Privately financed infrastructure PPP contracts have long terms so that the government can obtain Value for Money (VfM) from life-cycle management and from effective risk transfer. There are other factors that can provide an incentive for the government to extend the term. However, at some point, increasing the contract term will not provide any additional or incremental VfM, or it may introduce more disadvantages than advantages.

Many legal frameworks restrict the term that may be granted in a PPP contract (even prescribing different terms for different legal types of contracts in some jurisdictions). Regardless of the legal limit, for some projects and in some markets, there will be term limits beyond which the project contract is not adding VfM.

There are a number of considerations to be taken into account when assessing the optimum term for a specific project (see figure 5).

- Life-cycle management and effective risk transfer;

- Private financial structure optimization;

- Affordability;

- Commercial feasibility (especially in user-pays projects);

- Political pressure;

- Budget management rigidity;

- Flexibility to accommodate risk and uncertainty; and

- Relationships with other projects and other contracts.

In addition to these factors, there is also the influence of precedents and the convenience of setting a standard term for all projects in a PPP program (for example, all health PPPs). This is explained later in “other considerations”.

Life-cycle management and effective risk transfer: PPP contracts should provide long terms so as to capture VfM from life-cycle management and for risk transfer to be effective. It is important that the term is long enough to include life-cycle costs, such as refurbishment of mechanical systems in social infrastructure projects or, for example, the resurfacing of road projects. This then focuses the bidders on providing an optimal whole-of-life solution, and it ensures that at the end of the contract (when the asset reverts to the public sector at the end of the concession), the asset is in good condition. However, for certain infrastructure (especially social infrastructure), terms above certain limits can introduce significant renewal risks for bidders, or (for example, in roads) risk/uncertainty of significant upgrading. Also, when the project is highly dependent on technology, longer terms may unduly increase the risk profile.

Private financial structure optimization: Longer contract terms allow for longer debt terms (up to the limit established by the respective loan market), and longer debt terms permit a higher leverage (see box 5.6 below).

When a PPP contract is shorter than the debt term available in a particular jurisdiction (including the customary debt or “loan tail”), or it is shorter than the debt term available abroad, if a cross border financial structure might be possible, then the contract term will be sub-optimal in financial terms.

In normal circumstances, a sufficiently long term (equal to the maximum debt term achievable plus a “loan tail” cushion) will allow for higher efficiency in terms of average cost of capital for the private finance package because it will allow bidders to maximize the gearing. However, this benefit will be limited by the local financial market’s capacity (particularly the maximum debt tenors available) and will depend on the risk profile of each project.

|

BOX 5.6: Debt Term, Contract Term, Tails and Leverage Typically, providers of senior project debt will require a cushion in the form of a “loan tail” between the term of the debt or debt tenor and the duration of the project contract itself. This gives the private partner the ability to restructure the debt if it faces temporary solvency difficulties (renegotiating a lower yearly debt service in exchange for an extension of the loan term). Let’s say that in the financial market of a particular country, it is customary for project finance loans to have terms of up to 20 years. If the contract has a term of 20 years, lenders will only be willing to consider a term of 17 or 18 years for the loan. Consider that a certain amount of revenue and cash flow is available for debt service, and a certain debt service cover ratio (DSCR) (for example, 1.3 times) which equals the minimum DSCR required by lenders, which itself limits leverage to a particular percentage (for example, 70 percent). If the contract term is expanded by two years, allowing the private partner to take advantage of the “other two years” of debt term available, this will allow for an increase in the debt amount because with the same amount of debt and the same gearing, the actual DSCR will be higher, that is, it will surpass the minimum requirement of 1.3. This creates room for increasing debt service and therefore allows bidders to ask for more debt (that is, higher gearing). The weighted average cost of capital (WACC) of the project will be lower than with the original 20 years of contract term (as there is more debt in the mix of funds, which is a cheaper source than equity), and therefore the financial package will be more efficient. That efficiency will be passed through to the procuring authority in the form of a more competitive proposal (under a properly structured tender with the proper incentives built into the evaluation criteria).

|

The term should also be long enough to provide room for the potential benefit of a refinancing if and when market conditions improve (enabling the private party to take advantage of longer tenor, lower margins, and potentially additional debt, that is, a “recap”). Alternatively, it may give space for a refinancing strategy "from the outset" (based on "mini-perm" loans or other bridging loans to finance the construction period), so that the financial package can be refinanced on a long-term basis after construction.

Affordability: Another consideration in favour of long contract terms is that the longer the term, the lower the yearly burden on the budget (in government-pays projects). This factor is correlated with project size, that is, the larger the project, the more likely it is that affordability will be an issue. Consequently, longer terms are more frequently seen in larger projects. However, this benefit should be balanced against the fact that the private finance package is usually more expensive than government financing. Indeed, the government’s aggregated exposure on fiscal accounts will increase with the term, and increasing the term beyond certain limits specific to the project will not generate any additional Value for Money from risk transfer.

Commercial feasibility (especially in user-pays): In user-pays PPPs (and for a fixed budget allocation in each year in government-pays PPPs), a longer term project is more feasible simply because it will provide revenues over a longer period. Especially in user-pays projects, the term will define the feasibility (unless co-financing or other public support — such as complementary funding — is considered). This is especially relevant if the government wants tariff levels to remain at what may be considered socially acceptable levels.

Political pressure: The general public and political stakeholders may argue against longer terms on the basis that they allow the private partner to make "unwarranted" profits. This is more common in user-pays PPPs, and governments/authorities may handle this through profit-sharing mechanisms (to limit or share profits above certain thresholds, or by ending the PPP contract when it has reached a certain amount of revenues, for example, toll road concessions in Chile) and through a proper and careful communication approach.

Rigidity: Governments should remember that PPP contracts introduce rigidity in fiscal management and service delivery, and strategic priorities may change during the course of the project. That is another factor, in addition to the potential decrement in VfM that should be balanced against affordability when deciding upon the appropriate term.

Flexibility to accommodate risk and uncertainty versus incremental risk profile in some projects: In contrast to the point above but consistent with the first point on risk transfer, contracts need a longer term to be able to accommodate the financial impact of changes and certain risk events. This is particularly important where the private partner is requested to finance any additional investments required as a result of these events (see section 9.3). However, some projects have risk profiles that necessitate shorter terms if VfM is to be achieved. For example, in projects exposed to high rates of technological change, it may not be VfM to require the private party to take the risk of such changes over a long term, and in countries with limited creditworthiness or higher country risk, longer term contracts may be unattractive to the private sector.

Relationships with other projects and contracts: In some cases, the project will have a relationship with an existing project or existing contract that will influence the appropriate contract term. For example, if there is an existing operational light rapid transport (LRT) PPP with 17 years of its contract remaining, and the government is structuring the contract for a new separate LRT PPP, it may wish to have the new contract end on (or around) the same date as the existing contract, as this will provide flexibility to put in place either combined or separate operating arrangements for the two LRT lines when the PPP contracts expire.

|

TABLE 5.1: Pros and Cons of Long Term PPP Contracts |

|

|

|

Factors in Favor of Longer Terms |

Factors for Tempering the Term |

|

|

|

|

What is the optimum term?

There is no possible methodology to determine the best possible term for a project contract, as this will depend on specific features such as the fiscal constraints of the relevant country at a certain point of time, the country risk and creditworthiness of the respective government, the access to finance in that market for the specific type of project, the technical and physical nature of the asset and its life-cycle profile, and other factors. See table 5.1 and figure 5.5.

It is, however, possible to identify a minimum term that should be considered for a specific project, which should not be extended significantly unless fiscal restrictions/ affordability require doing so. It should also not significantly compromise VfM.

The term of a contract should be at least long enough to capture key life-cycle costs (that is, material renewals and refurbishments in the asset that must be developed and planned in advance), and to enable lenders to provide maximum debt tenors capitalizing on the leverage — subject to the minimum equity that will be requested in the RFP as a sufficiently material financial commitment by shareholders/bidders.

In terms of experience and common practice, to define a reasonable range of PPP contract terms is not possible. Ultimately they may range from what may be commonly regarded as long term (above 10 years) to 50 years or even above for certain user-pays projects (for example, toll roads up to 99 years).

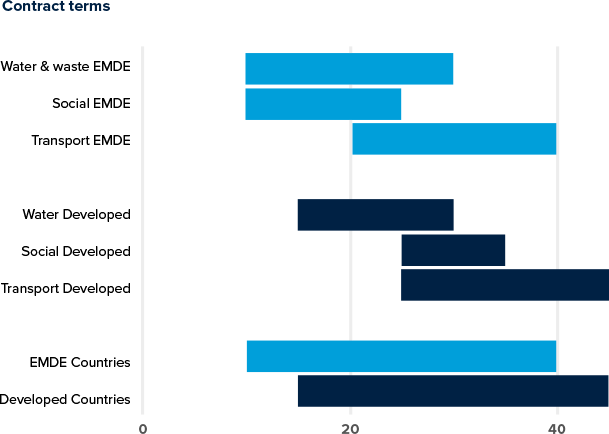

It may be said that most of the PPP contracts of a Design-Build-Finance-Operate-Maintain (DBFOM) form (that is, with significant capital investment) are within a central range of 15-30 years. However, toll roads in developed countries can increase this range up to 40 years and above, and water and social infrastructure projects can bring the range down to 10 years in some projects, especially in Emerging Markets and Developing Economy (EMDE) countries.

In general, the terms will often be shorter contracts in EMDE countries. This may be due to many factors, including the more limited terms available for financing, potentially higher restrictions by law (shorter maximum contract terms available) or higher political concern about “granting too much profit” to the private sector.

This should not be a recommendation or statement about good or bad practice as any project will have its own optimum term, plus there are other factors besides VfM that will influence the term definition.

FIGURE 5.5: Approximate Ranges of Contract Terms per Sector and Country Profile

Note: EMDE= Emerging Markets and Developing Economies.

Other considerations related to term definition in the contact

Some countries opt for making the term a bid factor, so that the term will be that proposed by the successful bidder (together with the price). In the evaluation, bidders that request lower terms score more highly on this criterion than bidders that request longer terms. This evaluation approach should be carefully considered as it may result in a term that does not incentivize effective risk and life-cycle management, especially in government–pays PPPs[11].

Another non-customary approach (but used in some projects) when defining the term within the contract is to define the contract term as the final term for construction (that is, the actual time that construction will last) plus a fixed number of years of operations. This approach is less effective in transferring construction risk, and may undermine the alignment of interest between the public and private sectors to construct and start operations as soon as practicable.

Finally, contract terms should be considered in the context of the overall PPP program. While each specific project will have its own optimum term, it may be beneficial to tender the same type of projects (in the same sector and with the same basic structure) with the same term, so as to be consistent with the market. This may be preferable to tailoring a particular term for each specific project, especially when a government is developing and launching a sectoral program (for example, if the government has a program of projects pre-announced for refurbishing and managing hospitals, it may be more efficient to have the same term (say 20 years) for each project).

Hence, in programs it is better to analyze and define the most appropriate term for the projects of the program and be consistent with that term.

[11] This approach has been applied in real toll roads in Chile. The variable proposed by bidders in these projects was not the term, but the total revenue required by the bidder. This means that instead of being a fixed period, the term is variable and continues until the project has generated the revenue amount proposed by the winning bidder.

Add a comment