Risk allocation: definition and rationale

Risk allocation is the exercise to define which party will assume each risk, identifying which risks the private partner will be (or remain) responsible for and to what extent, and identifying which risks the public partner will be responsible for and to what extent[33].

Allocation of risk to the private partner is also referred to as “risk transfer”, and allocation to the public partner is also referred to as “retained risk”.

Risk transfer is related to the search for efficiency which is the key motivation for undertaking a project as a PPP[34] (see chapter 1.5.2). Transferring the financial consequences of the project risk to the private partner creates the incentive for the private partner to deliver the infrastructure and service to the public as scheduled and in the required condition. This is based on the theory that the party in the greatest position of control with respect to a particular risk (in a PPP, this is usually the private party) has the best opportunity to reduce the likelihood of the risk eventuating and to control the consequences of the risk if it materializes[35]. Hence, the appropriate transfer of risk generates incentives for the private sector to supply timely, cost effective and more innovative solutions.

Therefore, transfer of risk generates efficiency (Value for Money – see chapter 4), but this is up to a limit. Governments should be ready to remain exposed to the financial implications of risk and the uncertainty affecting the asset and the service. Also, governments will always remain exposed from a reputational standpoint, as they are the ultimate owner of the asset and have ultimate responsibility for the service despite the delegation to a private party.

The private partner will include the cost of bearing and managing the risk in the price that it bids (for example, in the user charges or government payments). This cost is known as a risk premium. There are types of risks and/or levels of uncertainty (amounts of potential exposure) for which the risk premium may become too high or expensive. In addition, some risks may be simply un-assumable or the private partner (including its private investors and lenders) may not tolerate such risks. On other occasions, a risk may be tolerable by the private partner at a reasonable price, but the public partner may be better positioned to handle the risk and therefore may wish to take it back or to share it to some extent (so that the VfM will be increased by taking back the risk). The government should not push bidders too aggressively or recklessly to accept risks that the private partner is not, in reality, capable of managing, as this can result in serious project failure.

When there are clear signs that a risk transferred to the private partner will be unacceptable, or that it will only be accepted at a cost higher than the expected loss for the public partner if the risk were to be retained and managed directly (by the government), then the risk should indeed be retained (or taken back). Some risks will not be fully transferred or retained, but shared.

Risk analysis and allocation is clearly a progressive exercise. Risk allocation will normally have been preliminarily defined during appraisal in order to conduct the VfM exercise and the commercial feasibility analysis (see box below). This is done on the basis of a careful identification and assessment of risks (see box 5.15).

|

BOX 5.15: Interaction between Appraisal and Structuring in Terms of Risks During the Appraisal Phase, the government will normally have identified and assessed the risks, and then defined the preliminary risk allocation structure. The extent to which risks are structured during the Appraisal Phase will vary from country to country. Risk allocation during appraisal is necessary for VfM calculations (the risk allocation will affect the shadow bid model). It is also needed for a proper commercial feasibility assessment as well as the affordability assessment. In the Structuring Phase, the risk allocation will be reviewed and refined to incorporate it into the contract. When the risk structure (or pre-structure) has been shared in advance with the market (see section 6), the subsequent introduction of material changes should be avoided, or such changes should be carefully communicated. Also, relevant changes in the preliminary risk structure will affect the results of the appraisal because the financial base case will have to be adjusted, affecting the VfM, commercial feasibility, and quite probably affordability. |

The optimum allocation. VfM versus judgment

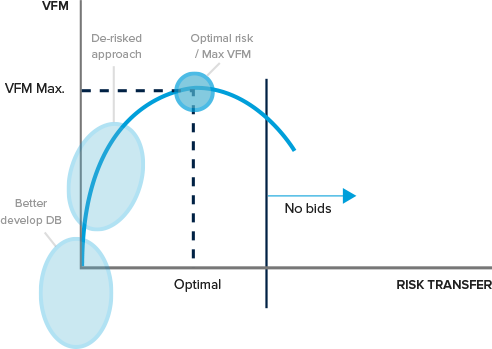

The essential driver for risk allocation and its refined structure is Value for Money, as in any structuring decision. Theoretically, the optimum point of risk transfer/retention or the maximum point of VfM will be that point at which the marginal VfM (the additional benefit in terms of incremental efficiency) of changing the risk allocation is negative. In other words, coming from a full transfer of risks, the optimum risk allocation structure will be reached at the point in which, if an additional risk is taken back, VfM decreases. Or, conversely, coming from a full retention, it will be the point at which, if an additional risk is transferred, the VfM decreases (see figure 5.8).

However, a quantitative assessment to calculate VfM has to be handled with caution, since innovation and management capability (to handle risks in particular) is difficult to evaluate and some risks are by definition unquantifiable. Therefore, for a number of risks, the analyst will rely on common practice and precedents as well as exercising judgment. The latter may be helped by asking the following question: “Is the private partner better placed or able to manage this risk more efficiently than the public partner?”

The general rule is to allocate the risk “to the party best able to manage it”.

As the Organization for Economic Co-operation and Development (OECD) states, “it is not always straightforward what is actually meant by being ‘best able to manage risk’. It can be the party that has the greatest ability to prevent the risk from occurring, or it can be the party that can best deal with the consequences after the risk occurs.” Furthermore allocation and transfer of risks depends on the ability to price risk appropriately — what the OECD and others call ‘risk profiling’.

Because of this, the OECD proposes that risk should be transferred to the party best able to carry it, and it clarifies that “best able to carry it” means the party that can carry the risk at the least cost.

This section develops these ideas and proposes a number of tips and signs for which party is best able to manage a particular risk (section 5.5).

FIGURE 5.8: The Optimum Risk Allocation

Note: DB= Design-Build; VfM= value for money.

It should be noted that optimum risk allocation may not be practical in some emerging markets or in less mature PPP markets. In this context, and especially when the availability of financing is an issue, it may be reasonable to sacrifice the VfM to some limited extent so as to ensure bankability and commercial feasibility by applying de-risking strategies, that is, until the respective PPP market matures and projects with optimal risk structures become bankable and commercially feasible.

Endogenous versus exogenous risks

Risks are sometimes divided into endogenous risks (“risks where the private partner can do something to ensure that the actual outcome approximates to the expected outcome”, OECD 2008) versus exogenous (risks that the private partner, and in many cases either party, “cannot control”).

However, the categorization of risks as endogenous and exogenous for risk allocation purposes may be misleading. The private partner might not be able to fully or accurately assess a risk, but it may still be well positioned to control (limit or mitigate) the consequences or control the occurrence (by limiting the probability of occurrence). For example:

- A private partner that is building and operating a new LRT line may not be able to fully assess the risk of vandalism affecting the physical state of the rolling stock, but the private partner may be more efficient than the public authority in managing the risk by means of preventive measures (for example, by taking appropriate security measures);

- A private partner that is building and operating a new hospital may not be able to prevent interruptions to the electricity supply to the hospital, but it can be proactive in mitigating the consequences by having a back-up generator on-site that automatically provides electricity if the main electricity supply is interrupted.

Risk allocation versus risk structuring

Once the risk allocation is defined, risk structuring can take place. By structuring risks, the risk allocation will be implemented and developed further into the contract. This is done through the appropriate provisions; specifying and nuancing the definition of the risk events (detailing when a specific risk event has occurred for the purpose of risk allocation); specifying the extent to, and the form in which, each party assumes each of the risks; and how the party that has not been allocated the risks will be compensated if the risk occurs.

Some of those contractual provisions will be specific to risk allocation and risk treatment, whereas in other cases risk considerations will be incorporated in other provisions by qualifying them (for example, by defining exceptions to unavailability events, adding qualifications to general obligations such as the need to complete construction, and commissioning within a specified time, and so on).

Section content outline

To reach the point where risks will be allocated and structured, a number of steps will have been taken. Identification and assessment of risks and early mitigation are the first steps in the risk management cycle (see section 5.2). This PPP Guide assumes that such tasks have been handled during the Appraisal Phase (see chapter 4.4.3), but the Guide will explain them in further detail in this section for convenience. Specifically:

- Section 5.2 introduces the concept of the risk management cycle. This puts risk allocation and structuring into context, as well as its interrelationships with other risk-related tasks advanced during the Appraisal Phase;

- Section 5.3 explains risk identification;

- Section 5.4 provides an overview of risk assessment and how it is pertinent to risk structuring;

- Section 5.5 explains the importance of mitigating risks by proper preparation and strategies to manage risks other than transferring/allocating the risk or accepting the risk;

- Section 5.6 explains the principles of risk allocation;

- Section 5.7 introduces the contractual categories of risks, based on how they are allocated;

- Section 5.8 proposes and describes a classification of risk event types, including the typical allocation of these risks. The analysis of potential allocations and its nuances is further explained in appendix 5A; and

- Finally, section 5.9 provides some additional recommendations for incorporating risks into the contract.

[33] As explained in section 5.7, retained risks (fully retained or shared) are incorporated into the contract in three categories: compensation events, relief events, and force majeure.

[34] There are three kinds of efficiency: allocative efficiency, technical efficiency, and X-efficiency (Fourie and Burger 2000, as cited in OECD 2008). The last two are the drivers for efficiency in PPPs, according to OECD (PPPs in the Pursuit of Risk Transfer and VfM, 2008).

[35] Partnerships Victoria (2001), Risk Allocation and Contractual Issues, http://www.dtf.vic.gov.au/Publications/Infrastructure-Delivery-publicati....

Add a comment