The other main motivation for the use of PPPs as an alternative tool to both finance and procure infrastructure is the potential long-term gain in terms of efficiency (when applying PPP to the right projects and under the right structure and procurement process) and effectiveness (when using PPPs for achieving the desired outcomes in a time and cost effective way).

For PPPs, the long-term expected cost to the public sector may be lower under a PPP structure than with conventional procurement (and/or the expected benefits may be higher). This is the case even after considering the higher cost of capital (financial costs) associated with the private financing that forms part of the PPP. For user-pays PPPs, the efficiency might also result in lower charges to users.

Irrespective of the procurement solution, a technical solution (that is, a project) must be tested through Cost-Benefit Analysis. The solution must also be sensible and valuable in terms of socio-economic outcomes (or simply be the optimum technical solution).

It is at this point that the project needs to be tested as a PPP so as to determine if PPP delivery will provide additional efficiency rather than reduced efficiency (due to costs increases or lower benefits). This is done as the Value for Money exercise which is extensively explained in chapter 4.

Some authors and texts differentiate between three types of efficiency: allocational efficiency (theoretically related to the original decision as to whether the project or service should be delivered), technical effiiciency, and X-efficiency[36]. See figure 1.7.

This PPP Guide prefers to center its explanation on “factors for incremental efficiency in a PPP”. It is recognized that some factors relate to a potential increase in the allocative efficiency (by maximizing prospected benefits of the project),while the bulk of the efficiency gains through PPP relate primarly to risk management, as well as cost management (including life-cycle management) and innovation. In any case, all these factors are heavility interrelated and it is not possible to explain one without the other.

FIGURE 1.7: Sumarizing Factors of Efficiency in a PPP

5.2.1. Cost Management: Higher Flexibility to Manage Costs and “For Profit” Nature

The private sector enjoys a different business framework that allows for higher flexibility, in terms of cost management, through flexible negotiations with subcontractors (in contracts not subject to public procurement rules) and/or a more flexible labor framework In this context, the private sector is not subject to the same level of social or political pressure with respect to staff numbers and employment conditions (such as salaries, rostering, and shifts).

Naturally, cost-efficiency in PPPs is also driven by other factors explained below (innovation capacity, risks management and their bundled-obligation nature — construction together with maintenance), all of which are related to the “for profit” nature of the private business (as opposed to the non-profit nature of the government).

5.2.2. Life-Cycle Cost Management

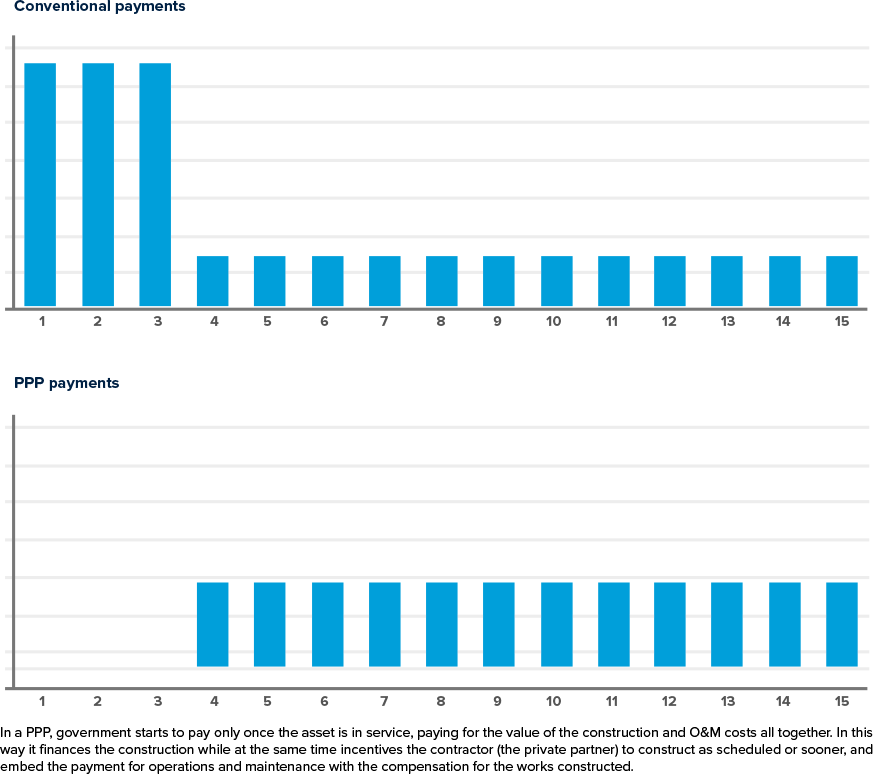

In a private finance PPP, the private partner is not paid during construction of the infrastructure but is compensated for the capital expenditure (capex) investment over the operational period (see figure 1.8). This is done either by means of user charges or by government payments (which will be subject to deductions for poor performance/quality of the asset and service). The private partner must assume maintenance risks (both ordinary and extraordinary maintenance, including renovations that meet hand-back conditions), so as to meet the performance/quality standards. Hence, the private partner has a natural incentive to design and construct the infrastructure in a manner that reduces maintenance and renewal risks, looking for long-term savings in the overall life-cycle cost.

There are other forms of procurement (including some regarded as PPPs with no private finance), such as DBOM contracts, in which the contractor is responsible for both construction and maintenance. However, under a DBOM, the contractor does not necessarily have the same incentive to look for savings in the overall lifecycle cost as it has with a PPP. As previously suggested, there may be a perverse incentive for the DBOM contractor to reduce the costs of construction to increase margin, as it will be paid for construction works separately and usually as work progresses.

5.2.3. Risk Transfer

The private sector is usually considered to be more efficient in managing certain risks (with a lower cost) through better risk assessment and better management of risk events (mitigating the probability and/or consequences of the risk or transferring them to a third party at an effcient cost). As a result, the private sector will require a lower risk premium than the likely cost to the government if it does not transfer the risk. PPPs transfer significant risks to the contractor, and hence offer greater opportunities to reduce the risk premium included in the cost of the infrastructure. In addition, private sector investors and financiers with capital and funds at risk in the project will perform their own due diligence, providing an additional layer of risk oversight.

Time risk (the reliability of having the infrastructure available for service in time as scheduled) is also transferred to the private partner by means of the payment mechanism: most if not all the payments will be only granted once the asset is constructed and commissioned (see figure 1.8).

Risk transfer will never be equally effective if there is no capital at risk. If a risk that has been transferred to the private sector materializes, a contractor that does not have capital at risk can potentially walk away from the project with a minimal loss rather than resolve the issue, whereas a contractor with capital at risk in a well-structured PPP cannot do so.

Risk transfer lies at the heart of incremental efficiency, and it is usually the most important driver of VfM. However, it should be nuanced: a PPP project with low or marginal risk transfer will not allow the private partner to provide incremental efficiency through better risk management and should therefore be procured by conventional means[37]. However, transferring too much risk may also spoil Value for Money (chapter 5 provides reflections on how to find the optimal risk allocation, retaining or taking back and/or sharing some risks).

5.2.4. Innovation

The performance oriented nature of PPP contracts provides a benefit by encouraging innovation. When the requirements in a contract are properly focused on performance and outputs, it is possible to grant the contractor a certain degree of flexibility to structure and organize its own means and methods. Therefore, the private sector’s ability to innovate will provide an additional source of savings and efficiency. Provided the contract is performance based (that is, there is a prescription of the output, through output or service specifications or requirements, rather than a prescription of the inputs or means), there will be room and incentives for the private sector to apply innovative techniques and methods. These are more likely to be cost-effective in meeting the required level of service performance. The way to capture these efficiencies for the benefit of the public authority and taxpayers is through the tender and evaluation process, which should have a significant focus on price and cost drivers.

FIGURE 1.8. Public Outflows Comparative Chart

5.2.5. Considering Benefits: Reliability and Effectiveness

Efficiency is often measured in financial cost terms. However, public policy decisions should also be taken considering costs and benefits in social terms. Some costs should be monetized (when this is practical) and benefits should also be monetized or at least qualitatively assessed[38].

The PPP approach might bring or capture incremental benefits, or it may provide savings in some social costs if these are properly incentivised in the contract (energy efficiency, reduced gas emissions, reduced noise pollution, and so on). A PPP can also improve the cost-benefit outcome by encouraging faster construction so that the infrastructure will be available and in service sooner, or by providing more certainty in the timing of the project (time reliability).

The delivery of service at pre-agreed levels of quality is another important aspect of the benefits of the PPP model. The public sector’s ability to maintain a reliable service level at the same quality is threatened by budgetary allocations, poor supply chain management and staff turnover. The linking of payment to performance levels provides an additional incentive in PPPs for the quality of service to be maintained.

In general terms, a PPP is able to provide additional reliability in the time (see figure 1.8) and cost of meeting the objectives (for example, service levels required, that is, quality). So PPPs can provide benefits not only in terms of efficiency, but also in effectiveness.

5.2.6. Efficiency Through Maximization of Use/Better Utilization of the Asset

In projects that rely significantly on user payments, as well as other out of the budget sources of revenue, higher than expected efficiencies may result in higher than expected revenues in addition to cost efficiencies (of the service may be provided to more people with the same or fewer resources).

In these PPP projects, the private sector has an incentive to increase public use of the infrastructure (higher traffic/use of a transport facility) and to increase its economic utilization or value. In some cases, this is done through commercial utilization of the space/sites for hotels, restaurants, leisure facilities, or other synergistic uses. This incentive leads to the private party proactively operating the asset and introducing innovative approaches and strategies.

This may produce a surplus of revenue for the public authority (which will be captured by charging a fee to the private partner[39]) and taxpayers or may lower the budgetary cost (since it will reduce the viability gap when this exists).

Some government-pays PPPs also provide incentives to maximize use or encourage alternative uses of the infrastructure (for instance, developing optical fiber in rail, exploiting commercial areas in all transportation schemes, and so on).

|

BOX 1.16: Are PPPs Really More Efficient? [40] There are numerous analyses and reports developed by (or for) governments and National Audit Offices as to whether PPPs are in fact delivering VfM. The majority of the reports produced by (or for) governments and audit institutions conclude that PPPs do generate VfM[41]. United Kingdom studies indicate that government departments that implemented PPPs registered cost savings of between 10 and 20 percent. According to the 2002 census of the United Kingdom National Audit Office (NAO), only 22 percent of PFI deals experienced cost overruns and 24 percent experienced delays, compared to 73 percent and 70 percent of projects undertaken by the public sector and reviewed in an NAO survey in 1999. The HM Treasury reported in 2006 that, according to a study for the Scottish Executive by the Cambridge Economic Policy Associates (CEPA), 50 percent of authorities administering PPPs reported that they received good Value for Money, with 28 percent reporting satisfactory Value for Money. Australia’s National PPP Forum (representing Australia’s National, State and Territory governments) commissioned The University of Melbourne in 2008 to compare 25 Australian PPP projects with 42 traditionally procured projects. The study found that traditionally procured projects had a median cost overrun of 10.1 percent, whereas PPP projects had a median cost overrun of 0.7 percent. Traditionally procured projects had a median time overrun of 10.9 percent, whereas PPP projects had a median time overrun of 5.6 percent. However, a note of caution is in order: the choice concerning the mode of production should be made on a project-by-project basis and, more specifically, on the basis of each project’s merits (OECD 2008). Sources: Adapted from OECD 2008; University of Melbourne 2008.

|

[36] As suggested in OECD (2008), in terms of economic theory, a distinction should be made between three kinds of efficiency: allocative efficiency (that is, the use of resources so as to maximize profit and utility), technical efficiency (that is, minimum inputs and maximum outputs), and X-efficiency (that is, preventing the wasteful use of inputs) (Fourie and Burger 2000:697). The decision by a government to deliver a service in the first place, irrespective of whether this is done through traditional procurement or a public-private partnership, involves allocative efficiency. Once a decision about delivery is made, the government must decide on the mode of delivery: to deliver it either through traditional procurement or through a PPP. The choice largely involves considerations about technical and X-efficiency.

[37] For example, in the case of Trencin water system in the Slovak Republic (case 8 in “Resource Book on PPP Case Studies”, European Commission 2004) there was no performance risk transfer. A revenue mechanism based on a cost-plus approach, that is, guaranteeing contractually that the private partner will achieve a certain profit on costs (as they are incurred) and with no deductions or penalties for sub-performance, presents a lack of risk transfer and absence of incentives for performance.

[38] Cost-benefit analysis (CBA) is the type of analysis that intends to capture the costs and benefits of a project solution, to confirm it offers net value to society, or to compare between project-options for selection or prioritization purposes. Chapter 2 of this PPP Guide explains more about the mechanics and use of CBA analysis.

[39] Ways for capturing excess revenues are explained in Chapter 5.8, “Payments to the procuring authority”.

[41] However, the academic community is not unanimous and there are some academic reports that supports the opposite conclusion, that is, a lack of evidence of the PPP as a facilitator or means of providing additional efficiency.

Add a comment