Following a successful PPP project screening, partnerships will be forged between like-minded organizations and a consortium will be formed with a view to responding to the procuring authority’s RFP.

Implementing the PPP project will require the implementation of material construction, operations, and maintenance activities. This means that the consortium will normally be made up of sponsors representing these interests. In practice, it is normal for the consortium to include a construction contractor, a service provider, an operations and maintenance provider, and an identified lender.

Collaborative working in a consortium has many advantages. It facilitates the development of innovative project solutions, including how commercial risks should be managed. It may also help combine different sources of project funding and complementary business aims. It will ensure too that bidding costs are shared among the consortium members. Its value comes from the proper combination of the members’ strengths, capabilities, and resources.

Forming a consortium may also be a prerequisite to submitting a RFP because many RFPs require a strength and depth of project experience that can only be provided by multiple parties ‘pooling’ their experience as part of a bidding consortium.

Working together in a consortium needs to be carefully managed. Significant efforts must be focused on finding the best partners for the PPP project. In some cases, due diligence is carried out by one partner on another in order to obtain assurance about its technical and financial capabilities, experience, and reputation. The principles to take into account for a productive and effective partnering, and consequently, for ensuring a successful consortium are as follows.

- Early involvement of key sponsors across institutions.

- Commitment of each of the sponsor’s senior management.

- Common goals between sponsors.

- Clear understanding of responsibilities, risks, and rewards between the consortium’s members and key suppliers.

- Identification of key individuals/teams who will work together.

- Selection of bidding partners based on value (not price).

- Common cultural values and processes across consortium members and key suppliers.

- Ideally, practical experience among consortium members of having worked together and of having built successful joint bidding/working teams.

- Previous PPP experience and track record of consortium members.

- The relationship a proposed partner has with the procuring authority.

6.4.1 Consortium Members

The consortium that responds to the procuring authority’s RFP will typically include the following key private partners, all of whom may be required to bid together on an exclusive basis.

- The sponsor is the party (or parties) who will assume a leading role in the PPP project during the investment life cycle. However, it should be noted that some project sponsors will not want to have an active role, so they will just be equity investors.

Sponsors create the consortium for the sole purpose of bidding for the PPP project. As will be seen below, it is the consortium that will eventually become the SPV implementing the PPP project. The sponsors (or their parent companies) often have to provide guarantees or enter into management or service agreements to cover certain liabilities or risks.

- The construction contractor (or construction team) is the party (or parties) that will be responsible for designing, building, and commissioning the PPP project asset during the Construction Phase. It includes designers, technical specialists, civil/Monitoring and Evaluation (M&E) contractors, and all sorts of construction advisors and suppliers. In some cases the construction contractor may also be a sponsor.

During the PPP project tender stage, the contractor will provide the main technical and quality outputs of the proposal as well as the construction/lump sum price (Capex). When awarded the PPP project, the construction partners may incorporate an adhoc vehicle called a Cooperative Joint Venture (CJV) or Engineering, Procurement and Construction Consortium (EPCC).

Unlike the approach taken by other members of the consortium, in many projects it has been the practice for the construction contractor to exit the consortium once the PPP project asset is built and fully operational.

- The operations and maintenance contractor (or operations and maintenance team) will be the party (or parties) responsible for operating and maintaining the PPP project asset over its life cycle. At the bidding stage of the PPP project, the O&M team will provide the technical and quality outputs related to O&M, as well as the price regarding operational expenditure and capital/life-cycle expenditure (Opex, operational expenditure and life-cycle costs). When awarded the PPP project, the O&M partners may incorporate an adhoc vehicle called an Operating Company (OpCo). Like the construction contractor, in some cases the operations and maintenance contractor may also be a sponsor.

In addition, and depending on the specific bidding requirements determined by the procuring authority, the lender (or bank), as the party (or parties) responsible for arranging debt[4], may be a consortium party. However, unlike the other consortium members, it will not be an equity participant. The lender might be a commercial bank, an institutional lender, a development bank, or an infrastructure fund.

It should be noted that the role and status of the lender is different to that assumed by the other consortium members. If fully committed finance is required at the RFP tender submission, then the lender will be a “tied-in” member of the consortium. It will normally provide the PPP project funding according to the terms of the RFP tender submission, subject to all parties agreeing to certain changes to the funding solution as required.

If, however, fully committed finance is not required at the RFP tender submission stage, then the lender will be more loosely associated with the consortium. It will provide indicative financing terms to the consortium and it will demonstrate its intention to support the consortium. However, it will not be until much later on in the procurement, perhaps after commercial close, that it will confirm its funding terms and so become a full member of the consortium by acting as the consortium’s lender.

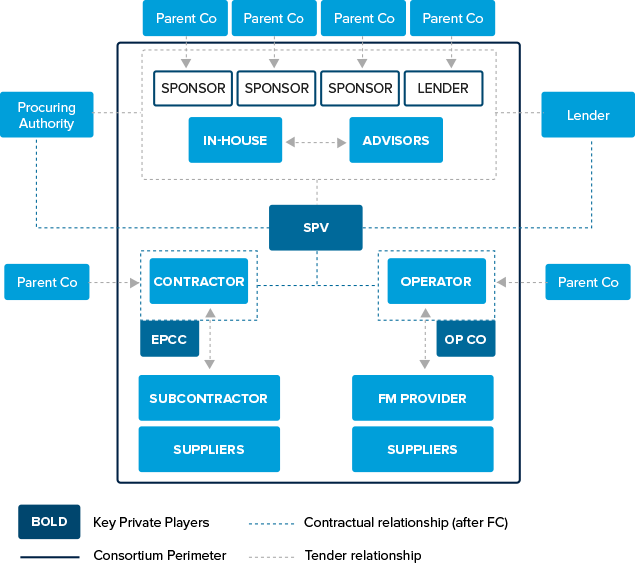

The consortium may also include members of the contractor’s and operator’s supply chain, such as key sub-contractors and facilities management providers (FM providers). This might happen if supply chain members are providing specialist support and there is a need to “tie-in” their involvement with the consortium, thus avoiding them working with a competitor. See figure 6A.5.

FIGURE 6A.5: Consortium Members and Key Relationships

Note: Co= company; EPCC= Engineering, Procurement and Construction Consortium; FC=Financial close FM= facilities management; OpCo= Operating Company; SPV= Special Purpose Vehicle.

6.4.2 Consortium Agreements

Once the consortium is formed, the next requirement is for the sponsors to put suitable bidding arrangements in place. These will normally take the form of a Letter of Intent or Memorandum of Understanding that will be entered into by the sponsors, which will set out their intention to bid together, normally on an exclusive basis. These agreements may not be binding. However, a more formal and binding agreement, known as a “consortium agreement”, may be agreed to by the sponsors.

The consortium agreement and the other associated agreements referred to above will set out how the consortium will operate, together with the rights and responsibilities of its members. Each member’s responsibility for carrying out and meeting/sharing the costs of bid development will be documented, as well as how parties will take decisions and work collaboratively. Specifically, the procedures and decision-making mechanisms to ensure proper governance of the consortium will be documented (for example, the creation and use of the steering committee for significant decisions – see section 6.4.3). See figure 6A.6.

The importance of the Consortium Agreement should not be underestimated. This agreement will form the basis of the shareholder’s agreement. It will influence the private party’s project structure and governance, and the allocation and responsibility for the management of project risks between the consortium parties. It is customary too that the sponsors will enter into a confidentiality agreement, meaning that they will agree to keep each other’s commercial information confidential at all times.

FIGURE 6A.6: Sequence for Bidding Agreements

There is no standard practice with regard to partnering. However, there are some methodologies (that is, “BS 11000 Collaborative Business Relationships”) that can be used to help develop and manage relationships between companies in such a way as to maximize efficiency.

6.4.3 Governance Procedure for Decisions and Approvals Relating to the Bid

Adopting good governance practices that embody accountable and transparent decision-making will help reinforce each consortium member’s responsibility to the other. The practices should help eliminate ambiguous project risk sharing and ensure that proper procedures are put in place to resolve disagreements between members.

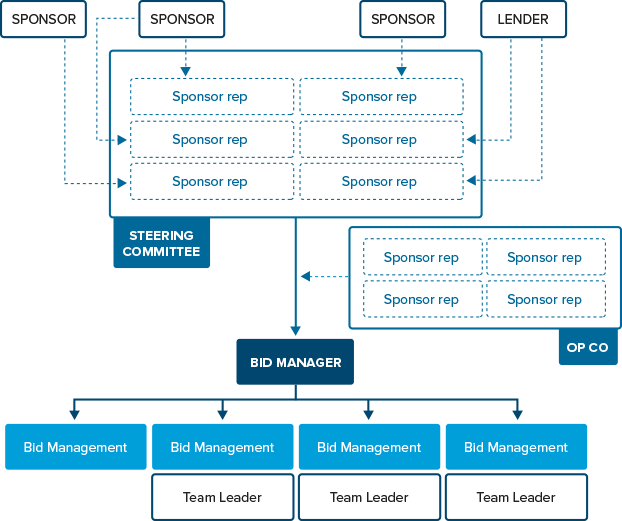

During the bidding process it will, therefore, be necessary to put into practice effective governance mechanisms to determine how best to run the RFP response preparation and to ensure that all members of the consortium are fully accountable. The most common way of doing so is by establishing a steering committee.

The steering committee will support the bid manager (see section 6.7 for a list of the bid manager’s responsibilities) in its role of ensuring that the preparation and submission of the RFP response is carried out properly and always meets deadlines. It will also support the bid management team, including those individuals who are responsible for taking key decisions about the content and progress of the RFP response. In practice, this will mean that the bid manager/management team will provide regular reports to the steering committee on arising PPP project issues. The steering committee will consider these and make decisions on the basis of the received reports.

The cornerstones of good project governance are the steering committee, the sponsors, and the bid manager and team. See figure 6A.7.

FIGURE 6A.7: Consortium Governance over the Tender Process

Note: Rep= representative.

Senior representatives from the sponsors comprise the steering committee (SC).

- The SC follows a formal framework that defines its role in relation to the bid management and the governing bodies of the sponsors/parent companies.

- SC members must be mandated/authorized to take the necessary decisions by their respective sponsors/parent companies.

- The SC defines and promotes the principles and objectives of the bidding team.

- The SC agrees to the bid strategy after input from the sponsors.

- The sponsors appoint the SC members depending on their number of shares.

- The number of SC members should be appropriate (no less than 4 and no more than 10).

- A chairperson and a secretary should be appointed.

- The SC empowers and provides direction to the bid manager in order to define acceptable risk profile/thresholds and maximize the bidding team’s options.

- The SC will approve the bid closure after obtaining approval from the sponsors.

Steering committee meetings will normally take place on a regular basis. It should be noted at this point that the steering committee, the bid manager and the team are in charge of managing and organizing the bidding process from the private party’s perspective. As explained later, there will always be a working team structure (not included in the above exhibit) that will be in charge of preparing the technical, legal, and financial solutions.

Prior to submitting the bid, each individual sponsor must obtain approval from its internal investment committee. Since each sponsor normally has different procedures and requirements (that is, different information may have to be provided, there may be different dates fixed for internal committees meetings, and so on), the bidding team must be prepared to provide project information to each of the sponsors well in advance of the procuring authority’s tender submission date.

Additionally, the consortium as a whole must obtain the approval of the steering committee to submit its bid because the decision to submit a final RFP response constitutes a formal decision to invest. Consequently, in order to submit a RFP response, all members of the consortium must be fully aligned and agree on its terms and conditions. If one sponsor cannot agree on an issue relating to the RFP response, meaning that there is no general agreement among sponsors, then it will be difficult for the consortium’s response to be submitted. In such a situation, it will be the steering committee that will try to broker an agreement. Once this is achieved, the RFP response can be submitted.

One of the most important governance challenges the steering committee faces is the need to deal with and manage disputes among the sponsors. Some sponsors might not be 100 percent aligned with each other, or they might be unable to adopt a consistent approach to the PPP project risks. Both situations would undermine the consortium’s ability to prepare a competitive bid and deliver Value for Money. To deal with key decision-making and conflicts of interest, it is normal to have in place the following procedures and mechanisms:

- A structured voting procedure identifying decisions to be adopted by simple majority, qualified majority voting, unanimity voting, and reserved matters.

- A deadlock mechanism and reference to independent experts.

- A dispute resolution procedure that may involve recourse to alternative forms of dispute resolution, such as mediation or arbitration.

- Recognized situations in which recourse to the senior management of the parent companies is required.

As noted, typically the governance procedures and the mechanisms in place during the bidding process will be incorporated into the shareholders’ agreement.

[4] The debt arranger will usually provide a part of the loan funds. Sometimes it may be committed to provide the whole amount (underwriting) so as to allocate part of the funds among other banks (syndication).

Add a comment