Design, Build, Operate and Maintain (DBOM)

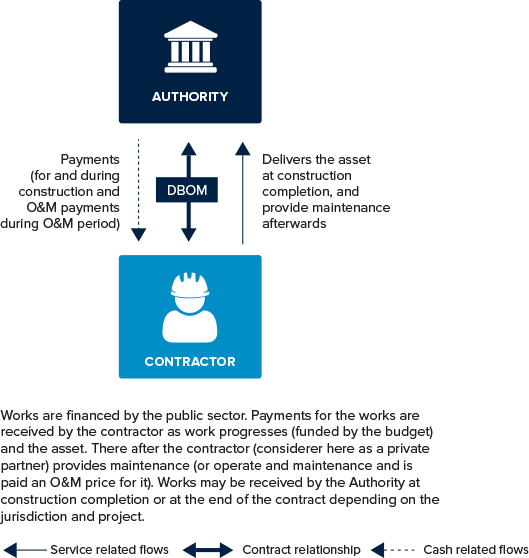

There are some contracts which are financed by the government against the budget (such as a conventional procurement) but in which the selected contractor will carry out the construction works, future operations, and maintenance.

Thesecontractsarereferredto asDBOM(design, build, operate and maintain). If the contractor is not responsible for operating[14] the infrastructure, the contract is usually referred to as a DBM. Under a DBOM contract, maintenance work is pre-contracted and is paid for directly by the government at a pre-agreed price. See figure 1.4.

A DBOM contract (as opposed to a private finance PPP) is still financed by the public sector, i.e. construction work is paid for directly as work progresses. And the Operation and Maintenance (O&M) price is closely tied to the performance of the O&M work and paid for in a separated stream. However, there may still be incentives for the contractor to reduce quality in construction as a way to save costs and increase margins, all of which needs to be carefully controlled.

The risk of unexpected maintenance costs can be transferred to the contractor in a limited manner, usually by means of liquidated damages. Nevertheless, the main portion of the maintenance risk, which depends on the proper design and construction of the asset, usually remains in the hands of government.

The incentives for the contractor to properly perform the works and deliver high construction quality may be limited. However, due to the absence of capital at risk, if maintenance risk is transferred to the contractor, together with construction risks, a DBOM contract may be close to the PPP concept in terms of scope and potential efficiencies[15] (for this reason, many countries regard a DBOM contract as a type of PPP).

FIGURE 1.4: Basic Scheme of a Design, Build, Operate and Maintain (DBOM) Structure

Note: O&M= operations and maintenance.

The government may choose to deliver a project as a DBOM if it considers that the benefit of a more integrated management approach will exceed the loss of efficiency incurred. This loss is inherent in giving up the possibility of running a separate competition for the future O&M contract. This choice tends to occur when the project specifics and financial context are not sufficient to justify a private finance PPP (usually a DBFOM contract, as will be explained below).

DBFOM Contracts

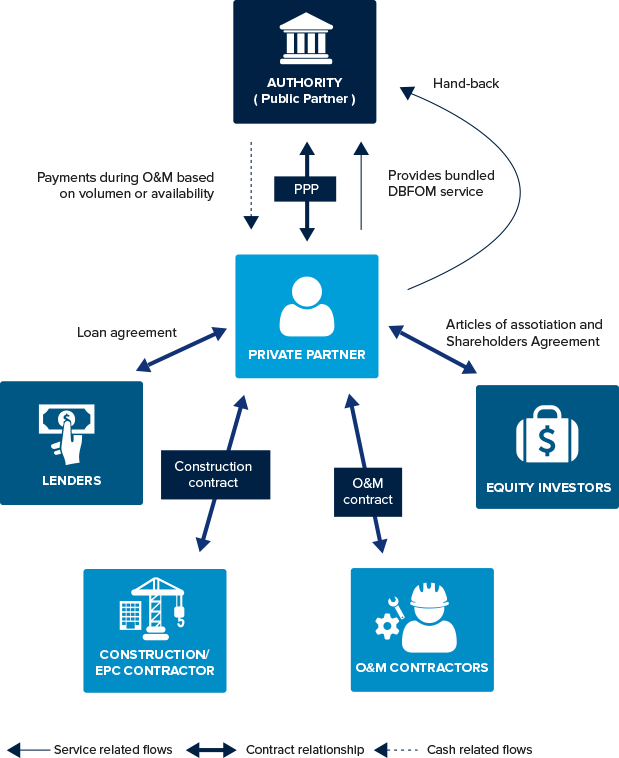

In a DBFOM contract, the contractor will develop the infrastruture with its own funds and funds raised from lenders at its risk (that is, it will provide all or the majority of the financing). The contractor is also responsible for managing the infrastructure life cycle (assuming life-cycle cost risks) in addition to current maintenance and operations. To carry out these tasks, the contractor (a private partner in the PPP context), will usually create an SPV (section 6 explains in further detail the structure of a PPP under a DBFOM contract type, its agents and main relationships).

The contract is often referred to as a DBFM when operations are not included in the scope of the contract.

DBFOM (and DBFM) contracts (and other equivalent terms such as Build-Operate-Transfer [BOT], Build-Own-Operate-Transfer [BOOT], Build-Transfer-Operate [BTO] and so on — see section 3.2.) are the only type of contract (in terms of scope) that fulfill all of the conditions required to be a private finance PPP. However, whether a DBFOM contract may be regarded as a true private finance PPP depends upon the effectiveness of risk transfer and the nature of the links between the performance and revenue, as some DBFOMs may represent a DBOM with financing provided by the private party without the investors taking on any material risk. If there is no material risk transfer to the investors, the project will provide a similar VFM outcome to a DBOM rather than a DBFOM contract.

DBFOM Contracts Based on User Payments (user-pays PPP or a concession)

When authorities decide to charge for the use of infrastructure, the potential revenue to be generated by such a public asset or infrastructure may be used in several ways. It may be used as revenue for the general budget, as a source of funds for the funding needs of the particular sector (for example, the eurovignete approach in some European Union [EU] countries), or even earmarking the revenues to the specific system that generates them (for example, water supply system revenues in a city, tariff revenues generated by a public metro operator in a city, or toll revenues generated by the government’s own highways — as is the case of the Turnpike enterprises in some states in the US).

The future revenues to be generated by a new investment/asset may be earmarked to the specific project investment, assigning those revenues to a specific new company.

Funds coming from users may be sufficient to cover O&M expenses and long-term maintenance with a surplus that can then be used as a source to repay the financing of the construction of the asset.

A contractual assignment by a public administration to a private party of future/potential revenues associated with the public use of public infrastructure as a means to fund the procurement of the infrastructure and related services is a user-pays PPP. User-pays PPPs are also known as concession schemes, especially in civil code-based countries[16].

A user-pays PPP used to finance, deliver and manage infrastructure is a form of contract whose scope includes DBFOM in an integrated manner, in which the financing is private (and usually regarded as private finance under national accounting standards[17]) and in which the source of revenue is totally or mainly in the form of the right to commercialize the use of the asset: all or the majority of revenues come from the users. See figure 1.5.

In these contracts (in the context of procuring new infrastructure or significant upgrades), as opposed to the conventional procurement described above, the private partner will not only construct (and likely design) the works, but will also operate and maintain the asset under a long-term contract (in addition to financing it at his/her own risk — with exceptions discussed later in this chapter).

The private partner will recover the investment (directly in equity or indirectly with investment of funds raised in the form of debt) at his/her cost and risk from the user payments. The private partner will remain the economic owner of the asset during the life of the concession contract. This means that the private partner will have to maintain and renew the asset at its own expense and risk, without the ability to make claims on the public party (with exceptions inherent to a proper risk allocation scheme).

If and when the expected revenues surpass the revenue needed to support the financing of the project, the user-pays PPP structure will likely include a payment from the private party to the procuring authority in the form of an upfront fee and/or a deferred fee that may take diferent forms (see chapter 5.4).

FIGURE 1.5: Basic Scheme of a DBFOM Contract Structure (user-pays)

Note: DBFOM= Design, Build, Finance, Operate and Maintain; EPC= Engineering, Procurement and Construction; O&M= operation and maintenance; PPP= public-private partnership.

Conversely, it may happen that the potential of the user revenues is not enough to offset all of the financing obligations as well as the O&M costs. However, if the project is still regarded as a sensible and valuable project solution for the public/taxpayer, the government will be keen to fill the “viability gap” under a variation of the DBFOM scheme (see box 6 below).

- Apart from the standard form of user-pays PPP described above and the co-financing variation, there is another relevant variation in the DBFOM scheme: the public-private mixed equity company or public-private joint venture (“empresa mixta”). See box 1.6 below.

|

BOX 1.6: User-Pays PPP Variations Co-financing and hybrid schemes in concessions which are not self-financing. Viability gap funding. A concession as a means to procure and finance new infrastructure requires the existence of a margin or benefit in terms of revenues in comparison to O&M costs, i.e. the project should generate a surplus of revenues over O&M costs that may be used to amortize the financing applied to the asset and generate a return for the private investor. However, the revenues, and therefore this surplus, may not be enough to offset financial obligations and provide return on the equity. This situation is referred to as a viability gap. This gap is usually filled by public financing, usually in the form of grants (co-financing schemes) or by means of complementary budgetary payments linked to performance. Typical sectors/project types where user revenues are significant enough to fund most or all of the needs of the project are roads, airports and ports. Also, some telecom and water projects (when the project consists of the integral water cycle, including water supply to homes, and constitutes a significant part of the system). In those projects where user revenues are insufficient to fund all of the needs of the project, co-financing and other forms of revenue support may be needed to fill the viability gap. There are sectors and project types that generate user-based revenues which will almost never cover the funding needs for the infrastructure project to be viable. That is typically the case for infrastructure rail transportation, because the combination of highly intensive capital needs with socially subsidized prices, in which co-financing and hybrid payment regimes (mixing user charges with service payments) are a standard feature. N.B. Co-financing may be used even when a user-pays project is self-viable for other reasons. Co-financing is further explained in section 7.5. in this chapter and with greater detail in chapter 5.4. Mixed-equity companies, joint ventures, and institutionalized PPPs[18] It is not uncommon to see PPP contract structures where the government participates in the equity shares of the PPP project company that will act as the private partner. However, these structures will vary significantly depending on the extent of the government equity participation, the rights and degree of participation, and the influence that the government reserves for itself in the management of the project company. Many of these structures are referred to in some countries as mixed equity companies (or “empresas mixtas” in Spanish-speaking countries) or as joint ventures (between public and private partners) in others. The EU Commission uses the term institutionalized PPPs[19]. They may be also referred to informally as institutional PPPs when the government retains the control of the project company, and usually holds the majority of the shares (see “Public Partnerships and Institutional PPPs (controlled by the procuring authority)” below). This PPP Guide uses the terms joint venture, joint equity companies, mixed equity companies, and institutionalized PPPs as synonyms to refer to contract structures where the government retains a material equity participation in the company as a shareholder, has a presence (with voting rights and commensurate to their equity shares participation) on the SPV board, and participates actively in the management of the company (for example, with the ability to designate high-level staff). The equity participation is held either directly by the government/procuring authority or by a public entity in charge of the area of service related to the PPP contract. Conversely, when the government participation is represented simply by a minority stake in the equity shares, with no right to influence the management beyond the rights usually enjoyed by a minority shareholder acting under market standards, it is not customary to refer to the PPP structure as a joint venture or alike terms (while this may happen depending on the custom of some jurisdictions). The distinction between a joint venture and a “conventional PPP with government participation in equity ” can be very subtle or even quite unclear, and sometimes may only reflect the legal nomenclature or conventional terminology used in the respective country.

|

DBFOM Based on Government Payments (government-pays PPP or Private Finance Initiative [PFI][20])

The preceding paragraphs explain how a user-pays PPP or concession is an alternative for financing and procuring infrastructure under a DBFOM scheme. A public authority or administration (the original and ultimate owner of the right to charge users for a public service or for the public use of infrastructure) endorses those rights to a party in exchange for that party’s obligation to develop and construct the asset, provide the financing, and maintain the asset/infrastructure to certain quality standards on an ongoing basis.

The previous section explained that when user revenues are significant but not enough to entirely fund the project, the project may be made viable by means of grants or complementary payments from the government.

However, if there is no revenue from users (for instance if there are no final users to be charged) or the potential revenue is insignificant in comparison with the capital needs (typical of rail projects) or the infrastructure is available to users at no charge (for example, non-toll roads), a government may decide it wants one of the following options:

(i) The contractor assumes the integral life cycle of the infrastructure, that is, managing it from construction through to a renewal (or even more cycles).

(ii) The contractor finances the works with its own funds.

(iii) The contractor maintains and/or operates the infrastructure according to certain service levels or performance requirements during the life of the contract. This is usually based on the availability and quality of the infrastructure and service rendered from it.

(iv) The contractor/investor will be paid for both construction and O&M only as long as, and to the extent that, the infrastructure is available under specified availability and quality standards.

As in the concession, the contractor derives revenue from the infrastructure. However, the revenue results from service provision to the grantor, providing a service related to the availability of use for the infrastructure, with the precedent conditions of design and construction, and an ongoing obligation to maintain and (usually) operate. In some of these projects the government is not the user (for example, for a toll free road), and in other projects the infrastructure is used by the government or by public employees/servants (for example, a hospital to provide public health services, a prison operated by public officials, a court, or a school.).

As in the case of user-pays PPPs, public-pays PPPs may include user revenues and/or other commercial revenues. When these market or comercial revenues are not predominant (that is, they do not represent the majority of the revenue), the PPP contract may still be properly considered to be a government-pays PPP.

Other variations applicable to user-pays PPPs are also present in government-pays PPPs: co-financing (see section 7.4.) and “joint venture”, although the later variation is rarer in the case of user-pays PPPs.

A specific variation of a government-pays PPP occurs when users are charged with a toll or a tariff, but the user-revenue is intentionally left out of the revenue received by the private partner (see example in box 1.7 below).

|

BOX 1.7: The I-595 Road, an Example of a Government-Pays Toll Road PPP with Grant Co-financing The I-595 road project promoted by the Florida Department of Transportation (FDOT) in 2008 consisted of a DBFOM contract for the reconstruction, widening, resurfacing, operation and maintenance of the two roadways, as well as the construction, operation and maintenance of three reversible Express Lanes for one of the roads. The total project capital expenditures (capex) amounted to approximately US$1.6 billion. The private partner had the obligation to finance the majority of the infrastructure (against the right to receive availability payments once the infrastrucure was open to service), but FDOT also provided the project company with $685 million in deferred grants (not reimbursable) received in seven payments on dates established in the contract, or on the construction final acceptance date, whichever date was later. In this way, FDOT used a part of its budget allocation during the early years of the contract, while enjoying lower yearly commitments related to the availability payments. The infrastructure is subject to tolling. It was decided that traffic revenues remained the property of FDOT (and therefore at its risk). FDOT would then use the traffic revenues to partially or totally offset the availability payments to be made to the private partner, rather than transferring them to the private partner as a source of revenue. That would allow for higher flexibility for FDOT in terms of a tolling strategy, which was a sensitive issue as it was used as a dynamic tolling system with the main aim of managing traffic congestion. It was considered that, if the private partner collected tolls rather than receiving availability payments, there could be a conflict between the government’s objective of managing congestion and the private partner’s motives for maximazing revenues. A description of other features and drivers of this PPP project may be found in various case study papers and articles[21].

|

Figure 1.6 iIlustrates the DBFOM basic structure for government-pays PPPs. A more detailed figure and explanation of the structure (both for user pays and government pays) is provided in section 6.

FIGURE 1.6: Basic Scheme of a DBFOM Structure (government-pays)

Note: DBFOM= Design, Build, Finance, Operate and Maintain EPC= Engineering, Procurement and Construction; O&M= operation and maintenance; PPP= public-private partnership.

Public-Public Partnerships and Institutional PPPs (controlled by the procuring authority)

Governments can created hoc government owned companies (State Owned Enterprises or SOEs) to construct, finance, and manage infrastructure, usually on the basis of revenues generated by the infrastructure or the service provided by the infrastructure (such as road tolls, public transit tariffs, and user charges/tariffs for water supply services).

When a public corporation is created specifically to develop, finance, and manage infrastructure under a DBFOM contract from the government that owns that corporation and that has approved the project (or such a DBFOM structure is implemented by an existing SOE), the arrangement may emulate much of the financial and governance structure of a conventional (private) PPP vehicle. In this case, the contract structure may be sometimes referred to as a “Public-Public Partnership”.

However, such structures are not regarded as PPPs by this PPP Guide: many service arrangements between governments and publicly-owned companies do not involve a contract in the strict sense of the word, but rather a general public authorization and assignment of economic rights to a government corporation or SOE. When these schemes involve a specific (in a narrow/strict sense) contract with delimitations of rights and responsibilities (including a defined term), they may benefit from project finance techniques (with lenders acting as financiers based primarily on the quality of the asset); however, there are reasonable doubts that there is a real risk transfer to the private sector of the economy.

An example is the public service contract structures developed by the European Bank for Reconstruction and Development (EBRD) for upgrading urban transportation in some European countries. In these cases, the authority signs a public service contract with its public operator, which emulates many of the PPP features (in which public payments necessary to reach a financial equilibrium are to some extent based on or affected by performance). The authority also signs a Municipal Support Agreement (MSA) with the EBRD to reinforce its financial commitment to the project[22].

However, a government may also procure a DBFOM type of contract to be assigned to a project company that is jointly owned by public and private partners ( that is, a joint venture scheme), but where the government retains the control of the SPV (usually by holding the majority of the equity shares). These schemes, whether a joint venture or mixed equity company, are also commonly regarded as “institutional PPPs” (see box below).

This PPP Guide considers that an institutional PPP may only be regarded as a true private finance PPP when the private sector is significantly involved as an equity investor (with a significant portion of the equity shares) in the project company. Therefore, the private partner assumes the project risks, participates significantly in the management of the company and/or the infrastructure operations (for example, as a nominee contractor), and the debt financing is at risk of performance.

This PPP Guide is focused on conventional PPPs (privately owned or otherwise controlled by a private investor, and with potential minority stake shareholdership by a government body) and the PPP process, including contract structuring. The tender process and contract management described in this PPP Guide is dedicated to this conventional form of PPP (while most of the contents of this Guide are equally applicable to a joint venture scheme).

|

BOX 1.8: An Example of an Institutional PPP: Madrid Calle 30 The Madrid Calle 30 (M-30) is the main ring road in Madrid and the busiest road in Spain. In order to accommodate future growth and manage congestion, as well as repair deteriorating parts of the road, plans were made to reroute parts of the traffic underground using a system of tunnels. The project includes 99 kilometres (kms) of new roads, including a 12-km tunnel segment in south Madrid that is the world’s longest urban tunnel. The total project cost is €4.5 billion (US$5.4 billion). It is financed by long-term debt subscribed to by a pool of banks as well as equity provided by the city council and a private investor (who is in charge of the effective operation and maintenance of the project). The project was structured as a 35 year DBFOM with availability payments between the city council and the project company. It is a joint venture (“Madrid Calle 30”) between the municipality and a private consortia (Empresa Mantenimiento y Explotacion M 30 -EMESA, comprised of three private operators). The city council retains 80 percent of the equity (in addition of acting as the procuring authority), and the private partner owns a 20 percent share through EMESA. The joint venture company subscribes the loan. A public tender was issued by the city council to select the private partner to enter into ownership of Madrid Calle 30. The private partner had to commit 20 percent of the equity, and enter into a back-to-back management contract (sub-contract) to deliver the operations and maintenance service (against a portion of the availability fees) that were contracted by the city council with the JV company. Interestingly, the civil work contractors chosen to deliver the tunnels and upgrades of the ring road were selected under a separate process and were directly contracted by the mixed equity company (Madrid Calle 30). The project was developed as a PPP with the intention of transferring it off of Madrid’s balance sheet. However, due to a number of factors, especially insufficient transfer of risk according to Eurostat, it was finally treated as an “on the public (municipal) balance sheet” project, registering the value of the project as a public debt. However, the structure seems to provide the right incentives for the private parties (private operators that are also significant equity investors in the project) to perform, and the service is generally well perceived by the public. The project’s website is: http://www.mc30.es

|

Source: Adapted from “International Public-Private Partnerships synthesis report (Parsons Brinckerhoff commissioned by FHWA, 2013)[23]

[14] Operations may be understood in a narrow sense (linked to collection of fees, sometimes referred to as commercial operations) or in a broad sense. In the latter case, the term includes other obligations and responsibilities that allow the infrastructure to be available for use and are not necessarily only maintenance activities in the strict sense of the word. For example, for a road project, the clearance of accidents, or the service of removing snow (winter viability service). Many jurisdictions, and common practice, use the term “operations” for all the activity concerning the availability of service, even if this is mostly related to maintenance activity.

[15] Section 7 explains the motives for, and advantages of, PPP — only achievable for the right projects and under the right preparation and structuring process, as is explained later in this chapter.

[16] In civil code countries, concession may be applied to both DBFOM contract types and service contracts, or contracts granting the right to operate an existing asset. For existing assets, common law countries also use the term “lease”. See section 3 for nomenclature clarifications.

[17] However, a DBFOM based on government payments might be considered a public asset impacting government deficit and debt for national accounting purposes, either generally or when some conditions are not met. It all depends on the specific accounting standards applicable to the respective jurisdiction (see chapters 1 and 3).

[18] Resource Book on PPP Case Studies (European Commission, 2005) includes a number of European case studies of joint ventures in the water and transportation sectors. Of special note is case study 10 which describes a effective example of a German JV constituted in 1993 for the modernization of both infrastructure and management of the water service supply service in the city of Schwerte.

[19] See Green Paper on Public-Private Partnerships and Community Law on Public

[20] As noted earlier in this section, there are a number of countries (especially in Latin America) that reserve the term PPP only for government-pays contracts, referring to user-pays projects as concessions. In contrast, some other countries use the term “PFI” (which stands for Private Finance Initiative) for government pays PPPs.

[21] See “Paving the Way: Maximizing the Value of Private Finance Infrastructure”, World Economic Forum, 2010; and “I-595: North American Transport Deal of the Year” – Infra-structura Magazine, Deloitte, July 2010.

[22] See Accelerating Infrastructure Delivery (WEF 2014). http://www.weforum.org/reports/accelerating-infrastructure-delivery-new-...

[23] http://www.fhwa.dot.gov/ipd/pdfs/us_ppp_case_studies_final_report_7-7-07...

Add a comment