This section describes the approach taken by the private party in a PPP project. The private party is the private sector entity that is successful in securing the right to implement and operate the procuring authority’s PPP project. A variety of names may be used to describe this private party. These terms include the private partner, the consortium and the Special Purpose Vehicle (SPV). Such terms are interchangeable and this section uses all of them.

In this section, it is assumed that the private party is responding to a greenfield PPP project that is being procured by a public authority under a one-stage, single tender process, all as outlined in the previous chapter. It is assumed too that during the biding stages of the procurement, the private party will put in place indicative funding arrangements and that these will be finalized, with the provision of fully committed funding, at the financial close of the PPP project.

It should be noted that the activities carried out by the private party, described in this section, may be the same if the procurement is for a brownfield PPP project, or if the project is a privatization or secondary market transaction. On a related note, many of the activities may also be carried out as part of certain non-PPP procurements (see chapter 1), such as Design-Build-Operate (DBO), or Design-Build-Finance-Operate-Manage (DBFOM) management contracts and concession/lease arrangements. However, consideration of these types of procurements, and the specific activities required of the private party to implement them, is outside the scope of this PPP Guide.

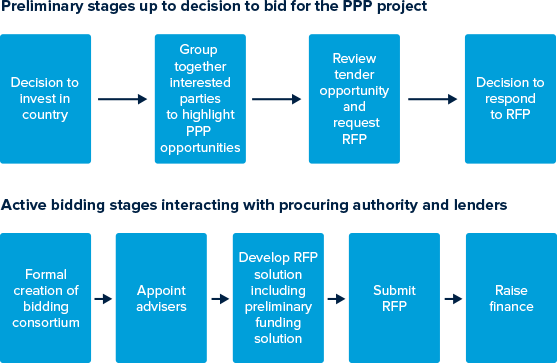

In this section, an account is given of the various stages of the private party’s PPP pathway, highlighting some of the key activities that it will carry out at each stage.

This section describes the factors that influence the private party’s decision to invest in a particular country and, specifically, to respond to the procuring authority’s Request for Proposal (RFP). It sets out how the private party puts its PPP project tender response together. This is a process that includes forming a bidding consortium and appointing advisors, right through to developing its commercial strategy and detailed technical, financial and legal solutions for the PPP project.

PPP projects involve the planning, design, construction, and provision of a PPP project asset together with the provision of associated services, such as the operation and maintenance of that asset. They also require a significant amount of financial support. Achieving this requires a series of agreements to be completed.

It is not simply the project agreement that needs to be entered into with a procuring authority; the private party will also need to enter into a suite of agreements with its construction, operation, and maintenance contractors, as well as the funders who will be providing financial support. A description of the required set of agreements is explained in this section. The key issues that have to be addressed by the private party, before entering into these agreements, are also highlighted.

Attention is also focused on the type of finance the private party can obtain for the PPP project, the lending requirements that must be met, and the stage at which fully committed funding is provided.

A description of the private party’s role at the concluding stages of the PPP project’s procurement, commercial close, and financial close is provided. Additionally, a note of the key activities that the private party needs to carry out in order to form the SPV is included in this section.

An overview of this section and its key learning points is set out below.

Targeting and Selecting Markets and Projects

The decision to select a PPP project depends on the region/country, the sector/market, and the project itself. The PPP project must be evaluated in commercial, financial, and risk terms once the RFP has been released (PPP project screening).

If the PPP project screening is sound, the private party will decide to participate in the bid. Resources should be spent only when the decision to participate in the bid is positive.

Putting a Bidding Consortium Together

A biding consortium includes four key private partners: sponsor(s), construction contractor(s), operations and maintenance contractor(s), and the lender(s) to the consortium. Sponsors must look for potential/like-minded partners in order to develop a winning bidding team.

The selection of bidding partners should be based on common goals, common cultural values, practical experience, and value (not price).

The consortium will be structured and operate in accordance with contractual arrangements such as the Letter of Intent, the confidentiality agreement, the Memorandum of Understanding (MoU), and the Consortium Agreement (CA). The parties involved in the consortium will agree to the work each party needs to carry out in order to prepare and submit the consortium’s bid. The cost of carrying out such work will be agreed and shared between the consortium’s members.

The Consortium Agreement will anticipate the basic terms of the future project and project company governance, including the decision-making process.

Project governance over the Tender Phase is assumed by the steering committee and is supplemented by the sponsors and the bid manager.

The steering committee decision-making mechanisms must be designed to resolve disputes and conflicts of interests among partners.

Getting Advisors on Board

One of the first matters the consortium has to deal with is the appointment of external advisors. External advisors provide general support, expertise, and resources to prepare tender documents on time. The areas covered during the tender stage are technical, legal, and financial in nature.

Determining the Corporate Structure of the SPV and the Structure and Type of Contracts Entered into by the Private Party

The SPV is the vehicle that implements the PPP project. It is comprised of shareholders, and will adopt a limited recourse structure with project obligations being passed through to the construction and operation and maintenance (O&M) contractors. These contractors may be members of the consortium if it is structured in such a way that they will be both future equity shareholders and contractors.

The SPV needs to ensure that all its project agreement obligations are made completely known to the key PPP project contractors.

Preparing and Submitting the Technical, Financial, and Legal Proposals

The preparation of the consortium’s bid involves the completion of technical, financial, and legal proposals. While these proposals are being prepared, the consortium will develop and agree on the structure of the project vehicle to implement the PPP project. The consortium will also agree to the matrix of contracts that will be entered into between the project parties, assuming that the project is awarded to the consortium. These contracts will set out the obligations of each PPP project party, the level of risk they will assume and manage, and the level of award/remuneration they will receive.

The technical proposal will have to be endorsed by the construction and O&M contractors and the sponsors. Equally, the financial proposal, and notably the financial strategy and the risk/award assessment will need to be endorsed by the sponsors. Similarly, the legal details will need to be endorsed by the sponsors.

Bid Preparation and Decision to Submit

Only when an investor decides to participate in a tender does the bid preparation actually start. In parallel to the bid preparation, investors will carry out the project’s due diligence to decide whether or not to proceed with the submission of a response to the RFP.

Preparing a bid does not necessarily mean making a decision to invest. The decision to respond to the RFP is made only if some conditions/targets are met.

Technical Issues

The technical process will provide two main outputs: the technical bid package and the assessment of costs, specifically capital expenditure (Capex), operating expenditure (Opex), and life-cycle cost (LCC). These technical outputs will be taken into account in building the financial model/outputs and the price negotiations for construction and O&M.

Financial Issues

The financial team will identify and help obtain the best sources of project finance, such as debt and equity. The financial model reflects the financial structure of the consortium’s proposal. It will also be used as a tool to help refine the financial impact of any changes to the consortium’s proposal that might be agreed during negotiations with the procuring authority and/or the PPP project funders.

Legal Issues

The legal team will review the procuring authority’s documentation, and it will prepare the legal package to be submitted to the sponsors (for their endorsement) and the procuring authority as part of the tender response. It will draft and agree the heads of terms (HoT) relating to the construction and O&M contracts, as well as the drafting of the contracts themselves. The legal team will also draft the shareholders’ agreement and the finance legal documents. It will also ensure a complete pass through of the consortium’s obligations into the construction and O&M contracts.

Fundraising

Fundraising is a process that starts during bid preparation. However, it is only concluded after the award of the PPP project to the consortium. Before funding is provided, the funders will want to ensure the robustness of the project risk allocation. Funders will ensure they are protected against the adverse effects of PPP project risks through terms included in the finance documents and the security package.

The credit/loan agreement is the key financing document. Meeting the required financial ratios, such as loan life cover ratio and annual debt service cover ratio, help to ensure the financial robustness of the project.

Commercial and Financial Close

If the consortium successfully secures the award of the procuring authority’s PPP project, then it will normally be referred to as the preferred bidder. From the date of its appointment as the preferred bidder, the consortium will be required to complete a number of activities to ensure that it is able to enter into the project agreement at the required time. These activities will include finalizing all the PPP project contracts, including the construction and O&M contracts, and forming the SPV.

When all of the PPP project’s commercial issues are agreed and solved then it has achieved commercial close. Financial close occurs when the PPP project funding becomes available. Normally, commercial close and financial close happen simultaneously or in quick succession. See figure 6A:1.

FIGURE 6A.1: Private Partner PPP Pathway

Note: RFP= Request for Proposal.

Add a comment