5.4.1 Quantitative Assessment and Appraisal

As noted, a quantitative assessment (estimating or defining values of the possible outcomes or “expected values”) is usually applied during appraisal for financial analysis and VfM. This is also referred as “adjusting values to risk”, and it is also necessary to conduct the CBA analysis.

The outcomes of the values may be presented or calculated in two different forms:

a) The most likely of possible outcomes.

b) The full range of possible outcomes, including their probabilities.

As stated in chapter 4, “Since the reliability of the conclusions depends on the accuracy of the assumed probabilities, it is good practice to only conduct probabilistic analysis when reliable information about the likelihood of events is available. When this is not the case, the simpler approach to risk should be chosen, as it is more intuitive, reduces complexity and simplifies the interpretation and communication of the results”.

When assessing the project for financial feasibility and affordability, risks will have been quantitatively assessed in order to determine the cost and revenue (for user-pays) inputs and to define a set of projections adjusted for risk. This is done to construct the financial base case on which commercial feasibility is determined. The most common approach is to define the base case of the project’s main cash flows (construction and O&M costs, revenues from users/demand, and third parties) on the basis of the most likely outcome.

However, as explained in chapter 4, the set of financial projections put together for a prospective bidder will have to be tested against different scenarios as recommended in the costs and risks assessment, that is, the sensitivity analysis (see chapter 4.6.9). This means that the financial impact of both adverse and positive changes in the main drivers can be observed. It will allow the government to assess the robustness or resilience of the project’s financial architecture and to estimate the contingencies likely to be built in by the private partner.

When conducting the risk allocation task, quantitative analysis may also be used when there are significant risks for which the qualitative assessment is unclear or of limited value. In such cases, the expected value of costs and revenues (duly adjusted for risk and/or based on an estimation of contingencies) will have to be compared with the alternative strategies of taking back the respective risk, sharing the impact, or capping the risk transferred[47] so as to estimate the specific VfM inherent to the alternative allocation of such risk.

It should be noted that in order to construct the financial model so as to create the financial base case needed for financial and VfM appraisal, a preliminary allocation will have been defined on the basis of a qualitative assessment (see below).

5.4.2 Using Qualitative Assessment as the Risk Assessment Approach to Risk Allocation

As introduced here, the risk assessment conducted in order to allocate risks is usually qualitative in nature, with limited exceptions.

In this sense, each risk will be assessed, bearing in mind the private sector’s ability to manage it, and will produce nominal (for example, 1, 2, 3, and so on, levels) or descriptive (high, medium, low, and so on) scales for each of the two dimensions of risk:

- The likelihood or probability of the risk occurring.

- The size or financial relevance of the impact if the risk materializes.

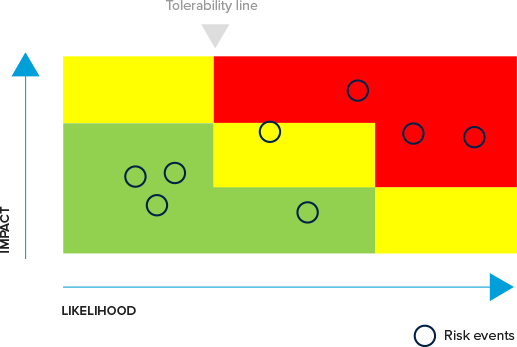

Qualitative assessment is sometimes referred to as “semi-quantitative assessment”. The result may be explained as a “tolerability matrix” (in this case, from the perspective of the private sector). See box 5.19 and figure 5.10.

|

BOX 5.19: Qualitative Risk Assessment according to the UK Treasury’s “Orange Book” This assessment needs to be done by evaluating both the likelihood of the risk materializing and the impact if the risk is realized. A categorization of high/medium/low in respect of each may be sufficient, and this should be the minimum level of categorization. This, in turn, results in a “3x3” risk matrix.

A more detailed analytical scale may be appropriate, especially if a clear quantitative evaluation can be applied to the particular risk. In this context, “5x5” matrices are often used[48] with impact on a scale of “insignificant/minor/moderate/major/catastrophic” and likelihood on a scale of “rare/unlikely/possible/likely/almost certain”. There is no absolute standard for the scale of risk matrices. Colour (“Traffic Lights”) can be used to further clarify the significance of risks. Ultimately, each organization should reach a judgment about the level of analysis that it finds most practicable for its circumstances.

Source: HM Treasury, Management of Risk: A Strategic Overview (The ‘Orange Book’). |

FIGURE 5.10: Simple Risk Tolerability Matrix

The qualitative assessment conducted to allocate risks is relevant in general terms for all risk assessment matters, including those conducted during appraisal, as it helps to prioritize risks.

“The objective of risk prioritization is to preselect significant risks in order to separate them from insignificant risks. This step can save a great deal of time in the long run, because it prevents undue attention being given to the management of risks that, in actuality, matter very little. This prioritization is used to determine whether a risk is negligible, extremely important, or lies somewhere in between. This decision is, of course, variable and the criterion for what passes as ‘negligible’ and what is ‘extremely important’ must be defined on a project-specific basis” (FHWA, 2013)[49].

The exercise to define the optimum risk allocation will usually be concentrated in the red and yellow parts of the matrix, assuming the default position that all ‘green’ risks will be transferred to the private partner unless those risks, for some reason, cannot be managed by them.

Principles of risk allocation are discussed further in section 5.6 below.

Every risk will be assessed independently as to which party will finally bear it because those risks that are finally retained will have to be managed by the public partner, either by self-insuring by means of contingency funds — or by evaluating them in order to reflect them in long-term liabilities.

Another general rule is that the authority should, for all relevant risks, analyze the possibilities for mitigating the risks in advance of contract execution or even launch. The authority should also assess the ability of the private partner to mitigate and manage the transferred risks.

Identification and qualification of risk mitigation is an exercise that runs concurrently with risk assessment because mitigation and management capability will inform the likelihood and/or potential impact of the risks.

Some risk mitigating factors may be developed by the authority in advance of contract execution (this can even be the case for those risks that will be transferred to the private partner) whereby the authority has the ability to contribute to the reduction of the risk or to reinforce the capability of the private partner to manage it. This is explained in further detail below.

[47] As explained in chapter 3, the commercial feasibility, VfM, and affordability analysis are, in essence, iterative exercises until the circle is closed with a satisfactory outcome, that is, unless the necessary risk to be taken back is so significant that the PPP is not providing VfM, and therefore the proposed procurement has to be re-considered.

[48] As advised in FHWA, 2013, the likelihood and consequence factors are assigned with 5 ranges of qualitative values of very high, high, medium, low, or very low. These judgments are then entered into a risk impact matrix to determine the risk rating.

[49] FHWA, Department of Transportation, US. (2013). Guidebook for Risk Assessment in Public-Private Partnerships.

Add a comment