This section introduces[16] the concepts of Cost-Benefit Analysis and economic analysis.

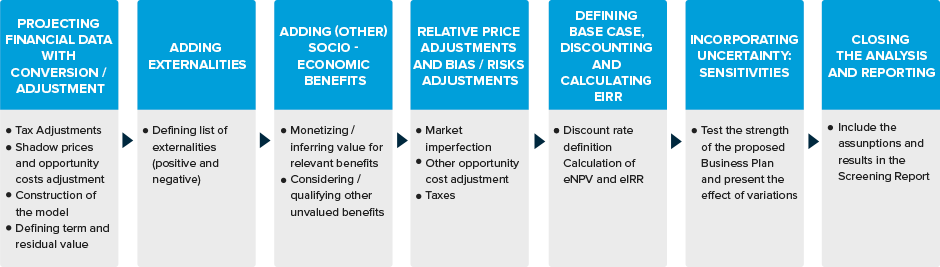

FIGURE 3.3: Sequence of the CBA Analysis

Note: CBA= cost-benefit analysis; eIRR= economic Internal Rate of Return; eNPV= economic Net Present Value.

The most refined form of economic analysis is the Cost-Benefit Analysis methodology. It assesses the social cost-benefit equation, in which the benefits for society have to be higher than the costs to the public for the project to be worthy of proceeding. It is an exercise that aims to include all relevant costs and benefits. This is done with a long-term perspective, projecting both costs and benefits through the analysis period. The period considered has to be in line with the useful economic life of the infrastructure asset.

CBA may be used to identify an option (from several technical solutions for the same need) when there are several options or alternatives under discussion. If the best technical option has already been identified, CBA may be used simply to confirm the investment decision. In this scenario, CBA is still comparing options: the “project” and the “doing nothing option”.

Regardless of the route or alternative selected for its procurement and financing, public infrastructure is always a “public investment” subject to the public domain. Therefore, especially when the project/investment is not commercially feasible and requires the use of public resources (no matter whether under a traditional public procurement entirely funded by public funds or under a PPP scheme), there is a clear need to demonstrate that the public funds or public contributions are well spent, that is, that they will produce net benefits for society.

CBA is the relationship between the value of resources used by a project, and the value of resources produced by the project. Value is measured in the same units, usually monetary, for both costs and benefits.[17]

Focused on government decisions, Kee (2005)[18] defines Cost-Benefit Analysis as:

“Cost benefit analysis is an applied economic technique that attempts to assess a government program or project by determining whether societal welfare has or will increase (in the aggregate more people are better off) because of the program or project. At its greatest degree of usefulness, Cost-Benefit Analysis can provide information on the full costs of a program or project and weigh those costs against the dollar value of the benefits. The analyst can then calculate the net benefits (or costs) of the program or project, examine the ratio of benefits to costs, determine the rate of return on the government’s original investment, and compare the program’s benefits and costs with those of other programs or proposed alternatives.”

Box 3.7 defines some key concepts of importance in Cost-Benefit Analysis.

|

BOX 3.7: CBA Primer[19]

|

When considering benefits in the Cost–Benefit analysis, benefits have to be considered in the broad sense of the term: direct or indirect, internal and external (that is, external are those that affect or benefit third parties beyond the population to which the project is addressed in a first instance). In order to estimate direct benefits, the first step would be to research whether there is available market data regarding the specific benefit.

In cases in which benefits appear as cost savings, the quantification of a benefit is implicit in the cost estimate of the alternatives under analysis (for example, the project will lead to lower congestion levels or will increase mobility, the project will substitute an old facility and generate environmental savings by means of lowering pollution, and so on).

When valuing project costs and benefits, a quantification problem can arise. Most of the costs are direct costs (such as the cost of the investment itself, the public works), but the project may have other indirect costs and benefits as well as positive and negative “externalities[20]” (such as environmental effects, damage to a certain population, such as commercial business affected by the works or the site of the project, and so on). Box 3.8 sets out the impact of some common externalities.

|

BOX 3.8: Impact of Externalities[21] Externalities, which will be positive where they provide a benefit and negative where there is a cost, may include:

|

Costs should reflect the best alternative use of the goods (opportunity cost[22]) to the extent to which it is possible.

- Although market prices are the best way to reflect the opportunity cost, in some circumstances they may not do so accurately (distortions in the specific market for the good or service due to monopolies or other market imperfections); and

- There is a need to discount the effect of taxes in the prices/costs, as they are part of the nominal value of the cost (in terms of cash flows), but do not imply a cost in terms of society (but in fact are a revenue for the government).

Dealing with benefits is especially challenging since all benefits have to be quantified. Benefits often relate to the “opportunity cost” concept. Time savings are a clear example (in the field of transportation projects).

Determining the unit of analysis and its monetary value is not an easy exercise for many intangible variables (such as quality of life, security of a neighbourhood). One alternative to determine its monetary value is to assess the highest price an individual is willing to agree to pay for a good or a service. As described by Breidert (2005)[23]:

“How much a person is willing to pay depends on the perceived economic value and on the utility of the good. These two values determine whether the price a person is willing to accept is the reservation price or the maximum price. If a person believes that there is no alternative offering, the highest amount of money he or she is willingness to pay equals the utility of the good and is the reservation price. If a person perceives an alternative offering with an economic value below utility, the highest price he or she would accept equals the economic value of the product and is the maximum price.”

Where it is difficult to determine the monetary value of a benefit, it can be useful to consider values from studies in other countries, although care is necessary in interpreting these as the value (for example, willingness to pay) in one country may be different from another.

If it is decided not to quantify a specific benefit, the benefit should be treated qualitatively and considered or included in the analysis in addition to the quantitative results. In this case, even when it is not possible to express all of the benefits or costs in quantitative terms, it is possible to reveal important aspects for decision-makers.

In socio-economic terms, it may be said that there is a need to demonstrate that a project’s social and economic benefits are higher than its costs. The first act is to demonstrate social and economic benefits in quantitative terms. When this is not possible, it may be handled through a qualitative analysis, describing the main advantages and the value added by the project to the society in terms of relevant magnitudes, defined in accordance with the authority’s strategic plan and global strategic objectives.

Table 3.1, taken from Kee (2005), provides a framework for Cost-Benefit Analysis with examples and generally accepted approaches to valuation of the benefits and costs.

|

TABLE 3.1: Cost-Benefit Framework |

|||

|

Benefits |

Illustration of Benefit Cost |

Valuation approaches |

|

|

|

Direct: Tangible |

Goods and services Increased production or profits/lifetime earnings Time saved |

Fair market value or willingness to pay Increased productivity/earnings After-tax wage rate |

|

|

Direct: Intangible |

Lives saved Healthier citizens Quality of life Aesthetics |

Lifetime earnings (if valued) (Implicit or contingent valuation using survey data or other techniques) |

|

|

Indirect: Tangible |

Cost savings Spill-over impacts to third parties Multiplier effects |

Difference between before and after action Estimated impact or mitigation of impact Additional indirect jobs created by proposal |

|

|

Indirect: Intangible |

Preservation of community Increased self-esteem |

|

|

Costs |

|

|

|

|

|

Direct: Tangible |

Personnel Materials and supplies Rentals (facilities/equipment) Capital purchases Land Volunteers |

Wages and benefits Current expenses Fair market rents Depreciation plus interest on un-depreciated part or annualized cost of depreciation and interest Next best use or market value times interest rate Market or leisure value

|

|

|

Direct: Intangible |

Fear of harm |

|

|

|

Indirect: Tangible |

General overhead Spillover costs to third parties Environmental damage Compliance/client costs |

Standard allocation formula or activity-based costing Estimation of impact or mitigation cost Resources required of others (money, time, and so on) |

|

|

Indirect: Intangible |

Loss of aesthetics |

Surveys of valuation |

Once the direct costs are duly adjusted and the externalities (external costs and benefits) are identified and quantified, a number of additional adjustments should be made before the results of the analysis are calculated and presented.

- Adjustment for inflation: it is advisable to construct projections in real terms, since a correction for cost projections should be done for those cost items that are considered likely not to follow the general Consumer Price Index (CPI). This is usually considered as corrections in relative price changes; and

- Adjustment for risk and uncertainty (section 2.8.2).

[16] This PPP Guide is not a manual for project appraisal and readers should refer to specific texts on CBA for detailed guidance. For instance, for further details see The Green Book: Appraisal and Evaluation in Central Government – HM Treasury from the United Kingdom.

[17] Yates, B. T. (2009). Cost-inclusive Evaluation: A Banquet of Approaches for Including Costs, Benefits, and Cost–effectiveness and Cost–benefit Analyses in your Next Evaluation. In Evaluation and Program Planning 32 (2009) 52–54.

[18] Kee, J.E. (2005). Cost Benefit Analysis. In Encyclopedia of Social Measurement, Volume 1, pages 537-544.

[19] Guzman, A; Estrázulas, F. Full Speed Ahead: Economic Cost-Benefit Analyses Pave the Way for Decision-Making. In Handshake, the International Finance Corporation’s (IFC’s) quarterly journal of public-private partnership. Issue #7 – October 2012.

[20] Externalities refers to situations when the effect of production or consumption of goods and services imposes costs or benefits on others which are not reflected in the prices charged for the goods and services being provided.

[21] Yescombe, E. R. 2007. Public–Private Partnerships: Principles of Policy and Finance. Published by Elsevier Ltd.

[22] Opportunity cost is a concept used in economics to describe the trade-off between different choices, or the cost associated with making one choice over another. The opportunity cost of using a resource in a certain way is the value of the next best alternative use that is forgone. For example, the opportunity cost of investing in building a school could be the forgone value of investing in the next most valuable infrastructure project (or any other use of the expenditure) and the benefits associated with these (e.g. building a road, hospital, etc.). HM Treasury. 2014. Supporting public service transformation: cost benefit analysis guidance for local partnerships.

[23] Breidert, C. 2005. Estimation of Willingness-to-Pay. Gabler Edition Wissenschaft.

Add a comment