Traditional procurement of infrastructure: public finance and public management. Build and Design, and Build contracts.

Public works and public infrastructure are traditionally financed by the government. The source of funds for such traditional procurement is the public budget[11].

The public sector may raise debt/funds for specific projects. However, this is not the most common approach; in the majority of jurisdictions, public debt is managed under the “single-till principle” (that is, borrowings are for the general purposes of government, not tied to specific projects).

Furthermore, in the past, many governments had their own means for delivering public works, including their own equipment and personnel. Today, practically all public works are constructed by separate corporations that are, in most cases, contracted under a public tender. Some public corporations are exceptions, but even in those cases most of the works are carried out by private corporations under subcontracting schemes.

Traditional procurement usually takes one of the following forms:

- Build only (B) contracts, in which a design has already been completed by a different entity and a contract is tendered to build the infrastructure asset. This form is also sometimes referred to as Design-Bid-Build; and

- Design-Build (DB) contracts, in which a single contract is tendered for both the design and construction of the infrastructure asset. In some countries, B or DB contracts may also be referred to as Engineering, Procurement and Construction (EPC), especially when the asset to be built consists mainly of a plant. Another term that may be used to refer to the same scope of contract is Turnkey contracts, in which the price and construction term are fixed.

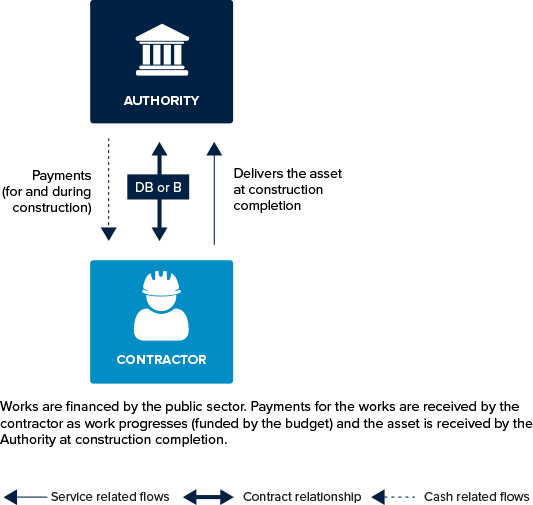

When infrastructure is procured by conventional means, the procuring authority pays for the works against its budget and assumes the entire responsibility of the asset once construction is completed (see Figure 1.2). Payments are usually made as work is progressing, and at the stipulated price (or subject to revisions). The contractor may be responsible for fixing defects at its own cost during a short period, and may provide security (such as a bank guarantee) in respect of its liability for defects. The contractor may also remain responsible for hidden defects over a longer period, but with no security provided during this period.

The ordinary maintenance tasks are usually contracted out to a private party through a separate contract. However, long-term management or life-cycle management (and related risks) remain a direct responsibility of the government, public agency or corporation created for that purpose. Renewals and major maintenance will usually be contracted and funded by the government or such agency as and when needed.

B or DB contracts therefore have a lack of natural incentives for the contractor to care about quality and resilience of the asset. However, the contractor does have a clear motivation to increase profits by either reducing costs (and hence compromising quality) or claiming extra payments (for example, for government variations to the scope of the contract). The risk of reduced quality or increased costs for the public sector may only be controlled with intensive quality assurance oversight and/or a natural inclination for being highly prescriptive in defining the technical requirements.

However, B or DB contracts may be appropriate options for developing infrastructure in many instances, provided that the public sector has the skills, knows clearly what it wants as a technical solution, prefers to retain the maintenance responsibility over the life of the asset, and has available funds from the budget to pay for the works. There is not a universally preferred or best procurement option for any infrastructure, but each project will demand a specific procurement route as the optimum.

FIGURE 1.2: Basic Scheme of a Design-Build or Build-Contract

Note: B= Build; DB= Design-Build.

Design, Build and Finance (DBF)

A DBF contract is similar to a DB contract in that the government receives the asset once construction is completed. The government also retains the responsibilities and risks related to the state of the asset in the long term.

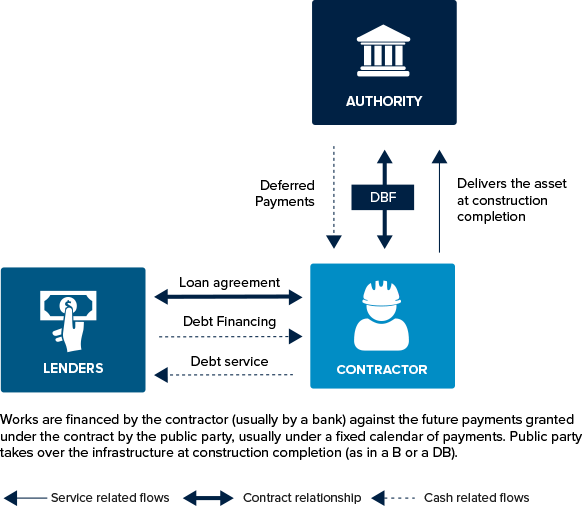

However, in a DBF contract, the government does not pay directly for the works but defers the payment, making the contractor a “de facto” lender. A DBF contract may be regarded as a variation of traditional procurement, with the variation being the timing of payment. The contractor is acting not only as construction contractor but also as a lender to the public sector. The lending is indirect, as ultimately the funds will be provided by a lending institution — such as a bank — against a pledge on the right to receive the government payments (see Figure 1.3), or even buying at discount without recourse to those future payments[12].

The payments are not made until the end of the construction period, that is, at the commissioning stage. It is usually in a number of fixed installments over a number of years, for an amount offered by the successful bidder (which includes the construction costs and the financing costs).

Although the private sector is providing finance to develop the infrastructure, that financing is not materially subject to project performance risk — only construction risk. So it is not regarded as private financing for the purpose of this PPP Certification Guide. Also, this procurement method is usually considered as public finance under many national accounting regulations[13].

FIGURE 1.3: Basic Scheme of a Design, Build and Finance (DBF) Structure

Note: B= Build; DB= Design-Build.

The aim of this procurement option is usually for the public sector to avoid a short term restriction of funds. There may also be benefits in the provision of the finance, as the debt is dedicated to the asset (hence the financer provides an additional layer of due diligence for the project, but only with respect to construction risks). There is potentially a greater transfer of construction risk than in a B or DB contract (basically the risk of construction delays) as long as payment for the construction works will only come (in cash terms) once the work is completed.

This feature may provide benefits in terms of efficiency (especially the reliability of the proposed construction term) provided that payments are to some extent conditional upon construction completion and commissioning.

The government should consider whether the potential benefits of the DBF contract will offset the higher cost of the financing. Even though there is a very limited credit risk in the scheme (basically related to construction term considerations), there will be an interest rate premium over the cost of direct public debt raised by the public sector.

As in a DB contract, in a DBF contract there is no natural incentive for quality construction. However, as noted, there still may be a perverse incentive for the contractor to maximize its margin during construction because the payments are not linked to the performance of the works or future service, and the long life-cycle cost of the infrastructure is not managed by the contractor but retained by the public sector.

There are some countries that regard DBF contracts as a type of PPP (sometimes referred to as a method of “innovative financing”), based on the financing characteristic and the ability to transfer more construction risks.

In any case, a PPP may not be the most appropriate option to procure a particular infrastructure project, but a DBF contract may offer some advantages and benefits to the public authority, compared to a purely conventional DB or B contract.

[11] Note that in some countries, governments establish specific taxes for funding transport infrastructure (typically roads), usually structured as levies charged on oil consumption. In other cases, funding may be based on specific charges to the users of the infrastructure, which may be used to finance the costs of the infrastructure through different financial and public corporate structures, with the infrastructure still being procured under a conventional method. For example, a SOE may raise finance against future toll revenue and contract out the construction of the road under a DB scheme.

[12] Rather than financing the works through a loan subscribed by the contractor and to be repaid with the instalments of payments from government, it is not uncommon that the financing is structured by means of the sale by the contractor to the lender of the right to receive those payments, a sale that is usually without recourse (or with limited recourse that is waived when construction is completed). These structures are also known as forfaiting.

[13] Any country that follows any of the international standards on government accounting and fiscal reporting will/should regard this structure as public finance, that is, consolidating in government accounts the asset and the liabilities, as the asset is completely under the control of the procuring authority who assumes full ownership of the assets and all risks related once constructed. See chapter 4 for statistical information and national accounting as to when an asset and related liabilities are regarded as public according to some standards.

Add a comment