6.8.1 Negotiating with Banks

The consortium’s financial advisory team prepares the Project Information Memorandum (PIM). The PIM sets out details of the PPP project, including the anticipated key contracts and projected revenues. Assuming a financing competition, a group of funders will be asked to compete against each other to fund the PPP project. They will then submit their responses to the financial advisers. These will be assessed and a winner picked. That winner will become the PPP project’s funder. This practice is normally known as a funding competition.

The assumption made is that fully committed financing will not be required while the consortium is bidding for the PPP project. Rather, it is assumed that fully-committed financing will only be required once the consortium has been selected as the preferred bidder for the PPP project. In this situation, it is normal for the detailed funding arrangements to be put in place during the period between the appointment of preferred bidder and the close of the PPP project. However, in such cases, during bid preparation and before bid submission, the main terms of the project financing will have to be negotiated and agreed, or at least defined as a detailed “term sheet” under an indicative proposal. This is because the consortium needs to be confident that a project funder is satisfied with its RFP proposal.

The consortium needs to know the basis on which a funder will provide support to the PPP project. Ideally, this needs to be known prior to submission of the RFP response because the cost of finance will drive the overall cost of that response. It will be problematical if the consortium only gets its financing terms agreed after it has submitted its RFP response because the funder may make it a condition of funding that the terms of the consortium’s RFP have to change. However, if the RFP response has already been accepted by the procuring authority, then changing the RFP response will be difficult to achieve.

It should be noted that it is possible for the lender that has won the funding competition to be a sole bank or a group of banks, known as a “club” (or “syndicate”). The successful lender will enter into a mandate letter with the sponsors setting out the terms of the loan; these terms will form the basis of the finance documentation that is entered into at a later stage.

It will take a period of time to agree to the terms of the PPP project’s funding documents[10]. The funder will need to be satisfied that its investment in the PPP project, through the provision of funds, is suitably protected. The funder will want to ensure too that the PPP project risk allocation will minimize any chance of project default occurring.

6.8.2 Banks’ Approach to Risk

As well as ensuring that there has been a robust approach to risk allocation, the funders will want to ensure that the PPP project is structured in such a way as to give them an acceptable level of risk protection. Typically, the banks will require full disclosure of all PPP project information and data so that they can conduct their own due diligence to understand the PPP project risks and, ultimately, fix their lending rates and fees.

Some of the key ways the SPV will protect itself is through its limited liability, and by passing through the risks contained in the project agreement to the construction and O&M contractors. It will also expect these contractors to provide it with guarantees from their parent companies. These parent company guarantees (PCGs) will ensure that if the contractors fail to carry out their contractual obligations, then the parent companies will assume responsibility for the obligations and/or provide financial compensation to the SPV to cover the cost of the failure.

The funders will also adopt a series of key approaches to protect themselves against the adverse effect of the PPP project’s risks. They will want to ensure that the passing through of risks into the construction and O&M contracts is appropriate. The funders will therefore scrutinize the passing down of obligations as part of their due diligence. They will expect to see the allocation of risk as per table 6A.3 in section 6.7.3.

Additionally the funders will want to ensure the guarantee of equity/ subordinated debt subscriptions and the subordination of all other debt. The funders will also require a right of step-in to a failing PPP project to help ensure it gets ‘back on track’ in terms of performance. The step-in rights are set out in the “direct agreement” that is entered into with the procuring authority, SPV, and the funders.

6.8.3 Finance Documents and Their Review

The key financing documents are those that govern the terms of the funding provided to the SPV and the security for the money lent. The key document is the credit or loan agreement that sets out the types of funds that the funders will provide to the SPV. The funds, although provided under one loan agreement, will actually contain a number of “ring-fenced” amounts, known as “facilities” that can only be used for their agreed purpose.

The credit agreement is a baseline facility that will provide the SPV with funds to meet the costs of construction and other pre-agreed costs that arise during the construction period when the PPP project is not yet generating revenue.

The credit agreement will also include other facilities to be used as working capital to cover the costs of implementing changes in law, or to meet life-cycle and maintenance costs.

Like any other domestic loan, the credit agreement will set out how and when money can be borrowed (that is, the draw-down requirements), and how and when it has to be paid (that is, the loan repayment formula or repayment schedule). Typically, the repayment of the PPP project debt will take place over the life of the PPP project on a reducing basis. Usually the repayment schedule follows the PPP project’s cash flow projections.

The funders will also require the credit agreement to contain measures to ensure the financial robustness of the PPP project on an ongoing basis. These measures are known as the financial ratios, and they should not be breached by the SPV. Ratios are normally calculated and checked by the funders and the SPV every 6 months. The two most common ratios that will have to be met are as follows.

- Loan Life Cover Ratio (LLCR) – this is used to measure the ability of the SPV to pay back the funds. At any given point it compares the project’s projected Net Present Value (NPV) of the cash flow available for debt repayment and the amount of project debt remaining.

- Annual Debt Service Cover Ratio (ADSCR) – this is used to compare the past 12 months of the project’s Net Present Value (NPV) of the cash flow for debt repayment and the amount of debt repaid (principal and interests) during the same period, as well as the projected cash levels for the coming 12 months to the amount of debt due to be repaid.[11]

The finance documents will also include the security package that the funders take as their security for lending to the SPV. See box 6A.7. The security deed sets out what security the funders have taken over the PPP project revenues and assets. The funders will want to have the right to protect their interests in the PPP project, especially if the PPP project gets into trouble. Therefore, the funders will enter into direct agreements with the SPV and the construction and O&M contractors; this is so they can step into these contracts and take over the running and role of the SPV should the PPP project get into difficulty. Once the funders have got the project back on track they will then step-out and the PPP project will continue to run with the SPV in control.

|

BOX 6A.7: Funding Documents |

||||

|

Finance Document |

Purpose |

Key Terms within the Document |

Meaning of Key Terms |

|

|

Credit Agreement |

To provide funds to finance the PPP project. It will contain the terms and conditions governing the provision of the funds. |

Amount lent to the SPV

|

Monies used to finance the project. |

|

|

Price/Fee |

Costs of funds, including the margin. |

|||

|

Draw-down requirements |

Dates for receiving funds from the lender. |

|||

|

Loan repayment profile |

Period over which the borrowed money has to be repaid. |

|||

|

Representations and warranties |

Assurances given by the SPV as a precondition of receiving the funds. |

|||

|

Covenants |

Assurances given by the SPV that it will conduct itself in a way agreed by the funders. |

|||

|

Financial covenants/ratios |

Measures to ensure financial robustness. |

|||

|

Default events |

Circumstances that can lead to the project agreement terminating. |

|||

|

Security Deed |

Sets out the security taken by the senior funders for lending money to the SPV. As such it will necessarily supplement the Credit Agreement. |

Security is taken over all of the project’s documents and assets including:

|

|

|

|

Project contracts |

This includes the project agreement, construction and O&M contracts. |

|||

|

Project accounts |

Contains the revenues generated from the project and the monies that have been received by the SPV, including all the facilities monies, the amounts sitting in the insurance proceeds account, and the maintenance and life-cycle reserves. |

|||

|

Project’s physical assets |

For example, the PPP facility, SPV machinery. |

|||

|

Intangible project assets |

For example, the SPV-owned logos, intellectual property, patents generated as part of the PPP project, goodwill and so on. |

|||

|

SPV’s shares |

Shares held in the project vehicle; normally held by the sponsors and material investors in the PPP project. |

|||

|

Third party guarantees |

Includes PCGs and other support to the project provided by third parties. |

|||

|

Inter-creditor Agreement |

Agreement to regulate the relationship between co-funders |

|

Terms regulate the rights and obligations of co-funders. |

|

|

Direct Agreements |

Agreement that enables the lender to step into a PPP project |

|

Terms provide funder step-in rights, allowing them to take over the operation of key project contracts. |

|

|

Project Account Agreement |

Overarching agreement that sets out how the following project accounts will be operated: Debt service reserve account Proceeds account Lifecycle account Maintenance reserve account Compensation account Distributions account |

|

Terms regulate the use made of accounts containing project monies. |

|

Note: O&M= operation and maintenance; PCG= parent company guarantee; SPV= special purpose vehicle.

6.8.4 Security Package, Taking Security

The funder injects a significant amount of money into the PPP project, so it needs to protect itself and ensure that it will get paid back all of the money it has lent, together with the interest on the monies lent.

Full payment to the funder is predicated on the PPP project asset having been built and operated in a manner that generates sufficient revenue to make the debt repayment. To help ensure that, as far as is possible, this will happen in the future, the funder will, before lending, carry out due diligence on the PPP project to satisfy itself of the following conditions.

- The anticipated project cash flows are sufficient to pay off the debt.

- Payment to it will take priority over payment to any of the other funders.

- There is additional support provided to protect it against any shortfall in the project’s cash flows. For example, a parent company guarantee may be required from construction sub-contractors.

|

Similar to the formation of the SPV, although the procuring authority is not normally involved in the process of obtaining the PPP project funding, it will nevertheless be good practice for it to have an understanding of how the PPP project funding will work for a variety of reasons, including:

|

The funders will need to be satisfied that the projected PPP project cash flows are sufficient and secure enough to support the successful implementation of the PPP project and the re-payment of the money lent to the SPV. When “taking security” is referred to in a PPP project financing, it means the extent to which the repayment obligation of the SPV is secured.

The funders focus on the potential cash flows of a PPP project because this is the main source for repaying the debt. During the PPP project’s Construction Phase, no revenue will be generated because the procuring authority will not be receiving a service and so the rule, “no service, no fee” applies. Following completion of construction, however, the PPP asset will begin to generate revenue, whether that is through the provision of government or users’ fees to the SPV.

6.8.4.1 Project Revenues

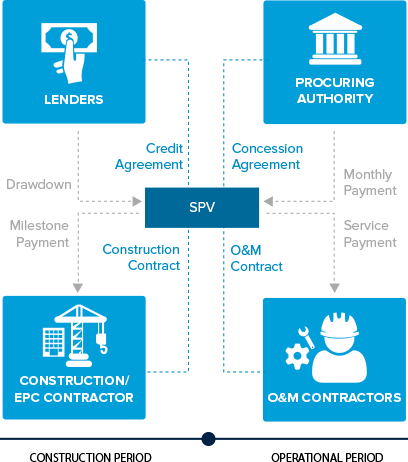

The structure of the PPP project has been set out earlier. For the purposes of understanding the flow of monies between parties, in order to ensure a successful PPP project financing, the structure can be overlaid with the following arrangements as outlined in figure 6A.14 and box 6A.8.

FIGURE: 6A.14: Money Flows between the Parties to a Project Financing

|

BOX 6A.8: Money Flows between Project Finance Agreements |

|

|

Agreement Name |

Money Passing between Parties |

|

Project Agreement |

Unitary charge payment from the procuring authority to the SPV.

|

|

Loan Agreement |

SPV payment of debt service.

|

|

Senior debt interest and repayments |

SPV payment of senior debt and interest to the senior funders.

|

|

Equity and subordinated debt |

SPV payment of dividends and subordinated debt distributions.

|

|

Operation and Maintenance Agreement |

Facilities management payment from SPV to O&M Contractor.

|

|

Facilities Management Sub-contract |

Facilities Management Subcontractor payment from the O&M Contractor to the Facilities Management (FM) Sub-contractor.

|

|

Construction contract |

Construction contract payment from SPV to the Construction Contractor (CC).

|

|

Construction Sub-contract |

Construction Subcontract from the CC to the Construction Subcontractor. |

Revenue generation is therefore a major source of debt repayment. As a result, the funders will take a keen interest in the financial model and the structure of the payment mechanism. This is because they are the key determinants of how likely the project will be able to meet its financial obligations.

The PPP project funders will conduct a series of sensitivities to ensure that the project’s cash flow projections are subject to as little risk as possible. Funders will therefore perform the following tasks:

- Carry out due diligence on project running costs, and perform technical checks on costing and life-cycle assumptions.

- Check to ensure that the risks have been passed through from the SPV to the construction and O&M contractors and their sub-contractors.

- Identify ways of eliminating potential risks. For example, they may require the SPV to enter into a hedging agreement to offset the effect of interest rate fluctuations.

- Ensure the provision of adequate step-in rights.

- Require the inclusion of the funders’ “permission to act” clauses in the loan documentation.

- Require the satisfaction of financial covenants in the loan agreements, including requirements to build up cash levels to meet debt service payments in advance of the payment becoming payable as well as retaining cash levels in excess of those required to service debt.

- Require cash retention for debt service and major works or operating costs.

- Check the assignment of the benefit of the contracts between the SPV and the procuring authority, including the income stream that the contracts will generate in the future.

- Request that the procuring authority provide additional information and clarification on issues arising as part of the due diligence exercise.

6.8.4.2 Main Forms of Security Documentation

The main forms of security that the funders require in a PPP project include the following:

Equity subscription agreement: The funders will require seeing a minimum amount of equity provided by the sponsors, and the funders will take security over the SPV shares.

Bank guarantees: The bank will require security in the form of guarantees to be given in respect of the construction and O&M contracts. These guarantees are normally given to the SPV by the parent company of the relevant contractor. The guarantees cover the due diligence and proper performance of the contractor’s obligations under the relevant contract. If the contractor fails to perform the obligations, then the parent company will perform or procure the performance of the obligations. The parent company will also indemnify the SPV for any losses or costs incurred as a result of the failure of the contractor to perform. The benefit of the guarantees are assigned to the bank, and if there is a default the bank can enforce the guarantees as appropriate.

Parent company guarantees: See bank guarantees above.

Completion guarantees: The SPV may be required to obtain from the construction contractor a guarantee that assures construction completion.

Income and shortfall guarantees: The SPV may be required to obtain an insurance type policy that pays out for loss of income.

Pre-payment of loans: The funders may require milestone payments of loans.

Letters of comfort: The funders may require the procuring authority to provide letters of support to the SPV, guaranteeing that the government-pays charge will be met.

Fixed and floating charge/debentures: The funders may take a debenture over the SPV as security for the senior debt. A debenture will charge all the property, assets, and SPV’s undertakings in favour of the funders. The debenture will generally create fixed charges over all of the SPV’s investments, land interests, plant and machinery, rights to insurance proceeds, book and other debts as well as the SPV’s Intellectual Property Rights (IPR), monies and uncalled capital. The debenture will also create a floating charge over all of the SPV’s assets that are not otherwise effectively mortgaged or charged under the fixed charges referred to above. The benefit of a fixed charge over specified assets is that it gives the funder priority over preferential creditors on enforcement. The benefit of a floating charge is that at crystallization the funder can block the appointment of an administrator over the SPV by appointing an administrative receiver.

Step-in rights: Such rights are normally contained in “direct agreements”. Direct agreements are normally tri-partite and entered into between the procuring authority, the SPV, and the funder.

Direct agreements: The funders will have the right to step into a project contract and assume the rights and obligations of the SPV.

Collateral warranties: Under a collateral warranty, a party contracting with the SPV, such as a professional adviser (for example, an engineer or architect), will give certain undertakings and warranties directly to the funder. Typically, these would include the professional adviser accepting it owes a duty of care to the funder; and agreeing that the work it carries out will be “fit for purpose”, will comply with accepted industry best practice; and that it will maintain a specified amount of insurance cover for a minimum period. The funders may require assignment/novation of these warranties.

Insurance: The bank will require the SPV to put in place certain project insurances, and these will be assigned by way of security to the bank. Such insurances will include insurance against physical damage or loss, third party liability, delay in start-up and business interruption. As the insurances are assigned to the bank, the SPV is required to give notices of assignment to the insurer.

6.9 Commercial and Financial Close

Commercial close means the point at which all the significant commercial issues between the procuring authority and the consortium have been agreed. However, at the commercial close stage, it may be the case that the SPV still has to be formed or that the PPP project funding needs to be obtained or finalized. It is not necessary for commercial close and financial close to take place simultaneously, or indeed to occur in quick succession. Although these two scenarios are the most frequent in project financing, it can be the case that financial close will happen some months/years after commercial close.

A project is said to have reached financial close when all the project documentation has been signed, all the pre-conditions attached to the PPP project’s financing have been met, and the PPP project funding becomes available. The flowing of the funds into the PPP project means that the SPV and its construction contractor can start to carry out the construction works to build the facility.

There are many pre-conditions, sometimes more than 100, that have to be met. The pre-conditions are referred to as “conditions precedent”. The conditions precedents have to be provided/met by the PPP project parties prior to triggering financial close. Generally they can be divided into 3 categories.

- Procuring authority pre-conditions: Provision of the procuring authority’s consent to enter into the transaction.

- SPV preconditions: Formation of the SPV; provision of board minutes authorizing the entering into the PPP project; and provision of the required security from the SPV and its construction and O&M contractors.

- Lender preconditions: Internal approval by its investment committee and entering into the funding swap.

Commercial close and financial close involve an intense period of activity for all parties as all the project commercial issues and documents need to be finalized. Final negotiations between the parties will take place, with the inevitable trade-offs being made on issues and costs.

The procuring authority will be responsible for preparing the project agreement. However, the balance of the project documentation — construction and O&M contracts, funding documents, and shareholder agreements (for details see the legal solution section above) — will be prepared by the private parties to the PPP project.

[10] Funding documents will not be finalized until all commercial elements of the project have been agreed. Consequently, the procurement timetable should factor in a number of additional weeks after the commercial agreement for concluding the finance documents.

[11] The value of the required ADSCR will depend on project risk and the variability of cash flows. If the SPV does not take demand risk, the minimum ADSCR would typically be: c. 1.2x -1.3x. However if the SPV accepts large demand risk, a minimum ADSCR c. 2.0x would be required.

Add a comment