The preceding sections explained how the PPP option may be a significant source of incremental efficiency and provide other benefits for better infrastructure management. It may also have weak points and other issues that make it inappropriate for some of projects.

Governments need to protect and maximize the potential benefits of the PPP tool and mitigate its potential risks and pitfalls. Otherwise, PPPs will create undue burdens to taxpayers rather than increase efficiency and reliability in public works and service delivery.

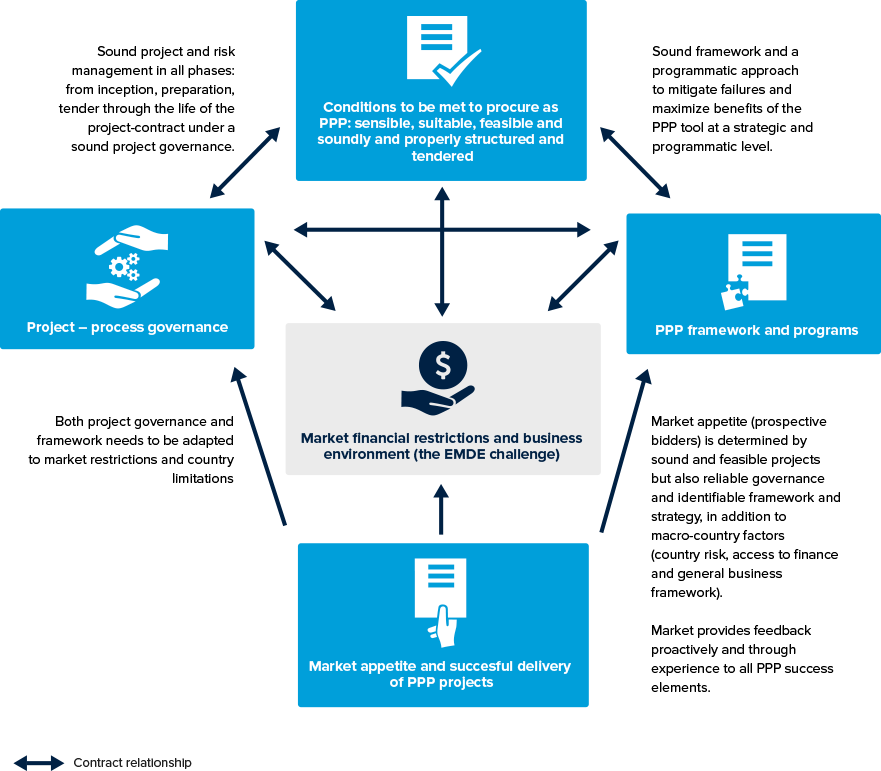

These benefits, especially those related to efficiency, will only be achieved if the project and contract meet the following conditions and the following actions are taken:

- The project must be a sensible project: A PPP will not perform miracles and will not make a good project out of a bad project, that is, a nonsensical or inadequate technical solution for a public need (chapter 3 explains the importance of how to identify projects, how to feed the PPP process cycle with PPP candidates from the pipeline of identified projects. It also introduces the need to test the project for economic soundness).

- The project must be a suitable project: PPP advantages will only be achieved in those projects that are suitable for PPP development (chapter 3 explains how to screen a PPP project). Some projects are not suitable to be PPPs.

- The project must be prepared and appraised: In particular, it must be commercially feasible, affordable and duly tested as a PPP (chapter 4 explains how to test the PPP suitability through the VfM exercise, as well as test the commercial feasibility[44] and affordability. It also addresses risk mitigation and other threats over the project life cycle through a sound preparation).

- The project must be properly structured: The potential efficiencies of a PPP will only be achieved with a suitable contract structure that allows the value drivers to emerge and become sustainable (chapter 5 deals with contract structuring and drafting).

- The project must be properly tendered: PPP efficiencies will be lost if there is an improper procurement process that does not generate sound and reliable competition (see box 1.18) (chapter 5 describes how to structure a tender process, and chapter 6 explains the tender process from a management point of view).

- The project must be proactively managed through the life of the contract: PPP efficiencies may be lost in the course of the contract life if there is improper contract management (chapters 7 and 8 deal with contract management).

All of these actions have a progressive and iterative nature. They represent the process cycle of a PPP and are explained in chapters 3 to 8 of this PPP Guide. Section 10 of this chapter provides an introduction to this cycle and to the chapters of the PPP Guide related to the process cycle.

The first factor in achieving a successful PPP is to pay attention to the benefits and risks affecting the PPP method in order to apply the tool to the appropriate projects. Projects then have to be appraised and prepared meaningfully, including the proper structure of risks and incentives. They also have to be tendered under a process that maximizes efficiency and transparency, and encourages sound competition by reliable bidders.

The conditions to be met for the project and the contract to be approved (investment decision and procurement decision) should be defined in a clear and understandable manner in the form of guidelines. There should be processes in place to ensure that these conditions are met. The project and the contract should be prepared so as to face risks in a flexible but predictable manner, providing the right incentives to the private partner and maximizing quality competition while avoiding and mitigating recklessness. Failure to do so will produce harmful consequences.

|

BOX 1.18: The Need for Competition. How PPPs are Procured[45] Competition is necessary to obtain VfM. Under direct negotiations, a government will most likely pay more than the fair price for the works and services received and they may be of lesser quality. Competition is what brings innovation into the equation, as companies under competitive pressure have the incentive to innovate to be efficient, and proactively assess and manage the risks in the most efficient manner. Clearly, without competition, the price of the same project with the same approach will be higher. Direct awarding or direct negotiations may be appropriate only in very few circumstances. Most of the reasons commonly used to justify negotiating directly are considered spurious (PPP Reference Guide, World Bank 2014). The few circumstances in which direct negotiations may be appropriate generally relate to situations when it is evident that only one company is prepared to deliver the project, or when there have been natural disasters or other emergencies that demand an expeditious process. In these circumstances, VfM becomes a secondary factor. Direct negotiations may not only harm VfM in an obvious manner, but may also seriously harm the interest of the industry in the relevant PPP program and market. Indeed, transparency is of the essence in accessing stable and significant interest from the bidding community. For this reason, a proper framework will clearly set up direct negotiations as an exception, and a country/government will use it as a process in very limited, if any, circumstances (ideally, where the need for such an approach is evident for the public and the industry). Good practice is represented by the many frameworks that set clear, limited conditions on the circumstances in which direct negotiations are allowed (for example, Puerto Rico´s PPP Law – Law 29 of 2009), with some jurisdictions going even further and forbidding direct negotiation processes (for example, Brazil´s Federal PPP Law of 2004). One particular approach, which may be a valid exception (in some circumstances and under specific rules and conditions) to the competitive process approach, is the unsolicited proposal (or “privately initiated project”). This lies somewhere between direct negotiations and a competitive process. In an unsolicited proposal, a private party initiates the project, that is, acts as a promoter and proposes to the government the delivery of a project to solve a specific need. Unsolicited approaches may be handled in a manner similar to a direct awarding (that is, pure direct negotiations), with the government entering into negotiations with the private initiator if the project meets the government’s investment and procurement conditions. A better practice is where competitive tension is introduced by submitting the project to competition, but granting some advantages to the original proposer. The degree of advantage offered may vary and thus encourages more or less competition. The competitive process should prevail as the standard or default approach to tender projects as it brings important benefits[46]. Privately initiated projects are discussed in chapter 2.6.6. This PPP Guide assumes that PPPs are procured under a competitive process in which there will be a tender to select an awardee among a number of candidates. Therefore, all the chapters dedicated to the PPP cycle are based on such a standard and transparent approach. The tender process should follow a published set of rules and procedures (the procurement framework). This will govern the management of the various options available to handle the different phases of the process, commonly including qualification, bid submission, evaluation, awarding, and contract signature. There is a relatively long list of tender process types worldwide, but many of them contain the same basic features with small variations. There are a number of key aspects that influence and define how the process will be designed and work, including:

Different combinations of the elements of the procurement strategy produce the most common types or models of procurement process. These are introduced in section 10. There is another key aspect that influences the selection process, which is the evaluation criteria (sole price or other financial criteria versus combined financial and technical or other qualitative criteria). Evaluation criteria are discussed in chapter 5. The design of the procurement process for the PPP project (preferably referred to as the tender process in this PPP Certification Guide) is discussed in chapter 5, and chapter 6 describes the Tender Phase itself. |

Improper project/process management (management of the PPP process cycle as previously described) will end up in project failure (see section 8). This may not only result in the government losing the benefits of the specific PPP project, but it may also affect the government’s overall reputation as a PPP and infrastructure procurer — both with the public and with the market.

Good management of the project process requires significant capacity (technical expertise and significant resources) built into a sound project governance structure, and it should be wrapped in a rigorous and clear framework (see section 9). Furthermore, a sound framework not only mitigates the risk of management failures and general potential pitfalls of PPPs, but also drives the PPP tool to a higher level, including the sustainable attraction of private funds (see section 9.4)[47].

Many failures in projects (using project in the broad sense) are ultimately due to the numerous challenges that a project manager has to face, and these can only be handled if there is proper project governance in place. This should comprise the following:

- Sufficient resources in a project team (not too large nor too small), a full-time dedicated project manager, and adequate incorporation of advisors;

- Clear identification of a Project Owner and a Project Champion;

- Existence of an advocate for the project outside the project team;

- A clear decision framework (organized through project boards and linked to a program governance structure) and decision chain;

- Proper stakeholder management (who should be informed about and engaged with the project from its early stages); and

- Fluent and clear communication (including communication to the general public).

Chapter 3 provides an introduction to project management, stakeholder considerations, the relevance of communication and the need and role of advisors when managing PPP projects.[48]

Section 8.2 explains further risks and threats that may compromise successful process management. It also incorporates the role of the PPP framework in mitigating risks of failure, providing examples of project failures due to lack of preparation, improper appraisal and poor management (8.3).

As explained in section 8, having a sound framework and approaching PPPs in a strategic and programmatic manner not only diminishes the risk of failures, but is the only route to extract the whole value of the PPP route. In other words, not only do projects need to be prepared and be ready to be launched and then properly managed, but governments themselves need to be ready to control the pitfalls and protect or maximize the value that private finance PPPs in particular, and PPPs in general, may bring[49].

These considerations are valid regardless of whether the respective country or market has unrestricted access to long-term financing, and regardless of stability of the country’s political, legal and economic environment (even if country risk is nonexistent). If the country or market has significant restrictions in its access to long-term financing, or has an unstable political, legal or economic environment, these limitations have to be worked out or mitigated (through the PPP framework and contract structuring), or the PPP strategy of the country needs to be adapted (see section 5.6).

FIGURE 1.9: The Basic Elements for PPP Success

Note: EMDE= Emerging Market and Developing Economy; PPP= public-private partnership.

[44] This PPP Certification Guide defines commercial feasibility as “the analysis conducted to check whether the project will effectively attract quality bidders, investors and lenders, as well as highlight the main conditions that must be met to do so”. Commercial feasibility relates to adequate risk/return ratios for investors and bankability. See chapter 4 for further information.

[45] Examples of the risks and pitfalls surrounding direct negotiations and lack of competition are numerous. Resource Book on PPP Case Studies (European Commission 2004) case study 17 (page 83) illustrates the case of a waste management project, and the PPP Reference Guide, V2.0 (World Bank, 2014) proposes an example of a directly negotiated IPP in Tanzania (page 197).

[46] The sense of some unsolicited proposals is anchored in the innovation factor. For example, see Virginia Hot Lanes PPP project (described in the PPP Reference Guide, V 2.0, page 40), based on an innovative approach proposed by the private initiator to manage traffic congestion and tolling (dynamic tolling and high occupancy tolls or HOTs).

[47] An interesting question is when the framework should be created. Generally, a proper PPP framework should be in place before announcing and launching a PPP program. However, the definition might not be exhaustive in the first instance, allowing government to adapt the framework to the real experience of the initial projects. In any case, it is good practice to launch “pathfinder” projects so as to test the water before committing extensive resources and reputation when a market is not yet sufficiently mature in PPP terms.

[48] These features and roles in project governance are explained in World Bank - Farquharson, Torres de Mästle, and Yescombe, with Encinas (2011) pages 80-83. Detailed knowledge on project management and project governance is outside of the scope of this PPP Certification Guide. However, robust project management and risk management processes should be applied throughout the whole project process (from identification through to contract finalization). For further information on project governance, see Project Governance: A Guidance Note for Public Sector Projects (HM Treasury UK 2007). For information on risk management of the PPP process, see The Orange Book. Management of Risk – Principles and Concepts. Additionally, in this PPP Certification Guide, chapters 4 and section 5.5 deal with risk management from the financial perspective, identification and assessment through allocation and structuring. Chapters 6 and 7 discuss further risk management during the life of a contract.

[49] Markets and countries with higher sophistication and capacity in planning and managing PPP programs are regarded as “mature PPP countries”. The PPP maturity concept is proposed and explained by Deloitte, including the three stages of development, in Closing the Infrastructure Gap: The Role of PPPs (Eggers and Startup (2006), Deloitte).

Add a comment