There are many private parties involved in a PPP project and each has its own specific reasons for investing in such a project. Influencing factors include a party’s investment appetite, together with its corporate strategy; the mandate it has to invest in specific sectors/countries; and how expensive or costly it is to bid for PPP projects in a particular country.

The level of PPP activity in a market will be influential too. A large number of existing PPP participants may reveal there is too much competition for a private party to deliver a winning bid. Too few PPP participants may indicate a lack of market liquidity. However, on occasion, a private party may simply form a view that a specific PPP project represents a good business opportunity and this will mean that it decides to become involved.

Each private party will have a different perspective as to what is the right investment for it. Some will be looking for a long-term investment, and a PPP project with a long 20–30 year term will be highly attractive. Others, such as the construction contractor may prefer to invest for the short-term only, managing the preliminary PPP project stages (design and construction) and exiting after the PPP project asset has been constructed. Some private parties will be O&M providers, and for these parties the prospect of a PPP project providing significant long-term operating revenues over a 20–30 year term is attractive. Normally, at the time a private party takes a decision to invest in a PPP project, it will also have an idea of how long it will remain committed to the PPP project and when it will exit.

6.2.1 Targeting Markets

The most attractive markets for a private party are ones that offer predictable and strong growth potential with high or adequate levels of return, and those that provide business-friendly environments within which to work. The attractiveness of any market, however, may be diminished by the risks present in it. As seen later in this section, a private party needs to ensure that any country or market risk, such as political risk or currency fluctuation risk, can be controlled. For example, a change in a country’s government might herald in the introduction of a new political policy that prohibits PPP projects and results in current projects being terminated.

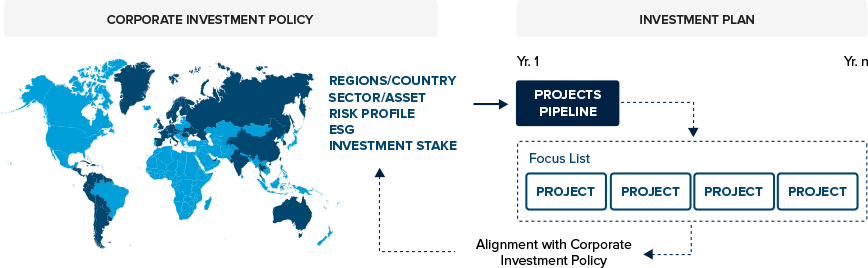

A private party goes through a structured process to identify where in the world and in what sector it wants to invest. Identifying the best investment opportunities involves several considerations.

- Appropriate target regions/countries (balancing long-term prospects versus political, financial, or regulatory risks[1]).

- The class of infrastructure assets in which to invest.

- The extent of secondary market activity which could provide options to sell/exit the PPP project.

- The risk profile of PPP projects and the procuring authority’s expectations regarding the degree of risk transfer to the private party.

- The acceptability of the environmental, social, and regulatory policies applying to the PPP project.

- The role the PPP private party wants to play when managing the PPP project asset: passive or active.

Such considerations also involve an assessment of how these factors are viewed relative to a private party’s capabilities and experience.

Based on the conclusions reached after consideration of these factors, a private party will decide on those countries and assets in which it will invest. The decision made will be formalized through the creation of a short list/focus list of target countries, assets, and specific projects (if known). Many private parties refer to this short list as their projects pipeline. See figure 6A.2.

FIGURE 6A.2: Origination of Project Pipeline and Focus List.

Note: ESG= Environmental, Social and Governance .

6.2.2 Project Selection – Screening the PPP Project

Once a decision has been made to target a particular market, as identified in the projects pipeline, it will then be necessary for a private party to make a decision about a specific PPP project, and particularly, whether it constitutes a good business opportunity.

The projects pipeline will be reviewed and updated regularly by the private party’s business development and investment teams to check on how it is being implemented. There may be a number of PPP projects that the private party is provisionally interested in pursuing. However, its decision to go ahead with a specific project is taken after it has received and considered a large amount of information.

A key stage in the private party’s PPP project selection process is the point at which a procuring authority announces its PPP project to the market. Such an announcement may be through formal channels (such as an official announcement in the Official Journal of the European Union), or it may be made informally through direct approaches to interested parties or by advertising in newspapers, trade journals, or on the procuring authority’s website.

Much more information about the PPP project will normally become available when the PPP project is announced. The additional information that is made available will assist a private party in carrying out its PPP project screening. Screening the PPP project is another key stage in the private party’s selection process; the information a procuring authority makes available will be highly influential in helping a private party to conduct its PPP project screening.

It is good practice for a procuring authority to ensure that the information provided is as robust as possible. Sometimes, however, the information provided is less than expected. In this situation, a private party will rely on its experience of carrying out similar PPP projects/transactions and on business intelligence to assist it in with PPP project screening.

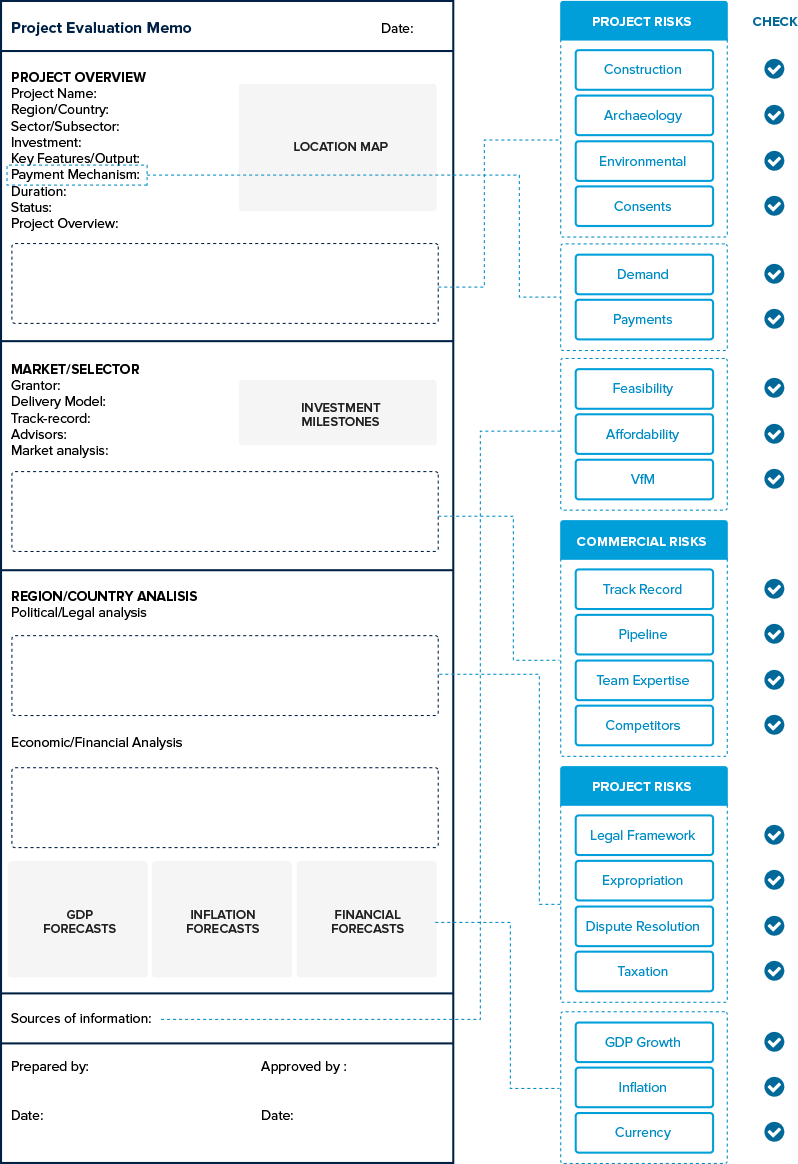

The PPP project screening involves consideration of a significant amount of information relating to a PPP project, including a review of the PPP project’s general commercial, technical, and financial requirements, together with an analysis of the PPP project’s risks. The information will be used to help a private party assess the PPP project’s commercial viability. See figure 6A.3.

FIGURE 6A.3: Project Evaluation Memo (PEM) and Preliminary Due Diligence Risk Check

Note: GDP= gross domestic product; VfM= Value for Money.

Using the PPP project screening information, a private party will make its initial decision as to whether to proceed with the PPP project (that is, to proceed with a full assessment of the PPP project and the preparation of a bid). If the result of the PPP project screening is satisfactory, then the private party may decide to progress with the PPP project, particularly if it perceives that it has a good chance of a successful bid.

Alternatively, even after completing a PPP project screening, it may consider that it needs to conduct further analysis and obtain more information. Obtaining additional information may help a private party to decide to proceed with the PPP proposal, but it may also lead to a negative decision and the PPP project being rejected by the private party.

A private party needs to be mindful of the costs associated with bidding for a PPP project; this assessment is a key element of the PPP project screening. The costs of bidding need to be proportionate to the financial/investment advantage that the PPP project will deliver to the private party. The PPP project screening will therefore include an assessment of bid costs: obtaining project information from the procuring authority; attending meetings in an overseas jurisdiction; instructing local advisers; and using personnel to prepare the bid.

Additional factors to consider are the preparedness of the procuring authority to conduct the PPP project procurement efficiently, and its previous track record in concluding projects quickly. A procuring authority with experience of conducting efficient and quick procurements will give a private party some confidence that its bidding costs will not escalate unexpectedly throughout the procurement process.

The private party will also consider the cost of any physical due diligence it is required to do before submitting its bid. For example, there may be a requirement to carry out a geo-technical survey. If this is expensive to do, then it may act as a barrier to entry; a private party may not want to incur the cost of an expensive survey with no guarantee that its bid for a PPP project will be accepted. As such, when a procuring authority is considering its tender requirements, it is useful for it to consider the costs of meeting these requirements and how such costs may influence whether a private party bids or does not bid on a PPP project.

Assuming that the PPP project screening is positive, the private party will begin its search for partners and advisors to work with it. When the private party has found complementary partners, it will form a bidding consortium with them (see section 6.4). At this stage, each of the key private party partners in the consortium will normally be referred to as sponsors.

In summary, the decision to become involved in a PPP project depends on the following factors outlined in box 6A.1.

|

BOX 6A.1: Factors Considered when Pursuing PPP Markets and Opportunities Factors to select countries or markets

Factors to select opportunities

|

[1] For further reading on the effect of regulation, see Sirtaine, Pinglo, Guasch, Foster, How Profitable are Infrastructure Concessions in Latin America? Empirical Evidence and Regulatory Implications, 2005.

Add a comment