One of the most important issues the consortium has to address is structure. Its members need to decide the most appropriate structure to adopt in order to finance and implement the procuring authority’s PPP project successfully.

This PPP Guide assumes a project financing approach. As such, normally this means the consortium will create a special purpose company, known as a Special Purpose Vehicle, in order to implement the PPP project. The consortium would not normally adopt an unincorporated joint venture or a partnership type structure.

The financing of the PPP project through project financing means that the sponsors will require protection from the PPP project risks. They will require a limited recourse structure that involves the creation of a SPV. All or most of the PPP project risks that are set out in the project agreement will be assumed by the construction and O&M contractors. These contractors assume the PPP project risks by means of the SPV ‘passing’ through the obligations it assumes from the procuring authority under the project agreement into the construction and O&M contracts.

Addressing structure, and taking a decision in relation to it, will be made in the full knowledge that it is the consortium that will be reformed as the project vehicle, and that the sponsors will become the shareholders in that project vehicle.

The SPV will normally be established just before the project agreement is entered into with the procuring authority, that is, at financial close. The members of the consortium will normally be the shareholders in the SPV, together with additional shareholders, such as investors.[5] However, not all consortium members will want to be SPV shareholders. For example, a construction contractor sponsor may decide that it does not want to be a SPV shareholder. Instead, it will decide to be part of the proposal as a nominee contractor.[6] It may wish to focus all its attention on construction activities, rather than becoming involved in all aspects of the PPP project’s implementation as members of the SPV are expected to do.

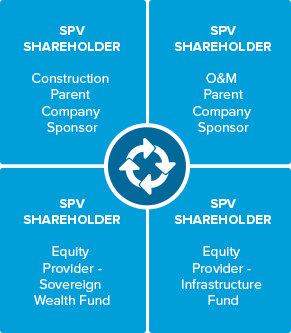

Each member of the consortium (with the potential exception of some nominee contractors) will have to be committed to participate in the future SPV as a shareholder, taking an equity stake in it. Shareholders will hold equity in the proportions defined and agreed to in the shareholders’ agreement. The size of an equity holding can vary from very small (pin-point equity) to large. Normally it is the primary project sponsors who collectively hold the largest amounts of equity.

The arrangements set out in the Consortium Agreement (see section 6.4.2) will be reflected in the SPV’s constitution and in project contracts entered into by the private party. The Consortium’s arrangements relating to working methods, the rights and responsibilities of sponsors, and how PPP project risks and rewards will be shared between sponsors will all be matters that are addressed in the documents entered into to establish the SPV and the other PPP project contracts.

The SPV’s incorporation documents will include the SPV’s “memorandum and articles of association” and the shareholders’ agreement. See figure 6A.9.

Often, there will be a direct link between one of the SPV’s shareholders and the construction and/or O&M contractors. Where there is such a link, there needs to be careful management of the relationship because there is a potential conflict of interest between the interests of the SPV shareholder and the linked contractor. In practice, this might mean that one of the SPV’s shareholders may be unable to agree with the remaining SPV shareholders to accept a term in the project agreement on the basis that it knows its linked contractor will not be able to meet the obligation.

FIGURE 6A.9: SPV Shareholders

Note: O&M= operation and maintenance; SPV= Special Purpose Vehicle.

The SPV will be set up with one purpose only — to design, finance, build, and operate the project. The SPV is arguably the main player in the PPP project because of the number of activities it undertakes.

The SPV enters into the project agreement, obtains funding from investors, and contracts with the construction and O&M contractors. All these activities illustrate the key role of the SPV. The consortium will be aware of its key role during the bidding stage and when formed into the SPV. The effect of this is that it places a significant responsibility on the consortium to ensure that the PPP project is structured in a robust way that protects its interests.

In a small number of PPP projects, the procuring authority has been a member of the SPV. This practice is not common, but when it happens there will be differences in how the SPV is set up and operates; for example, the private party may have a different type of shares and the process for dealing with disputes may involve recourse to a governmental body for a decision.

[5] Occasionally the procuring authority may, because of legal requirements, be a member of the SPV. In most cases, the procuring authority plays a nominal/minority shareholder role with a limited role in SPV decision-making. The SPV’s constitution will reflect the arrangement.

[6] Noting that in some tender processes it may be requested that the party that provides the construction or the O&M experience be part of the SPV as a shareholder with a minimum equity involvement.

Add a comment