For the purpose of this chapter, the term financial structure is taken from the public perspective, that is, the financial structure of the contract as opposed to the financial structure of the project company (which is how the private partner would use the term). In this context, the financial structure refers to the definition of the means of public compensation or payments. This may be in the form of grants (to co-finance the Capex) and/or service payments to be granted to the private partner in the contract as well as relevant conditions (including timing, indexation, and potential adjustments/deductions). It also includes other potential public party participation. For instance, the provision of financing (guarantees and other credit enhancement measures, equity, or debt contributions), as well as the resulting profile of government payments in terms of net present value (NPV) and yearly public expenditure, or indeed the profile of payments to be received from the private partner (in ‘over-feasible’ projects).

In order to document the financial structure, the contract term, the payment mechanism, and also the means, if any, must be incorporated into the contract for the government to co-finance the project or participate in the project as a lender.

The basic financial structure will have already been defined in the Appraisal Phase (see chapter 4.5) through the process of commercial feasibility analysis, affordability analysis, and VfM. See figure 5.4. In the current phase of the cycle, the financial structure will have to be confirmed, or redefined, in an iterative exercise so as to establish the final base case and set the ceiling of payments (or the floor of payments to be made by the private partner in some user-pays PPPs).

- The contract term will have been pre-defined (or defined within a range, subject to the final financial analysis and affordability exercise);

- If a co-financing approach has been considered (with a portion of Capex being financed by public funds), the amount of the co-financing will have been basically defined (within a range) during appraisal;

- Other financial support and participation by the public party will have been already decided, such as potential equity participation, provision of certain explicit guarantees and credit enhancement measures;

- In a user-pays project that is not financially feasible (that is, there is a financing gap), there should already be a basic decision on how to fill the gap. This decision may be subject to changes in a refinement process during structuring; and

- The basis for payment mechanisms (quality/availability based and/or volume) have already been defined, including the indexation approach and the main parameters of the payment scheme (availability criteria and adjustment factors, traffic or volume bands in a volume payment, and other features).

Public financial instruments available in the relevant market (for example, long-term loans provided by public financial agencies or public credit enhancement mechanisms) will have been considered when financially assessing the project. The intervention or participation of such financial agencies should have been triggered or mobilized during appraisal, while administrative management may still be needed through this phase[10]. If using such a structure, the government will need to be sure that the respective institutional financing is available; this is a preparatory activity that must be finalized before the tender is launched.

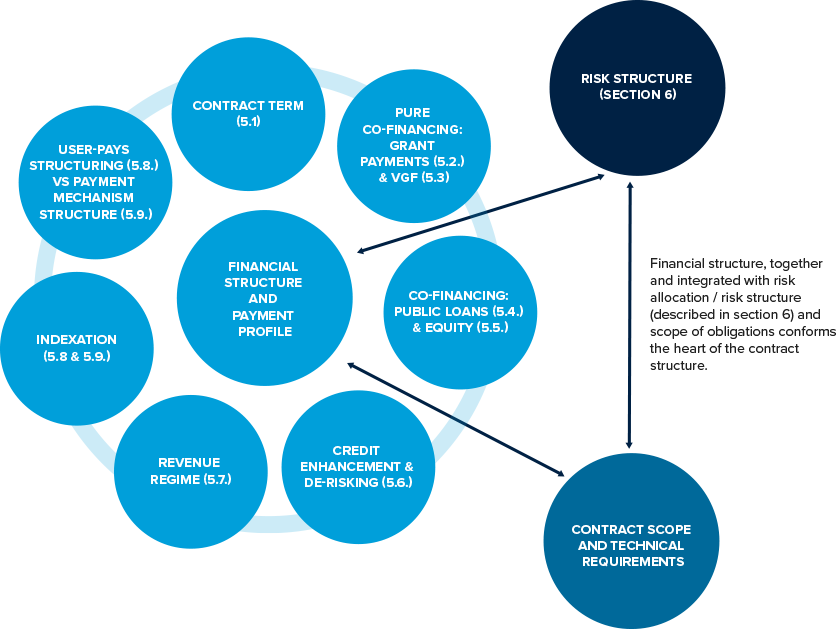

FIGURE 5.4: Elements of the Financial Structure and How they Relate to Contract Structuring

Note: VGF=viability gap funding.

It should be noted that co-financing, properly speaking, should only refer to the non-reimbursable/non-revolving provision of funds or in-kind support provided by the government (for which the cost of capital to the private partner is zero). These funds are considered public financing in the fiscal sense (even when the funds will come under a deferred payment mechanism). The PPP Guide will refer to such support as pure co-financing, to avoid confusion with the provision of funds through public funded loans (usually on favourable conditions, also referred to as concessional financing). The latter may be also a tool to financially support the project, with minor or no fiscal implications as long as it does not differ significantly from market conditions.

These and other elements of the financial structuring, which will be discussed in this section, will (or should) be finally defined with the intention of maximizing VfM, ensuring both affordability and feasibility (see box 5.5).

BOX 5.5: Competing Objectives of the Financial Structuring

|

The objectives of the financial structuring are ultimately the same as those objectives of the general structuring task: the government is aiming to ensure that the procurement of the contract will be a success by launching an affordable and feasible project that will deliver VfM.

The higher the payments (or the tariff levels in a user-pays PPP) or the longer the payment period (for the same payment or tariff), the higher the commercial feasibility — but the higher the burden either for the government or the public.

As in any structuring task, the objective is to find the right balance, but consideration should be given to the competition in the tender process, which provides an opportunity for the market (the prospective bidders) to set the bar of commercial feasibility through competition. If there is strong competition and the government sets the key affordability measure (for example, the level of user charge or the net present value (NPV) of government payments) as the financial variable that is subject to competition, the bidders will have a strong incentive to develop the most affordable solution that is commercially feasible for them to deliver.

Chapter 4 discusses commercial feasibility analysis and how it interacts with the affordability analysis and the technical definition of the project in an iterative manner (see chapter 4.8). |

[10] Financial support by means of public loans or loans provided by a public agency, as well as guarantees, may be limited in some jurisdictions by “state aid” rules. That is a subject that is beyond the scope of this PPP Guide. However, it may be said that generally when the terms of the financing or guarantee are close to or reflect market terms, or when the financing is available for any interested party, the financing is usually in compliance with state aid limitations.

Add a comment