounting treatment varies significantly in many counties. However, IPSAS 32 also outlines the contract’s effect on aggregate public debt, provided the criteria for registering the debt are met.

After the financial close of the PPP contract, while the construction is underway, the government should include the construction costs in the public balance sheet. The non-financial asset is also included, increasing the gross debt, but creating a null net balance sheet effect. Once the asset is operational, the debt is reduced (debt amortization) by an amount equivalent to the value of each government payment that relates to the asset repayment (excluding interest and service costs).The value of the non-financial asset is also reduced based on its expected life (asset depreciation). When the asset is handed over at the end of the contract, there should be no debt remaining and the residual value of the non-financial asset should continue to be depreciated accordingly.

For user-pays PPPs, the general outline of governmental debt under IPSAS 32 is very similar. However, the amortization of the debt is based on the flow of the tariff revenues used for repayment of principal.

In general terms, the marginal effect of a PPP contract on the gross debt would have the stylized outline described in figure 4.3 if a steady stream of governmental payments or user-paid revenue is projected.

FIGURE 4. 3: Stylized Outline of a PPP Project’s Additional Impact on Gross Debt of the Government/Contracting Authority for the Duration of the Contract

Add a comment