This section explains further the basic structure of a private finance PPP, assuming the form (or the scope) of a DBFOM that was first introduced in section 4.

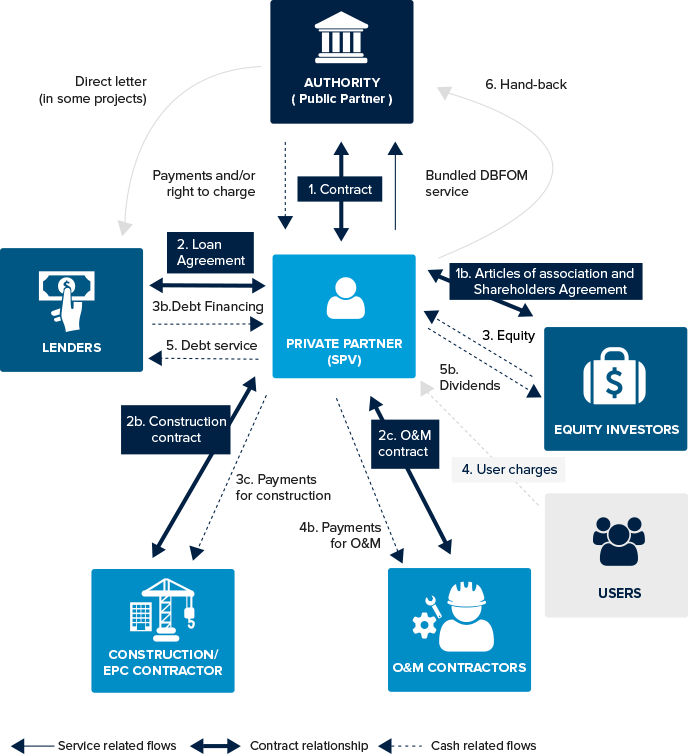

Figure 1.10 illustrates the basic structure of a common PPP (in which all of the equity in the SPV is provided by the private sector). This structure can be used for both user-pays and government-pays PPPs. The structure in figure 1.10 does not include “payments to the government” which could be the case in some over-feasible, user-pays projects. This and other potential variations are discussed when explaining the main relationship and cash flows inherent to the structure.

Broadly speaking, the project structure refers to the architecture of contract relationships and cash flows that govern the development and life of the project.

The main relationship and core element of the project structure is the PPP agreement or PPP contract[59] (also referred to as the “upstream contract”) between the authority and the private partner. It is developed by the authority and regulates the rights and obligations of the private partner to whom the development and management of the infrastructure will be delegated or contracted out. As the contract is the main or core element of the project structure, the PPP project structure and PPP project contract may be used interchangeably by this PPP Guide.

The PPP project structure will therefore be primarily based on the scope of the contract (which delineates the scope of responsibilities of the private partner), noting that the scope and structure may vary amongst projects of the same sector and type of infrastructure (see examples in section 6.3).

The project structure will also reflect the financial structure (how the private party will be compensated or paid for the works and services) and the risk structure of the PPP contract (that is, how the scope of responsibilities is qualified in terms of risks), as well as other provisions. Chapter 5 deals in detail with the structuring of the PPP contract. The payment mechanism is at the heart of the financial and risk structure, and is introduced in section 6.2.

As described below (see box 1.21), the private partner will usually be in the form of a Special Purpose Vehicle (SPV), that is, a project company created to develop and manage the project.

The SPV will “pass through” most of the rights and obligations to a downstream structure of contracts[60], allocating responsibilities, obligations, risks, and cash flows from the SPV to the different private actors through different agreements.

- Shareholders agreements (especially with financial investors).

- Financial or debt agreements.

- Construction/Engineering, Procurement and Construction (EPC) contracts and the like.

- O&M contract or contracts.

- Insurance contracts and guarantees.

The Construction/EPC and O&M contractors, or related investment companies, are also often shareholders of the SPV. There may be other shareholders that are, in essence, financial investors with no role in the project other than acting as equity providers. It is not generally necessary to be a shareholder in order to act as a contractor (although some governments may require this in some projects).

The following paragraphs relate to figure 1.10 and are intended to sequentially describe the most important contractual relationships and flows of obligations and funds.

FIGURE 1.10: PPP Project Structure

Note: DBFOM=Design-Build-Finance-Operate-Maintain; EPC=Engineering, Procurement, Construction; O&M= operation and maintenance; SPV= special purpose vehicle.

1. The consortium constitutes the SPV, which signs the contract.

The government (the procuring authority) is contracting with a private agent for the DBFOM of a new (or upgraded) infrastructure.

Typically, the government will award the contract to a company or group of companies (consortium). After awarding the contract, the consortium will have to incorporate a specific company[61] (the Special Purpose Vehicle, SPV) in accordance with the relevant legislation governing the formation of companies. The SPV will sign the contract with the procuring authority (this milestone is also referred to as “commercial closing”[62]), and the consortium members will execute the shareholders agreement (#1b).

By the contract signature, the private partner assumes the obligations described in the contract as follows.

- To finalize the design of the infrastructure, construct or develop the infrastructure asset (including obtaining all permits necessary if obliged to do so).

- To finance the works and other development costs (the full costs, or a relevant portion if the contract has a co-finance structure with grant financing from the government).

- To operate and maintain the asset (after commissioning the asset and obtaining approvals and authorizations).

2. The SPV executes financial agreements and implements its contract structure (downstream project contracts).

After contract signature, the SPV will do the following.

- Enter into the guarantee agreements for the performance bond.

- Enter into the insurance agreements and policies[63].

- Enter into the financing agreements, that is, the loan agreements[64], also commonly referred to as “financial close” (#2).

- Enter into the “downstream” contracts, i.e. the contracts with the construction or EPC contractors, and O&M contracts with the O&M contractors. (#2b and #2c[65])

In some projects, the authority will enter into a direct agreement with lenders (#2d) (see section 7.5).

Through the downstream contracts, the private partner is delegating responsibilities and transferring the risks to third parties in exchange for a price (noting that those third parties may belong to the same group of companies, as a shareholder of the SPV).

In most situations, there will only be one construction contract with a single contractor or with a group of contractors acting as a joint venture. However, in more complex projects, there may be several contracts for specific parts of the construction work.

For example, a light rail project may involve supply, installation and construction works. The SPV may enter into a single contract with a group of companies that will divide the works amongst themselves. Alternatively, the SPV may enter into separate contracts with different groups of contractors for the specific elements of the rail system development: civil works, tracks, systems (electrical, signalling and communications), and rolling stock. In the former case, the risk of proper integration of all the elements of the system is transferred to the contractor group and in the later it is retained by the SPV.

3. Construction works are executed, and funds (the proceeds of debt loans and equity contributions) are disbursed (#3 and #3a). The SPV pays the construction contractors (#3c).

Construction will typically start when the procuring authority gives the construction order. This occurs once final project design is approved and other pre-set conditions are met. Some of the pre-set conditions may be the procuring authority’s responsibility (for example, to provide the right of way or the land), and some others may be requirements of the lenders (such as final clearance of some permits).

In some countries, bank practice may be that the shareholders of the SPV have to invest the equity commitment prior to making drawdowns of the loan amounts granted by the lenders. In other countries, the loan drawdowns will occur in parallel with equity investment, in fixed percentages[66].

The contractor is paid the price of its construction contract in a progressive manner as agreed in the contract. In some projects, it may receive an advance payment for collecting materials, machinery and equipment, and in other projects, it may receive a relevant portion of the price at completion of the works.

However, the most common approach is monthly progressive payments against the successive and partial invoicing of the works executed. The works will commonly be reviewed by technical advisors appointed by the lenders.

To guarantee appropriate construction performance to the SPV and lenders, the construction contract will require the construction contractor to provide security, such as bank guarantees and/or parent company guarantees.

In the typical PPP as illustrated in figure 1.10, with total finance coming from the private sector (by means of equity and debt), the private partner will not receive any payment from the government or from users until the works are finalized and commissioned. However, if a specific government-pays project includes several facilities, the government may make partial payments starting when each facility becomes operational, but only making full payments once all facilities are operational. In addition, as explained in section 2, there are variations of PPPs that mix public and private financing (that is, “co-financing schemes”), where the public partner will provide payments during or at the completion of construction.

4. Operations commence (#4) and the SPV starts receiving payments from the government and/or users (#4b). The SPV pays the O&M contractors (#4c).

In most projects, the procuring authority only authorizes the commencement of operations once construction is completed and the works are commissioned. When the contract is of a user-pays type, the SPV will be allowed to start charging users (with some projects involving upgrades to existing transport infrastructure, charges to users may occur during construction). When the contract is of a government-pays type, the SPV will be allowed to start invoicing the procuring authority at the frequency established in the contract (for example, monthly) and according to the payment mechanism defined in the contract. These will be up to an amount equal to the payment offered, minus payment deductions or abatements (see box 1.21 below).

With the funds collected, the SPV will first offset the O&M costs which typically correspond to payments due to O&M contractors. Secondly, the SPV will pay the taxes and set aside the prescribed reserves required by law and by the contract. The remaining funds will be used to pay interest and repay debt, as well as make distributions to the equity holders.

O&M fees to be paid to O&M contractors may be for a fixed yearly amount or may be variable (as a percentage of revenues, especially when the revenue stream of the project company is based on demand or volume). These fees will usually be subject to the same deductions and/or liquidated damages that affect the original revenue of the SPV, partially or totally transferring the O&M performance risks to the O&M contractors.

During the Operations Phase, there will be a number of investments to be made (renewals or reinvestments, also referred to sometimes as “major maintenance” or “life-cycle costs”) so as to keep the asset in appropriate condition during the entire life of the contract. These works are usually done by the O&M contractors under the O&M contracts, but they might be handled and contracted separately under a specific contract for renewals.

5. Paying Back the Loan (#5) and Equity Distributions

The repayment profile is usually defined in advance in the financial agreements, and it is constructed to meet the Debt Service Cover Ratio.

Revenues may be paid to equity holders only when O&M costs, taxes and debt obligations are paid as scheduled and reserves are duly funded. The financial agreements usually include additional restrictions on payments to equity holders.

The bottom line is that the majority of the return to the shareholders (in the form of dividends (#5b)) will only come into place in the later stages of the contract[67].

6. Hand-back

Unless an early termination event occurs (that is, the contract is terminated before the original term expires due to a serious default by the private partner, a force majeure event occurs, or there is a unilateral decision by the procuring authority), the contract will expire in accordance with its terms.

At that point, the infrastructure will return to the hands of the government, which may re-tender the management of the asset in a new contract, contract the O&M of the asset in shorter-term contracts, or chose to directly manage the asset itself.

The handover of the asset to public hands is also commonly referred to as “hand-back”. It is good practice to require the private partner to hand-back the infrastructure in a specified condition. To meet these requirements, the private party will have to make some investments prior to hand-back. This is typically done during the last years (1 to 3 years) prior to the contract expiration date.

|

BOX 1.21: Special Purpose Vehicle (SPV) as a Common Feature of PPPs A SPV is a company created specifically to enter into the respective PPP contract. The successful bidder (usually a consortium of companies) will constitute the SPV after being awarded the contract, but before signing it. The consortium members will subscribe for pre-agreed percentages of the shares in the company (as committed at bid submission). It will be the SPV that signs the contract with the procuring authority. In some countries it is not compulsory for a consortium to create an SPV to enter into the contract. However, this PPP Guide considers that it is good practice to do so. Creating a SPV brings the following benefits for the parties:

For the latter reason, it is not uncommon that the RFP requires the creation of a SPV. While this requirement is not universal, it is regarded by this PPP Guide as good practice unless there are concrete reasons for not doing so. This may the case in small projects that do not require project finance techniques (so as not to impose unnecessary transaction costs to the PPP project), or when the company that signs the contract is an existing company (government owned) that will be transformed to empresa mixta through the PPP joint venture structure.

|

[59] While the contract will normally consist of one single document and its attachments detailing certain matters (such as the technical requirements and payment mechanism), this PPP Guide uses the term “contract” in a broad sense, so as to potentially include other agreements that may link the private partner with other public sector parties rather than the procuring authority (for example, in the case of off take agreements with a third party authority or body). The PPP contract may also be referred to as the PPP agreement.

[60] The downstream structure of project contracts is handled by the private partner and relates to transferring and allocating risks among different agents. These downstream contracts are often referred to as “back-to-back contracts” as they are intended to mirror the obligations and risks included in the PPP contract. Appendix A to chapter 6 describes this and other matters related to the preparation by the private partner to bid, develop, and handle the asset.

[61] In the variation of JV or empresas mixtas, the SPV may already be a publicly owned existing company, or the public party will participate as shareholder in the constitution of the project company.

[62] Contract signature may be also referred to as commercial close or contract “execution”, referring to the act by which the specific contract becomes valid and enforceable.

[63] The role of insurance policies and performance bonds are explained in Chapter 5.9.5.

[64] Sometimes (e.g. in certain countries) financial agreements will be executed the very same day as contract signature. In other situations, it may be possible to defer the fund raising and, as a result, the construction initiation will also be deferred by several months. The most common instrument for debt finance is debt loan agreements. However, in some markets, and depending on the risk profile of the project, project bonds (i.e. bond issuance to capture finance in the capital markets) may be also used. Section 7 explains the debt options for the project finance structure.

[65] Even if O&M will not start after construction is completed, O&M contracts have to be duly executed (signed) at least at financial close, as both lenders and investors require certainty regarding cost and risk transfer to the O&M contractor.

[66] A variation of the pari passu approach is that the lenders sometimes ask for a letter of credit or other standby guarantee to back the availability of the equity funding in advance.

[67] Unless one of the following actions take place: (i) re-financing the project, so equity diminishes against additional debt; or (ii) equity transfer, selling all or part to a new equity holder, which will also be subject to certain restrictions by the contract.

Add a comment